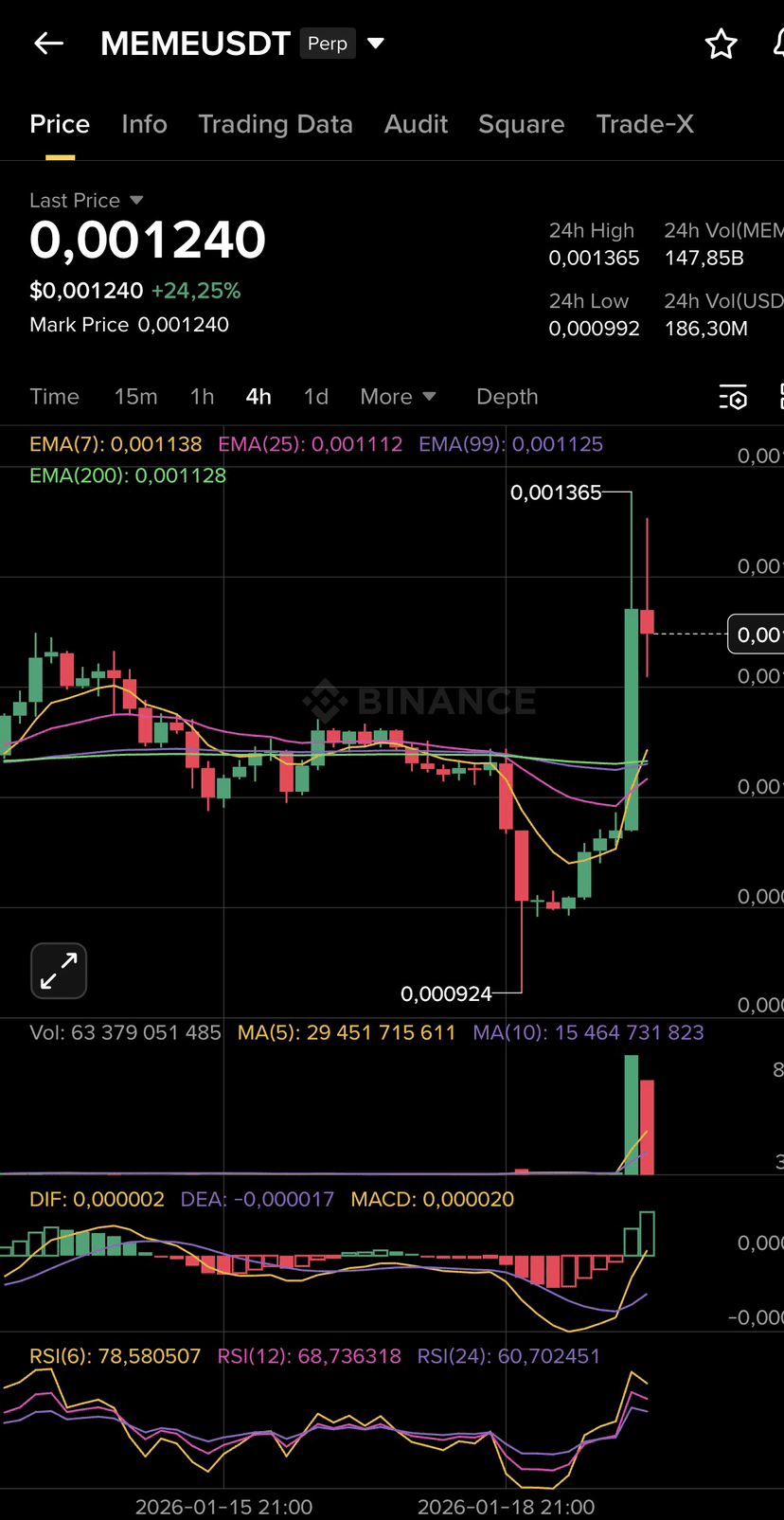

$MEME Breakout After Consolidation

Current Price: $0.001240 (24-hour increase of 24.25%). Strong upward momentum; price above the 7-day, 25-day, and 99-day moving averages, indicating good trend continuation.

🎯 Long Entry Points: $0.00118 – $0.00124

Target Price 1: $0.00136

Target Price 2: $0.00148

Target Price 3: $0.00160

Stop Loss: $0.00108

As long as the price remains above the $0.00113 support zone (7-day moving average), the bullish structure remains valid and is expected to continue moving towards recent highs. A decisive break above $0.00136 could accelerate the upward movement.

Trading MEME 👇

#MEME #Altcoins #CryptocurrencyTradingInsights #BinanceSquare

{future}(MEMEUSDT)

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data