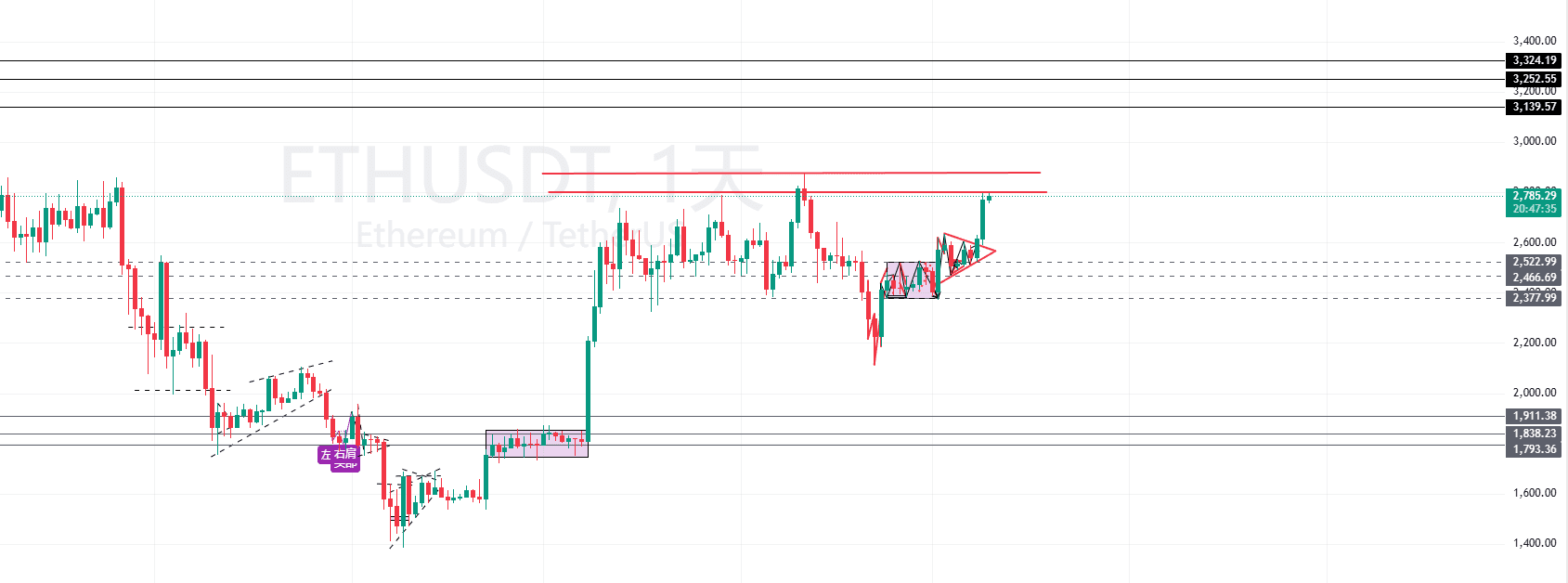

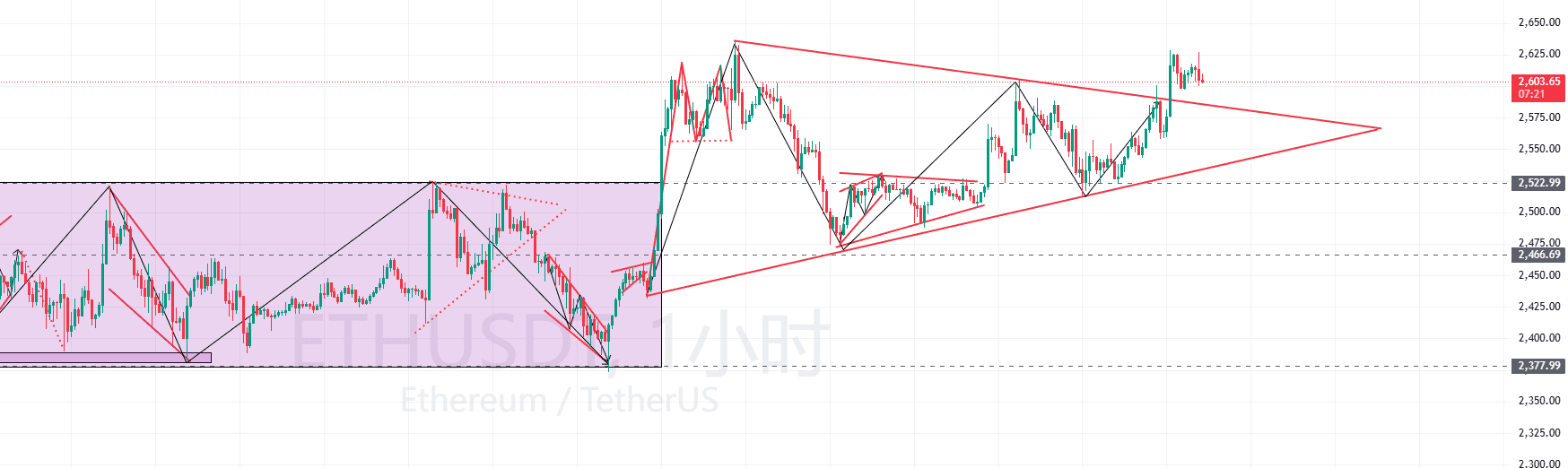

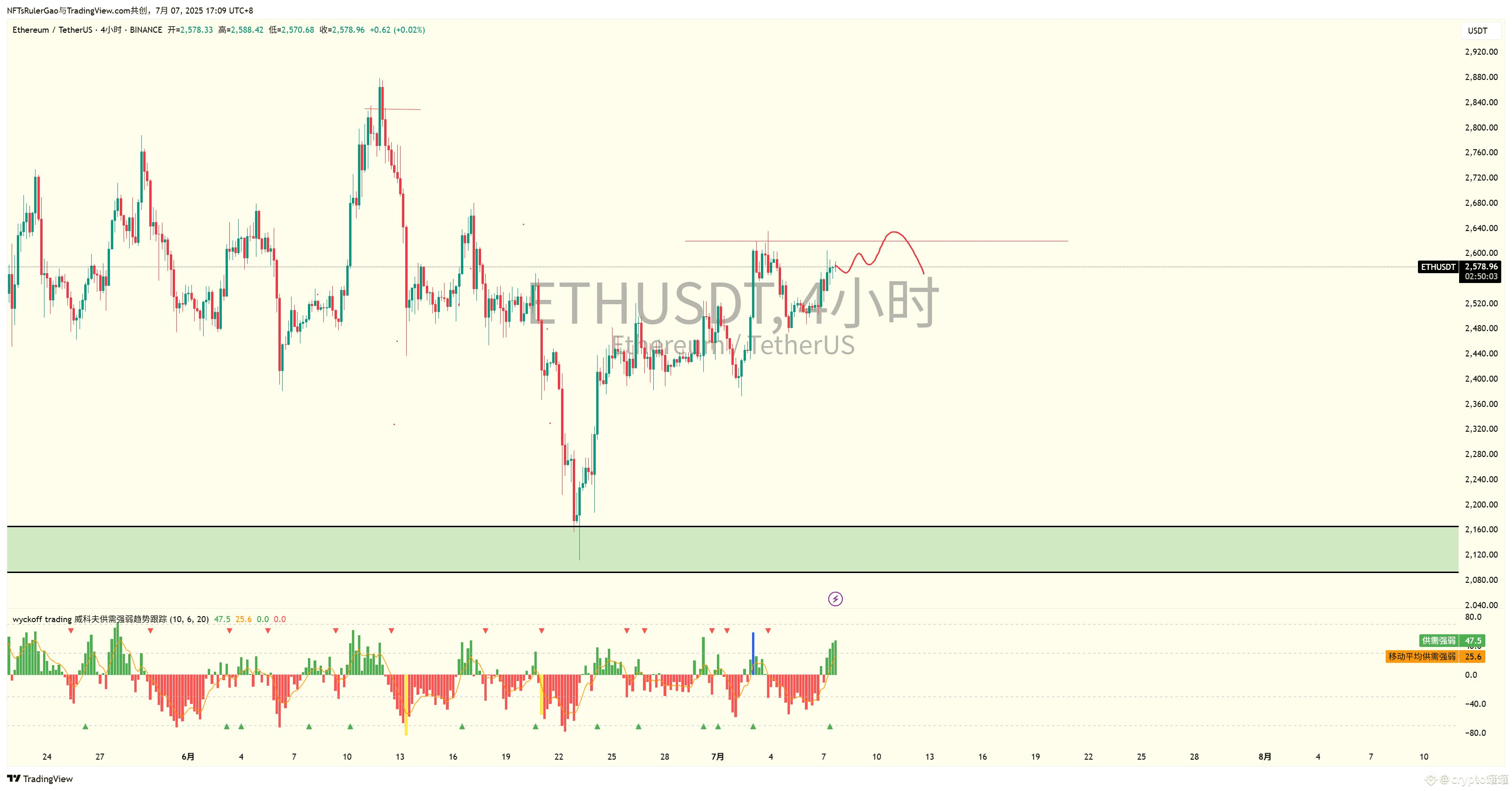

Many friends say that ETH has reached the bull-bear dividing line. In fact, this position is indeed very important. It is also the high point in the past two months (red line position). After the bottom came up, it was hit many times and then beaten down. After a period of shock accumulation, the probability of this breakthrough is relatively high.

