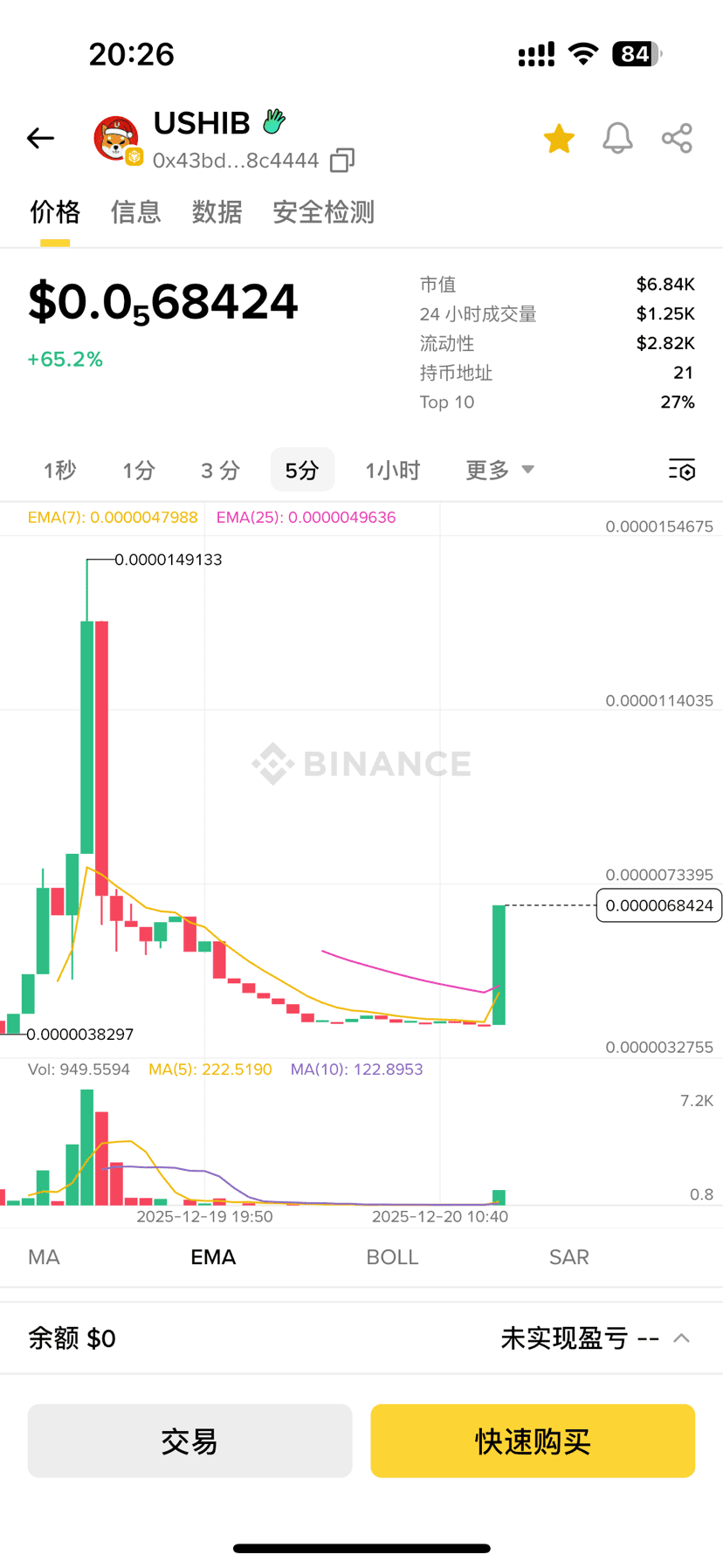

Cryptocurrency trading volume declined in December, with both CEXs and DEXs experiencing drops.

According to data from The Block, December's CEX cryptocurrency trading volume fell to $1.13 trillion, the lowest point in 15 months, a 32% decrease compared to November ($1.66 trillion) and a 49% decrease compared to October ($2.23 trillion). Binance held the largest share of CEX trading with $367.35 billion, followed by ByBit, HTX, Gate, and Coinbase. Seasonal factors, volatility restrictions, and year-end position adjustments are considered the main factors affecting trading volume. Meanwhile, DEX trading activity also declined last month, with total trading volume falling to $245 billion, a 20% decrease compared to November ($306 billion), and a 46% decrease in October ($451.2 billion). Uniswap continued to dominate the market with a monthly trading volume of $60 billion.

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data