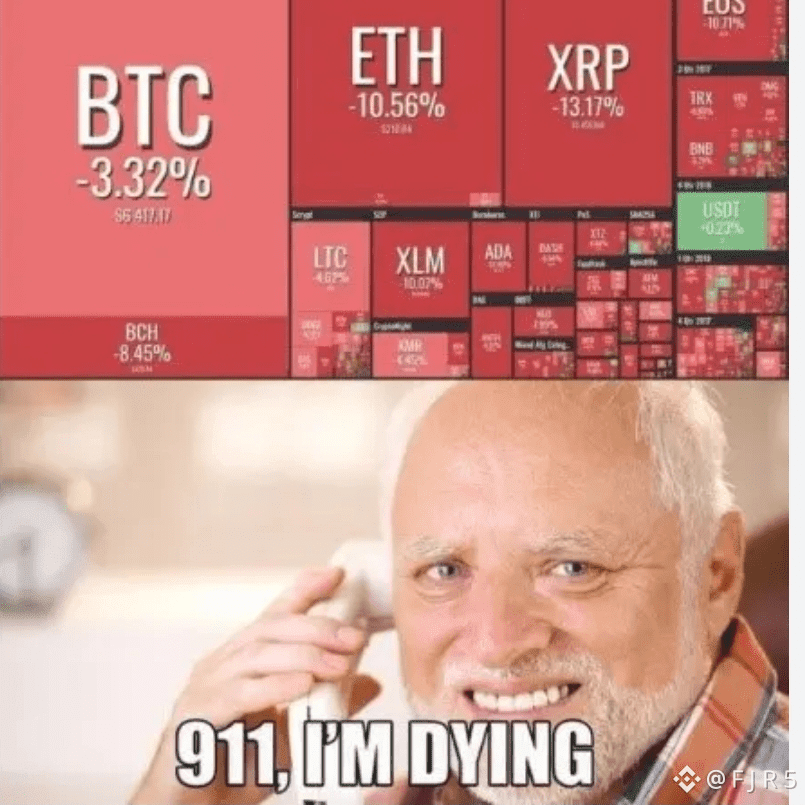

Even in the "Budget Bear Market", betting on projects with outstanding fundamentals can achieve alpha returns that surpass BTC and ETH. This article comes from an article written by Alex Xu, Lawrence Lee, and is compiled, compiled and written by Shenchao TechFlow. (Abstract: Zhao Changpeng: Adhere to fundamental investment "not knowing how to do technical analysis", I bought Bitcoin at $600 in 2014) (Background supplement: Cryptocurrency, inflation, bonds: Investment guide for risk control in 2025) There is no doubt that this bull market cycle is the worst performing round for altcoins. Unlike the historical law that various altcoins have performed actively after the start of the previous bull market, resulting in a rapid decline in BTC's market share, since the market bottomed out in November 2022, the BTC's market share has continued to rise from around 38%, and is currently firmly standing above 61%. This is still in the context of the rapid expansion of the number of altcoins in this cycle, and the weak price of this round of altcoins can be seen. BTC market share trend, Source: Tradingview This round of market has come to this day, which basically confirms the deduction of Mint Ventures in the article "Preparing for the main upward trend of the bull market in March 2014. In the original text, the author believes that 3 of the four major activators in this round of bull market are missing: 1: BTC's halving (expectations of supply and demand adjustment), √ expectations of loose or loose monetary policy, √ loose regulatory policies, √ innovation of new asset models and business models, × Therefore, the price expectations of the previous round of altcoins - including smart contract platforms (L1L2), games, Depin, NFT, Defi - should be lowered. Therefore, the recommended strategy for this bull market at that time was: higher allocation ratios on BTC and ETH (and more optimistic). BTC, mainly BTC for a long time) Control the configuration ratio on altcoins such as Defi, Gamefi, Depin, NFT, etc. Choose a new track, new project to take advantage of Alpha, including: Meme, AI and BTC ecology. Article published. Up to now, the correctness of the above strategies has been basically verified (except for the performance of the BTC ecology that is not satisfactory). But it is worth noting that although most of the coding projects have performed sluggishly in this round, a few of the price performances of the coding projects have been significantly better than BTC and ETH in the past year. The most typical one is the research report "Altcoins are falling, it's time to pay attention to the two special projects of Aave and Raydium mentioned by Mint Ventures in early July 2019 when the counterfeit market was at its lowest point. It was also since early July last year that Aave's highest increase compared to BTC was more than 215%, and its highest increase of 354% on ETH. Even after the current price has fallen sharply, Aave has increased by 77% relative to BTC and 251% for ETH. Aave/BTC exchange rate trend, source: Tradingview Since early July last year, Ray's highest increase compared with BTC has exceeded 200%, and its highest increase of 324% on ETH. Due to the overall decline of Solana ecosystem and encountered major negative news from Pump.fun's self-developed Dex, Ray's increase compared with BTC is still positive, and it also significantly outperformed ETH. Ray/BTC exchange rate trend, source: Tradingview Considering that BTC and ETH (especially BTC) have significantly outperformed most copycat projects this cycle, Aave and Ray's