Pump.fun, a Solana-based memecoin platform, achieved its strongest revenue week since 2025 in mid-August, as the memecoin sector recovered from a slump earlier in the month.

Decentralized finance data tracker DefiLlama shows that Pump.fun's weekly revenue reached $13.48 million from August 11th to 17th, marking the platform's highest weekly revenue performance since February.

This growth follows a significant drop in revenue from late July to early August, when Pump.fun's weekly revenue reached $1.72 million, its lowest point since March 2024, leading to a lackluster July.

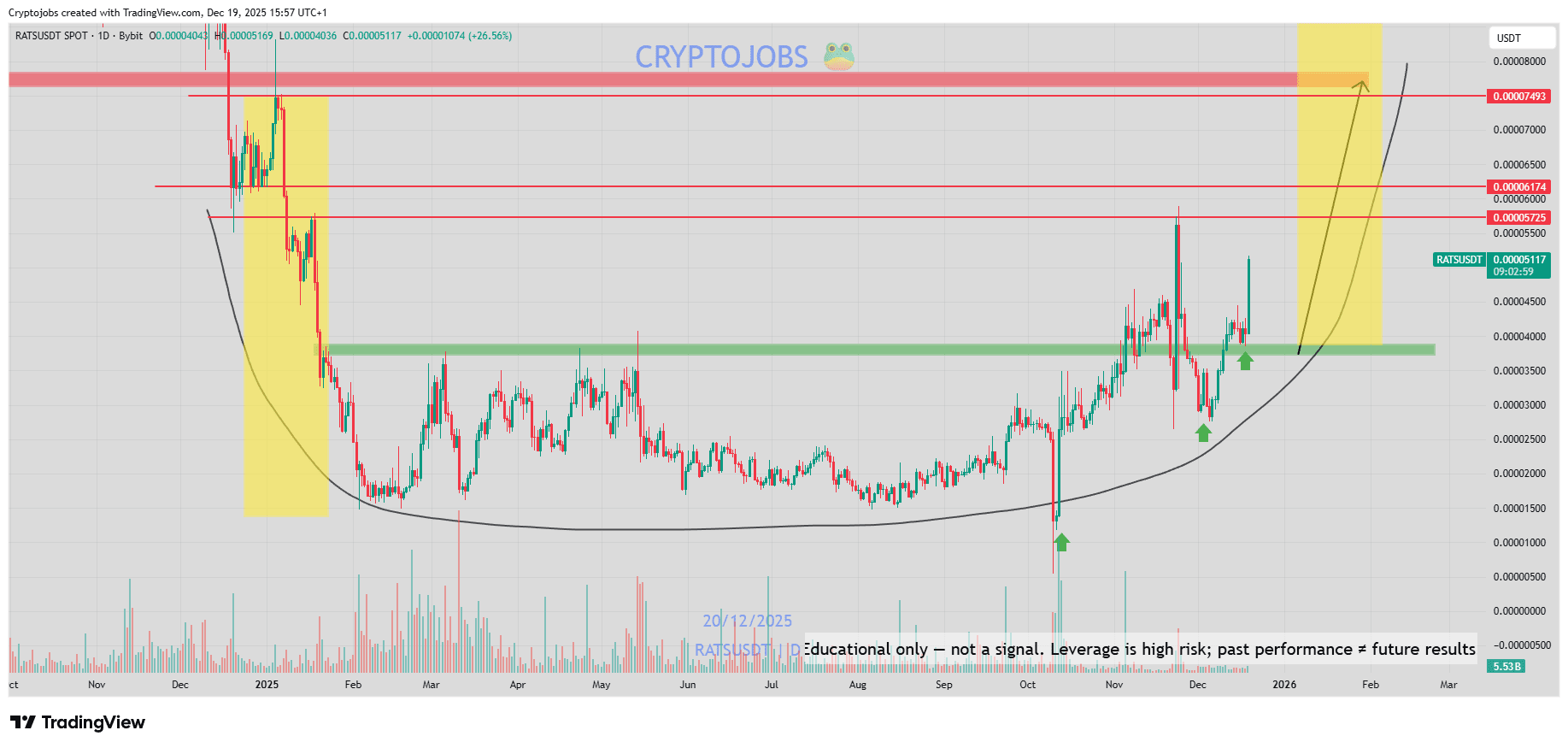

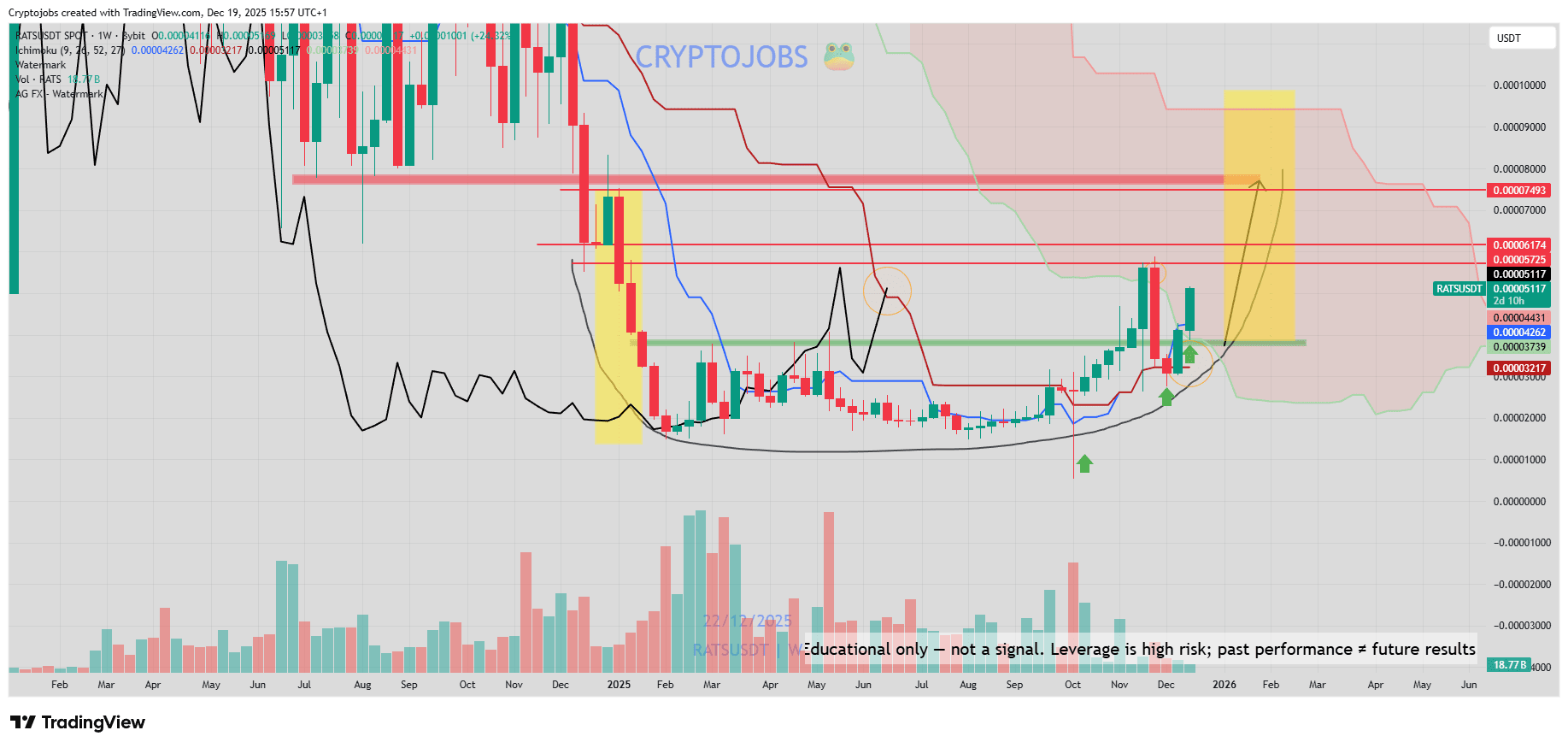

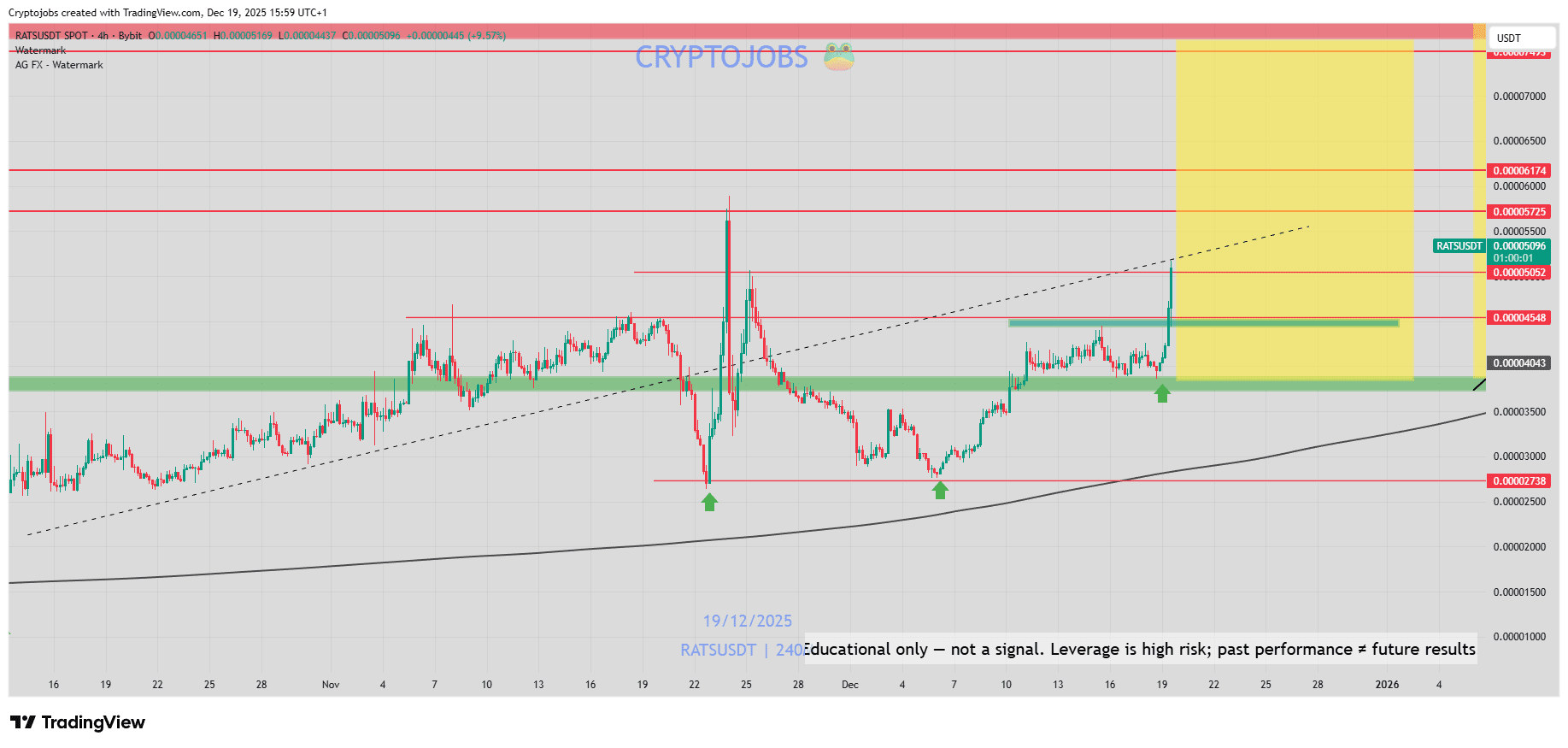

The overall memecoin market experienced a similar trend. CoinMarketCap data indicates that the memecoin market capitalization fell to $62.1 billion on August 3rd, a $16 billion decrease from $77.7 billion on July 28th. Pump.fun Weekly Revenue Data for 2025. Source: DefiLlama

