The enthusiasm for high-performance public blockchains has never been higher. Ethereum's congestion and high transaction fees have shifted market attention to emerging public chains like Solana, Avalanche, and Base. These chains have garnered the favor of developers and users with their higher transaction throughput and lower transaction costs. Solana stands out in particular—not only for its speed and low fees, but also because its unique technical architecture offers new possibilities for on-chain strategies.

Solana's core innovations lie in Proof-of-History (PoH) and the Sealevel parallel execution engine. PoH essentially timestamps each transaction, arranging on-chain operations in a sequential order and reducing node reconfirmation time. Imagine a group of friends queuing up to buy tickets. If everyone has to ask, "Who's in front of me?", the entire process slows down. PoH is like everyone having a queue number, allowing everyone to proceed directly according to their number, instantly improving efficiency. Sealevel allows non-conflicting transactions to execute simultaneously, similar to checking out at a supermarket. If A wants to buy an apple and B wants to buy milk, both can do so simultaneously. However, if both want to grab the last bottle of apple, they must queue. This allows Solana to process a large number of transactions in parallel in most cases, significantly increasing throughput. However, transaction rollbacks may still occur during peak periods, requiring developers to consider conflict control in their smart contract design. The editor's opinion is that while the speed and low cost of high-performance chains are certainly attractive, the complexity brought about by parallel transactions poses new challenges for strategy design.

However, high performance is only a foundational requirement. The true determinant of a public chain's vitality lies in the activity of its on-chain assets. This exposes a key issue: Bitcoin, the largest digital asset by market capitalization, has long remained dormant on high-performance chains. Whether it's cbBTC on Solana or wrapped BTC on other chains, most can only serve as a medium of exchange or underlying collateral, unable to directly generate returns or participate in complex strategies. This fragmented liquidity and inefficient use are like using a Ferrari solely for transportation, a wasteful act.

The complexity of cross-chain operations further exacerbates this problem. Users seeking to transfer Bitcoin from Ethereum to Solana to participate in high-frequency trading strategies face high cross-chain fees, lengthy confirmation times, and various technical and security risks. Traditional cross-chain bridge solutions either rely on centralized custody or are technically complex, making them difficult for average users to use smoothly.

Against this backdrop, Liquid Staking Tokens (LSTs) offer a new option for Bitcoin holders. Currently, a variety of LST solutions are available on the market. LBTC, launched by Lombard, is a typical 1:1 BTC-backed product, typically offering an annualized return of around 1%. This type of product features a non-rebalancing design: the number of tokens held by users remains constant, but the underlying BTC associated with each token gradually increases with staking rewards. For example, an initial 1 LBTC stake may become equivalent to 1.01 BTC over time, thus achieving capital appreciation.

In terms of security mechanisms, such products typically employ a multi-institutional custody model, using multi-signature technology and proof of reserves to ensure fund security. LBTC utilizes a custodian alliance comprised of 14 digital asset institutions to diversify risk. However, any custody solution carries counterparty risk, and users must balance convenience with control.

In terms of technical implementation, products like Lombard are exploring cross-chain functionality. Based on protocols like LayerZero, some LSTs have already achieved a bridge from Ethereum to Solana: transactions are verified by light nodes, messages are transmitted using a decentralized relay network, and asset mapping is achieved through price data provided by oracles. In theory, users can complete cross-chain transfers within minutes.

As more LST products are deployed on different chains, the strategic options available to BTC holders are indeed expanding. They can use these tokens as collateral in DeFi protocols, participate in DEX trading, or engage in lending operations. This development trend indicates that Bitcoin is shifting from a simple store of value to a more active DeFi asset, but it also introduces new technical and market risks.

Market Impact and Future Trends

From a broader perspective, this change has three implications. First, it improves capital efficiency—BTC is no longer a static asset, but rather a dynamic asset that can participate in multiple income strategies simultaneously. Second, it verifies technical feasibility—proving that high-performance chains can indeed support complex financial strategies. Operations such as perpetual contracts, liquidity mining, and lending run smoothly on the Solana environment. Finally, this provides a replicable template for the entire industry, demonstrating how to monetize and activate cross-chain assets while ensuring security.

Of course, this process is not without risk. The security of cross-chain bridges is always a challenge, and numerous historical hacking incidents have been linked to cross-chain operations. The stability of high-performance chains under extreme market conditions also needs further verification. Solana has previously experienced outages due to network overload. The uncertainty of the regulatory environment is also not to be ignored, and regulatory stances on LST products in various countries are still evolving.

However, judging by development trends, the activation of core assets such as BTC in the multi-chain ecosystem is an irreversible trend. Traditional financial institutions are experiencing growing demand for yield-generating digital asset products, while the technological infrastructure is constantly improving. The development of new technologies such as zero-knowledge proofs and account abstraction will further lower the barrier to entry for users and enhance the security and convenience of cross-chain operations.

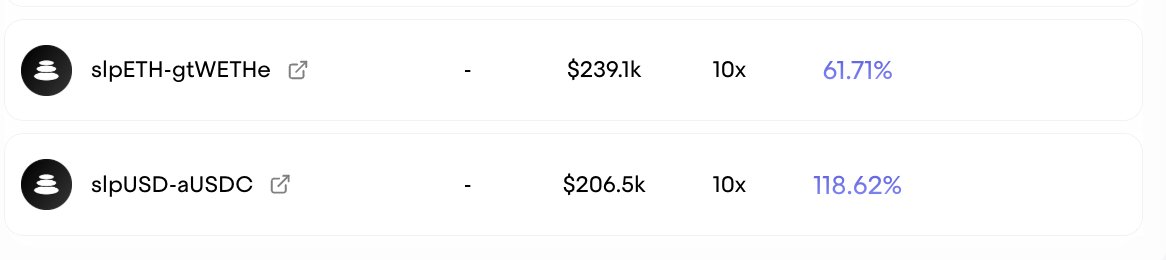

Market data supports this assessment. Currently, the global BTC market capitalization is approximately $1.2 trillion, but BTC assets involved in DeFi account for less than 1% of the total supply.If this ratio can be increased to 5%-10%, the corresponding market size will reach $60 billion to $120 billion. Ethereum's liquidity staking market has already proven the feasibility of this model, with a total locked-in value exceeding $40 billion, providing a valuable reference for the development of BTC LST.

In the era of high-performance public chains, competition is ultimately not simply a TPS contest, but rather a test of who can build a more active and efficient on-chain economic ecosystem. Technical performance is fundamental, but asset activity, cross-chain interoperability, and user experience are the key determinants of success. The successful launch of LBTC on Solana not only provides strong support for Lombard's upcoming token launch, but also provides strong support for Lombard's upcoming token launch.