prices are even better among the many copycats. This is because compared with most copycat projects, Aave and Raydium have better fundamentals, which are reflected in the fact that their core business information has hit record highs in this cycle, and have unique moats, with stable or rapid expansion of market share. Even in the "Budget Bear Market", betting on projects with outstanding fundamentals can achieve alpha returns that exceed BTC and ETH, which is also the main purpose of our investment research work. In this research report, Mint Ventures will find high-quality projects with solid fundamentals from thousands of listed and circulated encryption projects, track their recent business performance and market share, analyze their competitive advantages, evaluate their challenges and potential risks, and provide some reference for its valuation. It should be emphasized that the projects mentioned in this article have advantages and attractiveness in some aspects, but they also have various problems and challenges at the same time. Different people may have completely different judgments about the same project after reading this article. Similarly, projects that have not been discussed in this article do not mean that they have "bad fundamentals" or "we are not optimistic". Welcome to recommend the projects and reasons you are optimistic about. This article is the stage thinking of the two authors as of the time of publication. It may change in the future, and their views are highly subjective, and there may also be errors in facts, information, and reasoning logic. All the views in this article are not investment advice. We welcome criticism and further discussion from peers and readers. We will analyze from several dimensions of the business status, competition situation, main challenges and risks, and valuation status of the project. The following is the main text part. 1. Lending track: Aave, Morpho, Kamino, MakerDao DeFi is still the best track for PMF in the crypto business world, and lending is one of the most important sub-tracks. User needs are mature and business income is stable. This track gathers many high-quality new and old projects, and they have their own advantages and disadvantages.For lending projects, the most critical indicators are loan size (Active loans) and protocol revenue (Revenue). In addition, the protocol expenditure indicator - Token Incentives (Token Incentives). 1.1 Aave: The King of Lending Aave is one of the few projects that have traveled through three rounds of encryption cycles and have developed steadily to date. It completed financing through ICO in 2017 (the project was still called Lend at that time, and the model was peer-to-peer lending). In the last cycle, it surpassed the lending leader Compound at that time, and its business volume has remained at the top 1 lending industry. Aave is currently serving on most mainstream EVMs L1 and L2. Business status Aave’s main business model is a lending platform with a point-to-pool model, earning interest income from loans, and liquidation fines generated during the liquidation of collateral. In addition, GHO, the stablecoin business operated by Aave, has also entered its second year, and GHO will generate direct interest income for Aave. Active loans Aave's loan scale, source: Tokenenterminal Aave's loan scale has exceeded the peak of 12.14 billion in the previous round (November 2021). The current peak is at the end of January 25, with the loan volume of US$15.02 billion. Recently, as the enthusiasm for market transactions has cooled down, the loan scale has also declined.