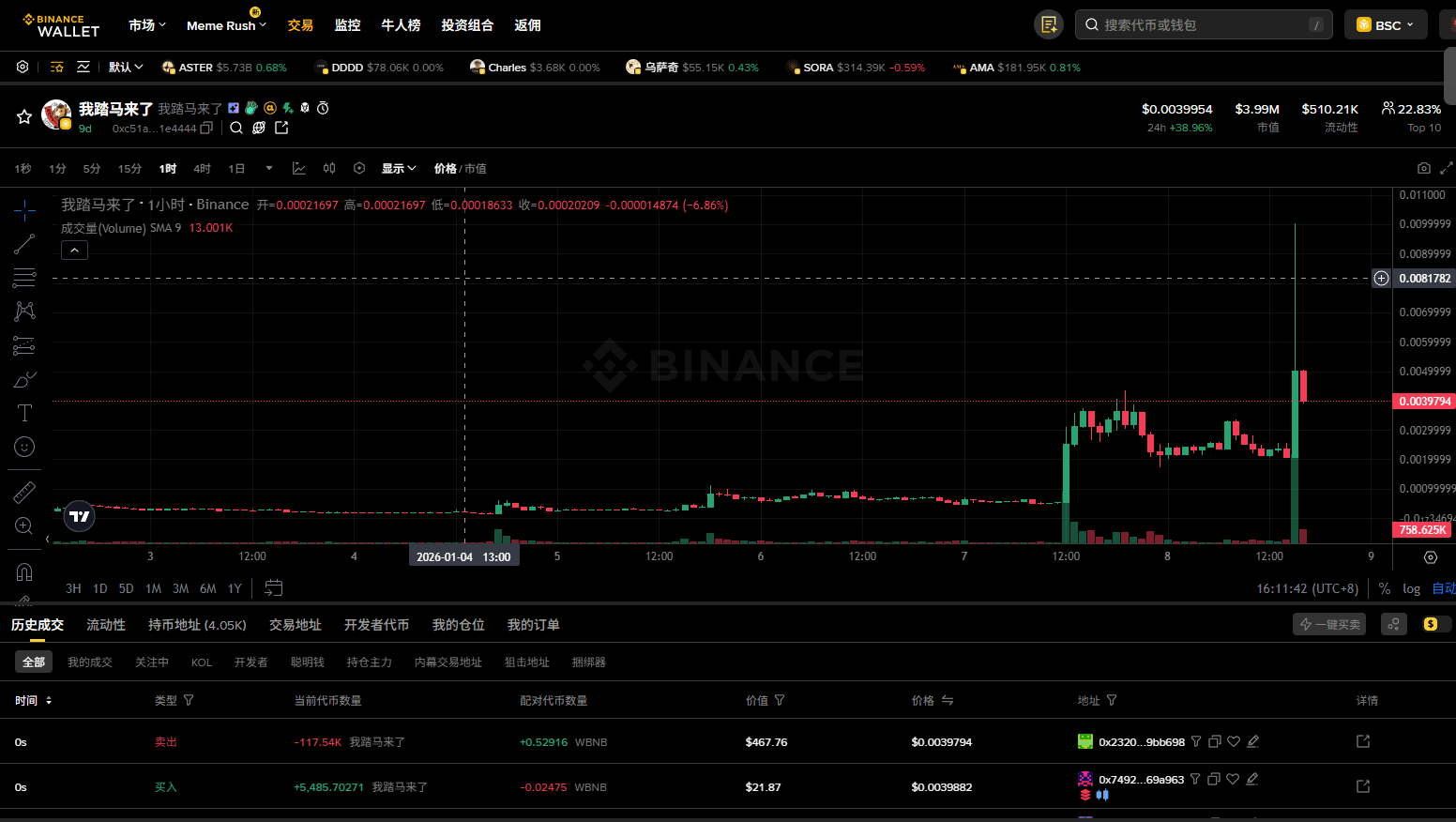

Stablecoin Anchors: Are lisUSD and USD1 Complementary or Competitive Within the Lista Ecosystem?

@lista_dao The Lista ecosystem produces its own stablecoin, lisUSD, and also deeply integrates with the external stablecoin USD1. What is the relationship between these two? From a design perspective, lisUSD is generated through over-collateralized crypto assets, more like MakerDAO's DAI; while USD1 is an externally injected stablecoin that may have fiat currency reserves.

Within the ecosystem, they may play different roles: lisUSD is an "internal circulation currency," with its generation and repayment tightly tied to lending activities; USD1 may be an "external value input anchor" and a core financial asset.

Understanding their positioning and circulation changes can help you determine whether the ecosystem's funds are primarily internally circulated or continuously attracting inflows of external stablecoins.

Liquidity Risk: It's necessary to monitor whether lisUSD has sufficient liquidity pools across various DEXs to maintain its peg to the US dollar. Any de-pegging will impact the entire system.

Do you think a protocol with both "endogenous" and "exogenous" stablecoins is more robust or more complex?

Stablecoins may decouple due to insufficient collateral, liquidity crises, or regulatory issues.

@lista_dao #BestUSD1InvestmentStrategyListaDAO $LISTA

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data