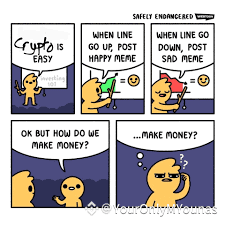

Jajaja cuando suben 0.56$ y piensas que hicistes la mejor inversión de tu vida

。

。

。

。

。

。

$BNB $XRP $SOL

#meme #FOMCWatch #Write2Earn

Price Converter

- Crypto

- Fiat

USD美元

CNY人民币

JPY日元

HKD港币

THB泰铢

GBP英镑

EUR欧元

AUD澳元

TWD新台币

KRW韩元

PHP菲律宾比索

AED阿联酋迪拉姆

CAD加拿大元

MYR马来西亚林吉特

MOP澳门币

NZD新西兰元

CHF瑞士法郎

CZK捷克克朗

DKK丹麦克朗

IDR印尼卢比

LKR斯里兰卡卢比

NOK挪威克朗

QAR卡塔尔里亚尔

RUB俄罗斯卢布

SGD新加坡元

SEK瑞典克朗

VND越南盾

ZAR南非兰特

No more data