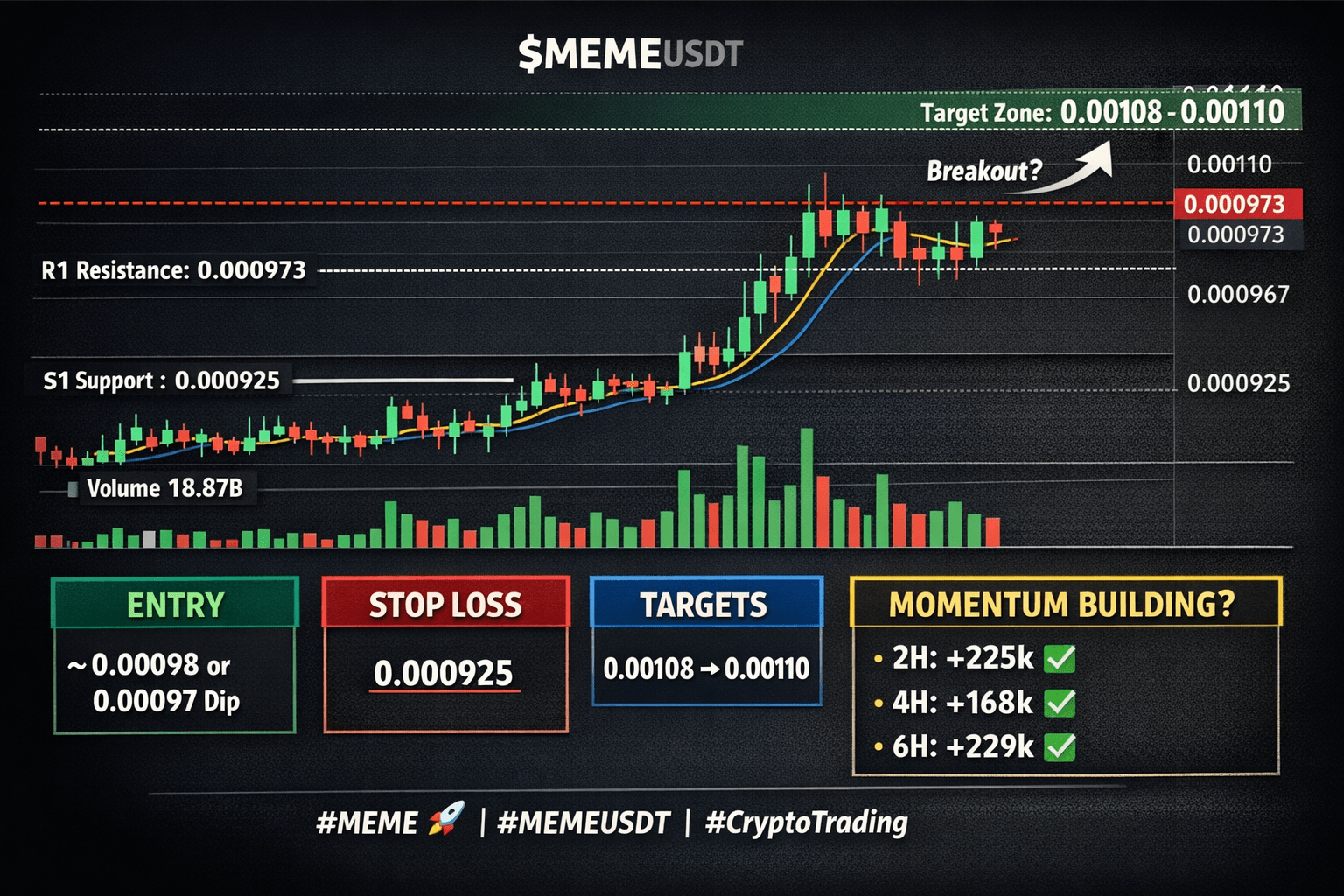

🚀 $MEME is currently in a consolidation phase, but the overall trend is bullish. Trading volume is exceptionally high: 24-hour volume reached $18.87 billion, and has continued to climb after the appearance of a green candlestick pattern → genuine accumulation is underway.

💰 Fund Flow:

2 Hours: +225,000 ✅

4 Hours: +168,000 ✅

6 Hours: +229,000 ✅

1 Hour: -115,000 (Quick profit-taking)

24 Hours Spot: -31,000 (Slight pullback)

📈 Trading Strategy:

Entry Point: ~0.000998, or a pullback to 0.00097-0.00098 (5-day/10-day moving average support level)

Stop Loss: 0.000925 (below S1 support level)

Target: 0.00108 → 0.00110 (R3 and Bollinger Band middle section)

👀 Observation: If the price breaks through R1 0.000973 with volume, momentum is confirmed. It could be an imminent surge, or it could be a temporary false breakout!

#MEME #MEMEUSDT #CryptocurrencyTrading #Memecoin 🚀

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data