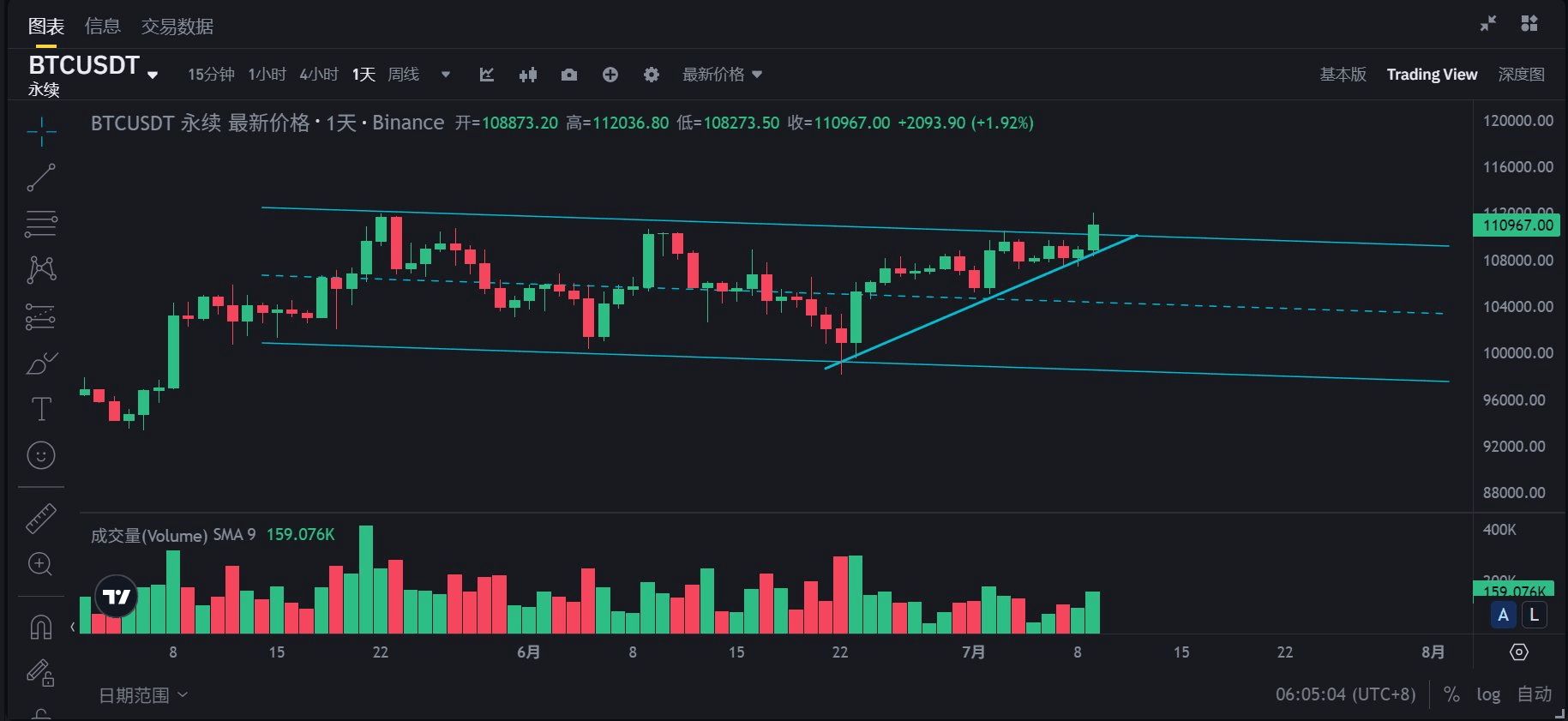

Because the daily or 4h level rising momentum is still very strong, it is in a continuous expansion stage. In addition, many big investors have begun to build positions in ETH again, and then the big pie has broken through the new high again, basically not trapping anyone, which means that the cost performance is not very high. As long as the big pie is stable and does not fall sharply, then the cost performance of ETH is still very high.

So BTC overflow funds must choose ETH first. As the second largest market, ETH means that ETH is still the currency with the greatest potential in addition to the big pie. If you are a big investor, do you choose to continue to chase the big pie, or layout ETH or SOL? So most people will choose the latter, which is why ETH's increase is higher than BTC. BTC has broken through historical highs many times, and ETH has only started to improve this time, indicating that big players have now begun to choose ETH.

Once ETH breaks through this trend line, it will usher in a reversal, and the market belonging to ETH may come. For altcoins, there will also be an explosive market. The logic is: Eth rises-gas fees rise-L2 demand increases-Defi Tvl growth-ecological currency rotation to make up for the rise, and the sector currencies that benefit the most from the ETH sector are as follows:

1, L2 sector: op, arb, strk, metis

2, defi sector: uni, aave

3, lsd sector: ldo, ssv, ethfi

4, meme sector: pepe, shib, floki

Once the ETH ecosystem begins to explode, the sector that will explode again is the sol ecosystem. It will be updated step by step in the future. The main focus is whether Eth can successfully break through and stand firm on this trend line before judging the later trend.