The Origin and Reasons for LTC's Title "Digital Silver"

LTC (Litecoin) is called "digital silver" primarily due to the long-term cumulative effect of its founding positioning in 2011, its technical parameter design, community marketing, and market consensus, forming a complementary narrative to BTC's "digital gold" positioning.

I. Founding Positioning (2011, Charlie Lee)

In October 2011, former Google engineer Charlie Lee released LTC based on a Bitcoin code fork, positioning it as a lightweight version/payment supplement to BTC: BTC focuses on value storage (analogous to gold), while LTC focuses on small-amount, high-frequency payments (analogous to silver).

The official website initially explicitly used the marketing slogan "Bitcoin Gold, Litecoin Silver," directly anchoring itself to the precious metal analogy narrative.

II. Technical Parameters Reinforce Silver Attributes

1. Faster Block Generation: Block time is approximately 2.5 minutes (BTC 10 minutes), resulting in faster confirmation, lower transaction fees, and suitability for daily trading.

2. Larger Total Supply: A cap of 84 million coins (BTC 21 million, 4 times), offering less scarcity than BTC but better liquidity, aligning with silver's "secondary scarcity, high liquidity" characteristics.

3. Algorithm Difference: Employs the Scrypt algorithm (BTC uses SHA-256), lowering the early mining barrier and facilitating decentralized adoption.

III. Market and Community Consensus Solidification (2013–2017)

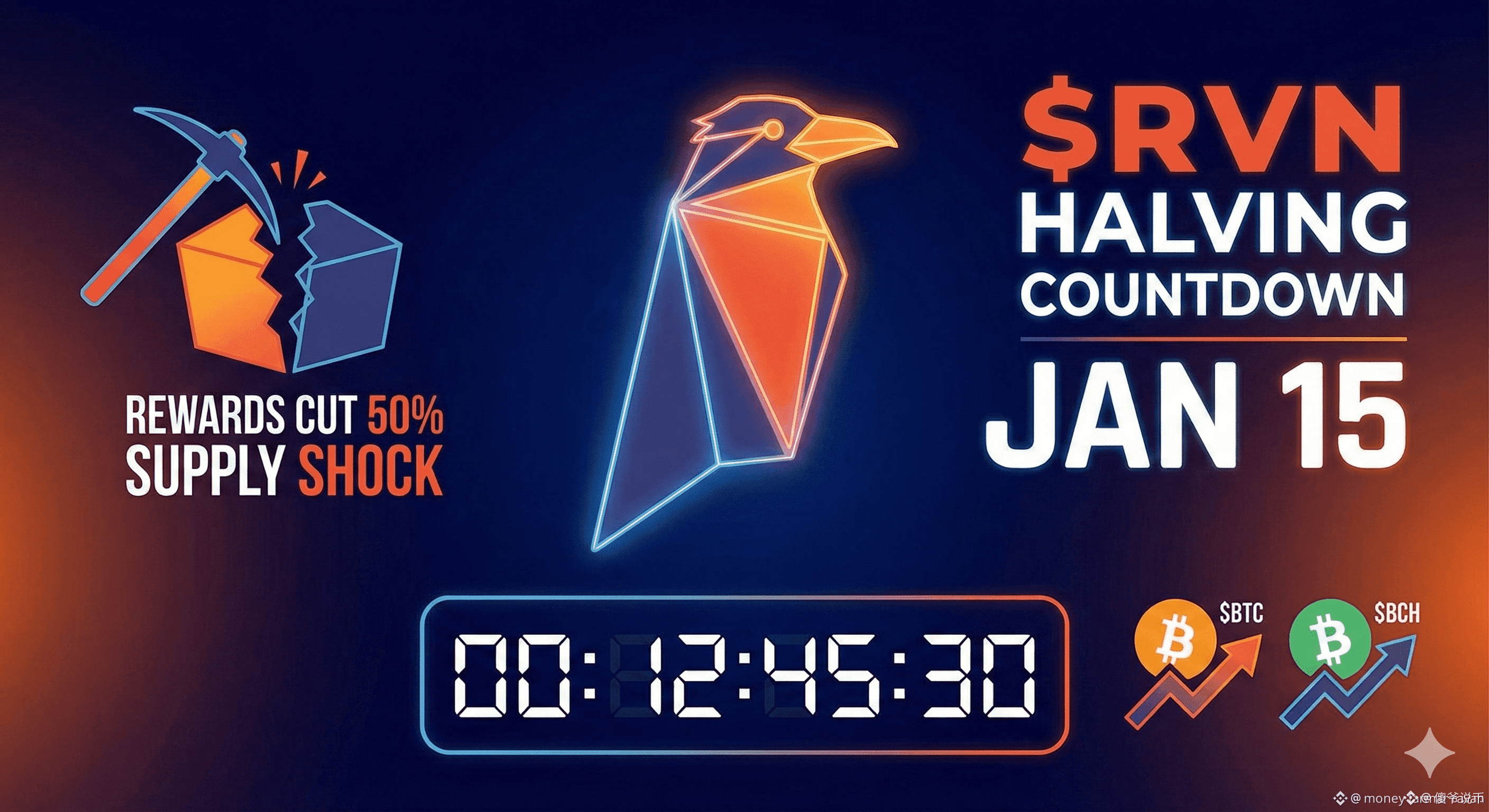

The first halving at the end of 2013 caused a surge in price and market capitalization, establishing "digital silver" as a mainstream media and community consensus.

In 2017, it was the first to activate SegWit and support the Lightning Network, further strengthening its "payment layer" positioning and solidifying the silver narrative.

As a long-term Top 5 crypto asset, it exhibits strong correlation with BTC, forming a "gold-silver" market pricing and volatility relationship.

IV. Key Summary

LTC's "silver" quality is not an inherent attribute, but rather the result of a combination of technological design, positioning marketing, and market validation: it became a payment supplement to BTC with faster speed, larger total volume, and lower barriers to entry, and was ultimately solidified by the community and the market as "digital silver."

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data