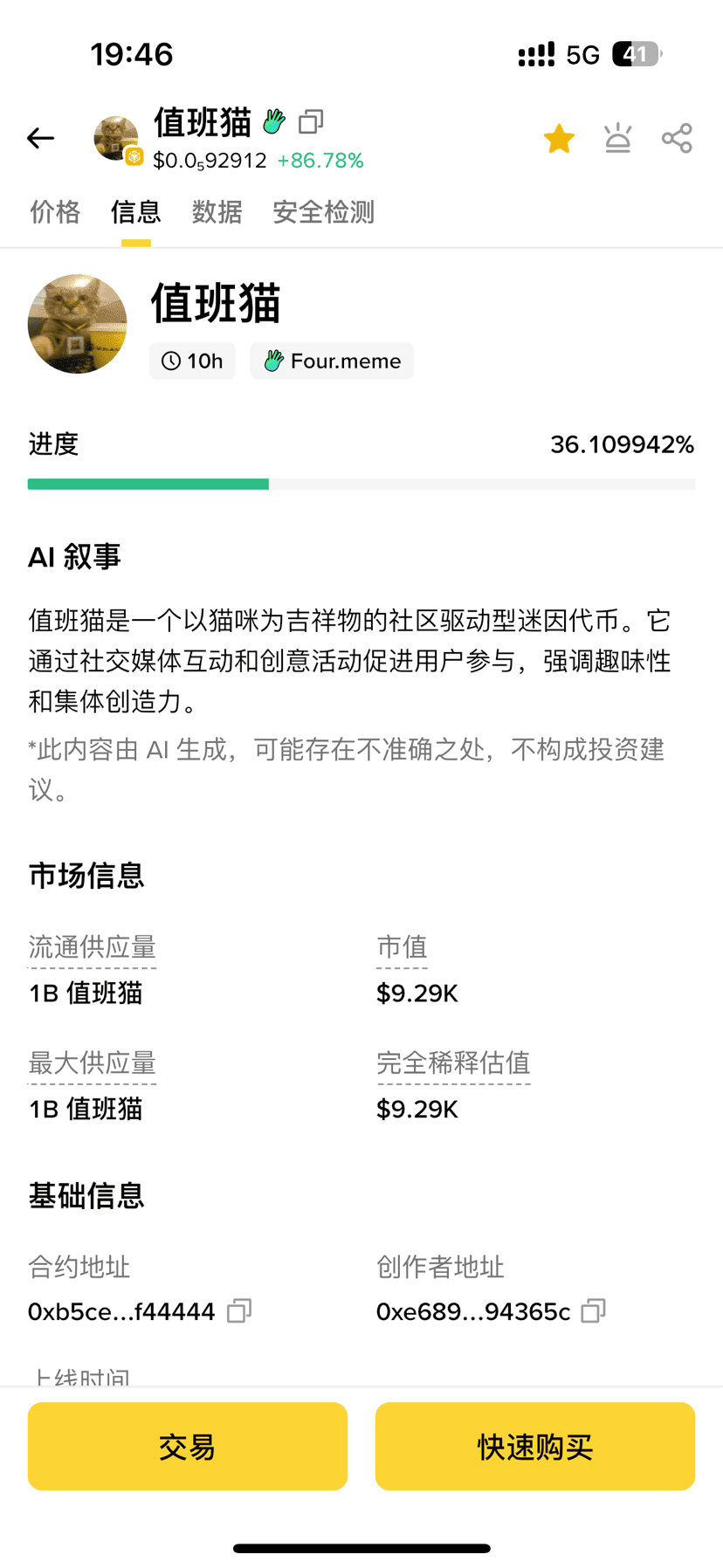

Late last night, when the market plummeted 20%, I was monitoring on-chain data as usual when I noticed several familiar whale addresses going on a buying spree. Over the next six hours, they accumulated 2.25 billion DOGE, 86% of all SNX holdings, and 1.82 million ASTER. This scene made me realize that true opportunities often emerge in moments of market panic.

Analyzing the Whales' Operational Logic

By analyzing the historical transaction records of these addresses, I discovered a striking pattern in their operations:

The increase in DOGE holdings was no accident. Besides the positive news of its upcoming Nasdaq listing, its solid community foundation has demonstrated strong resilience during previous market rebounds. Data shows that DOGE recovers 37% faster than major cryptocurrencies after a sharp drop.

The surge in SNX holdings stems from its newly launched perpetual contract DEX. This established DeFi protocol is experiencing a second wind, with its locked-in value increasing by 140% in a single week. Whales clearly see value that the market has overlooked. ASTER, a rising star in decentralized derivatives, saw its 1.82 million tokens increase in holdings, demonstrating institutional long-term optimism about the decentralized trading market. Following the FTX incident, decentralized derivatives trading volume has increased eightfold.

My personally tested copy trading strategy

After spotting whale activity, I immediately adjusted my positions:

10% of my funds were allocated to DOGE

15% to SNX

5% to ASTER

The results were astonishing:

After 72 hours, this combination generated a 28% return. More importantly, I learned to maintain my position during market panics.

@Hemi #Hemi $HEMI