Let me explain what happened last night with ListaDAO, MEV Capital, and USDX.

First, Lista Lending's MEV USDT Vault showed an APY that surged to 3570%. However, this is compounded interest; the actual annualized rate is around 300%, less than 1% daily.

The reason is that ListaDAO removed the 30% cap on borrowing rates early yesterday morning. This was undoubtedly a wise move, as the risk on USDX was already very evident, and the last escape route was the remaining liquid available for liquidation on DEXs.

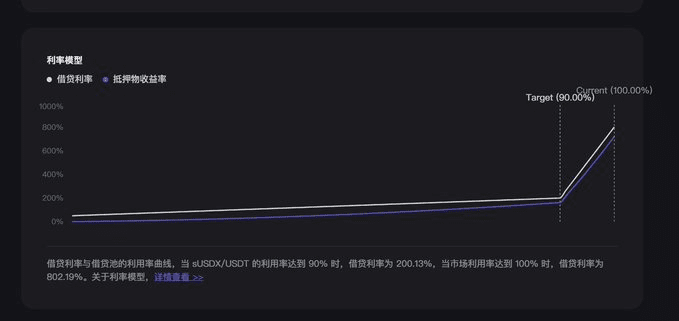

Then, looking at MEV Capital, after ListaDAO removed the interest rate cap, MEV Capital's AdaptiveCurveIRM mechanism started to take effect. Simply put, when the utilization rate exceeds 90%, the borrowing rate will increase exponentially. If the utilization rate still doesn't drop below 90% under these circumstances, the latter half of the curve will continue to shift upwards, increasing exponentially.

Furthermore, MEV Capital has a larger risk exposure to manage through Stream Finance, which may be where MEV Capital is currently focusing its efforts.

So, what will happen next?

What we're seeing is that even with borrowing rates soaring to new highs of 300% to 800%, borrowers (suspected Stables Labs-related addresses) show no signs of repayment. There have even been instances of them exchanging USDX for USDT and depositing it into Binance.

If this continues, proactive risk control measures from AdaptiveCurveIRM or other curators will quickly trigger the liquidation of USDX/sUSDX. Based on current data, this process is estimated to occur within three days.

Currently, the counterparty LP liquidity for USDX/sUSDX on DEXs is less than $10 million, while the lending market position is likely above 10x. A stampede is inevitable.

Therefore, my advice is not to be greedy for a 1% daily return. Withdraw funds from the following Vaults as soon as possible, provided you have liquidity (PS: The ListaDAO protocol itself is safe and reliable; the risk is limited to specific Vaults):

1) ListaDAO's sUSDX-lisUSD pool

2) ListaDAO's MEV Capital USD1 and USDT pools

3) ListaDAO's Pangolins USDT Vault

4) Re7 USD1 Vault

5) Euler's USDX and sUSDX pools

6) Silo's sUSDX/USDC pool

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data