Pump.fun Reclaims Top Spot on Solana Listing Platforms

Pump.fun's revenue growth comes amid a broader recovery in the memecoin space.

According to CoinMarketCap, the memecoin sector rebounded to $75 billion on August 11th, before falling to $70 billion by August 17th. Its current market capitalization is $66 billion.

Furthermore, Pump.fun has regained its dominance in the Solana memecoin listing platform rankings.

On July 7th, a newly launched Solana platform, LetsBonk, surpassed Pump.fun in 24-hour revenue.

However, according to data from Solana DEX aggregator Jupiter, Pump.fun has regained the top spot in market share, reaching 73.6% over the past seven days and generating $46.8 billion in trading volume.

The platform also boasts 1.37 million traders and over 162,000 token mints. Solana memecoin launch platform data. Source: Jupiter

Related: Nasdaq-listed company plunges 50% due to BONK memecoin

Pump.fun faces $5.5 billion lawsuit

Despite regaining momentum, Pump.fun faces legal challenges. A class-action lawsuit filed on January 30th accuses the platform of using "guerrilla marketing" to create an artificial sense of urgency for its tokens.

On July 23rd, the lawsuit was amended, alleging that Pump.fun acted like an "unlicensed casino" and that investor losses had reached $5.5 billion.

Despite facing the lawsuit, the platform continues to perform well. According to Dune Analytics, the platform has generated $800 million in total revenue.

Solana Labs co-founder Anatoly Yakovenko recently commented on the platform's potential, saying it has the potential to become a global streaming platform.

Magazine: Solana Seeker Review: Is a $500 crypto phone worth it?