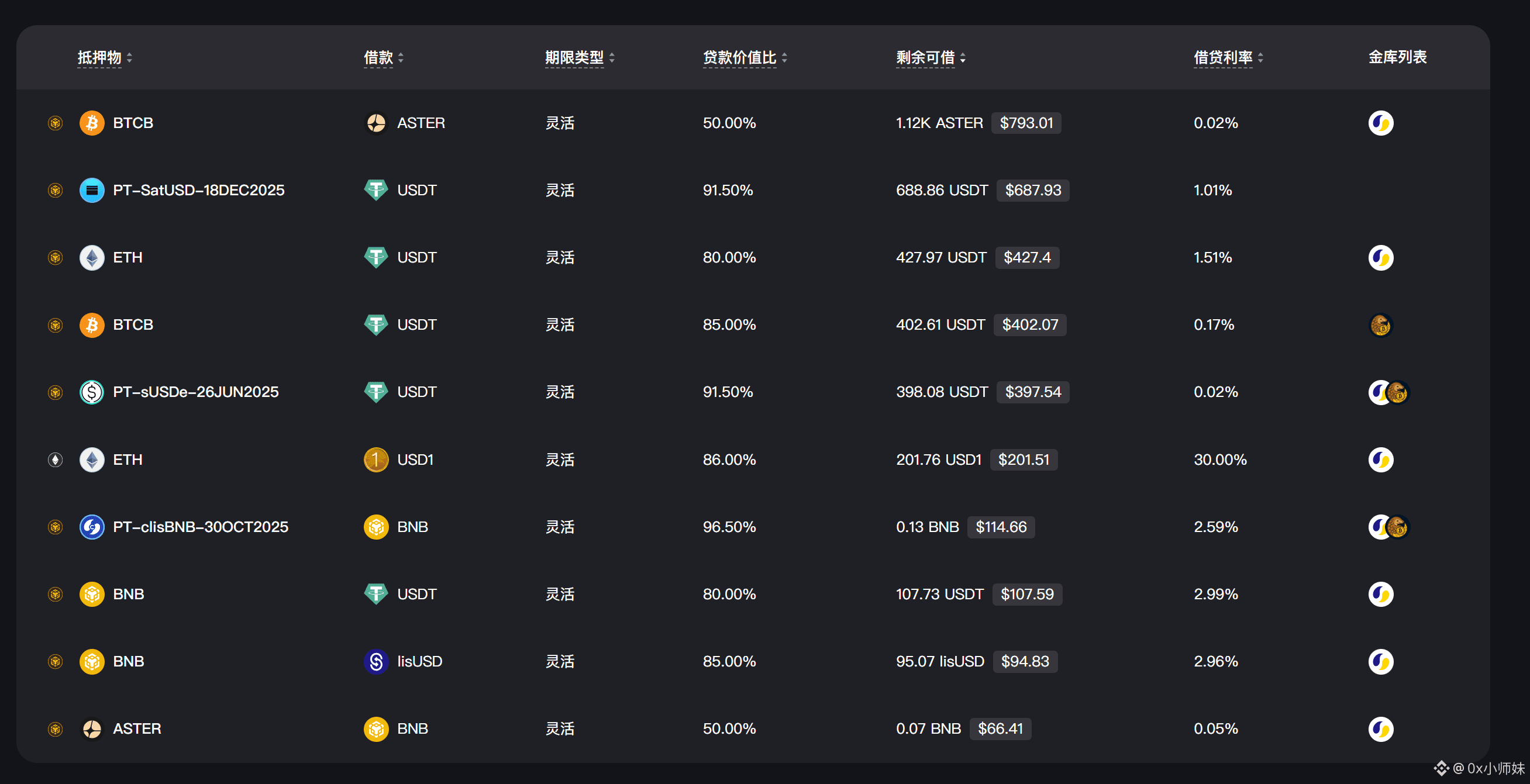

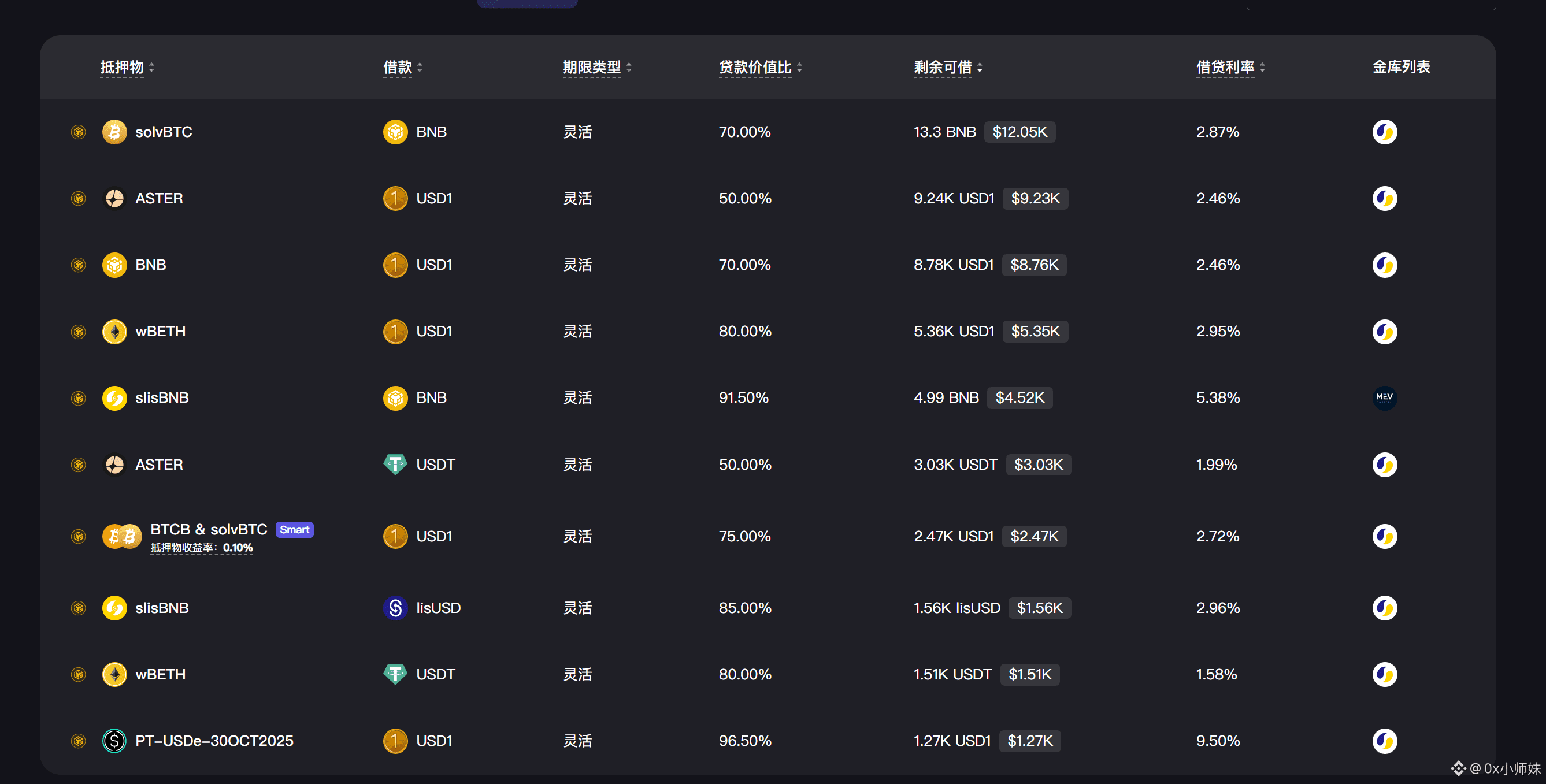

Borrowing lisUSD using @lista_dao is just the first step; the real skill lies in how to utilize this capital to generate higher returns.

The BSC chain boasts a wealth of DeFi building blocks, and lisUSD, as a native decentralized stablecoin, has been widely adopted by major protocols.

A classic strategy is to borrow lisUSD from LISTA and then combine it with other stablecoins on decentralized exchanges like PancakeSwap or Thena to form a liquidity pair (LP). Since it's a stablecoin-to-stablecoin pair, the risk of impermanent loss is negligible.

Then you stake this LP token for mining. Let's do the math: your BNB earns staking rewards and $LISTA rewards on LISTA, while the borrowed lisUSD earns transaction fee sharing and platform token rewards on the DEX.

This means your capital is working for you in two places simultaneously. As long as the DEX mining rewards cover the LISTA lending interest, it creates a positive cash flow flywheel. This combined approach maximizes capital utilization. #USD1 Best Investment Strategy ListaDAO

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data