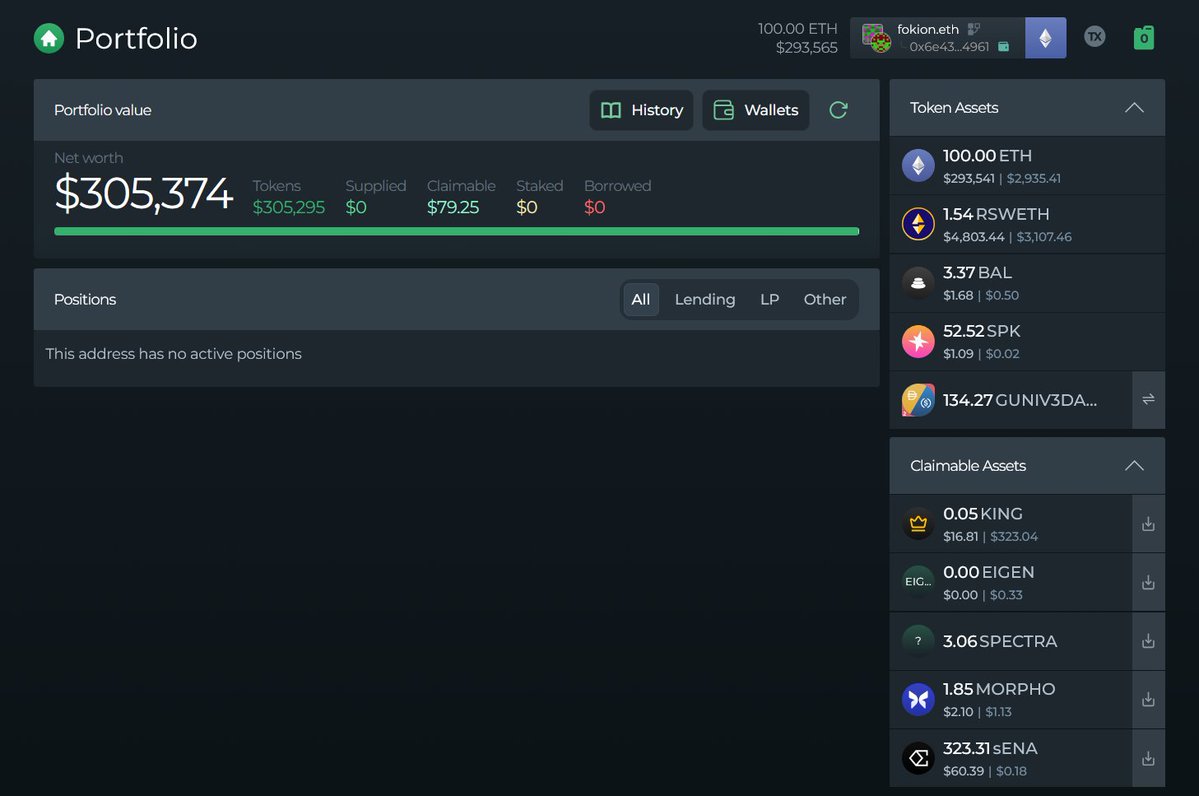

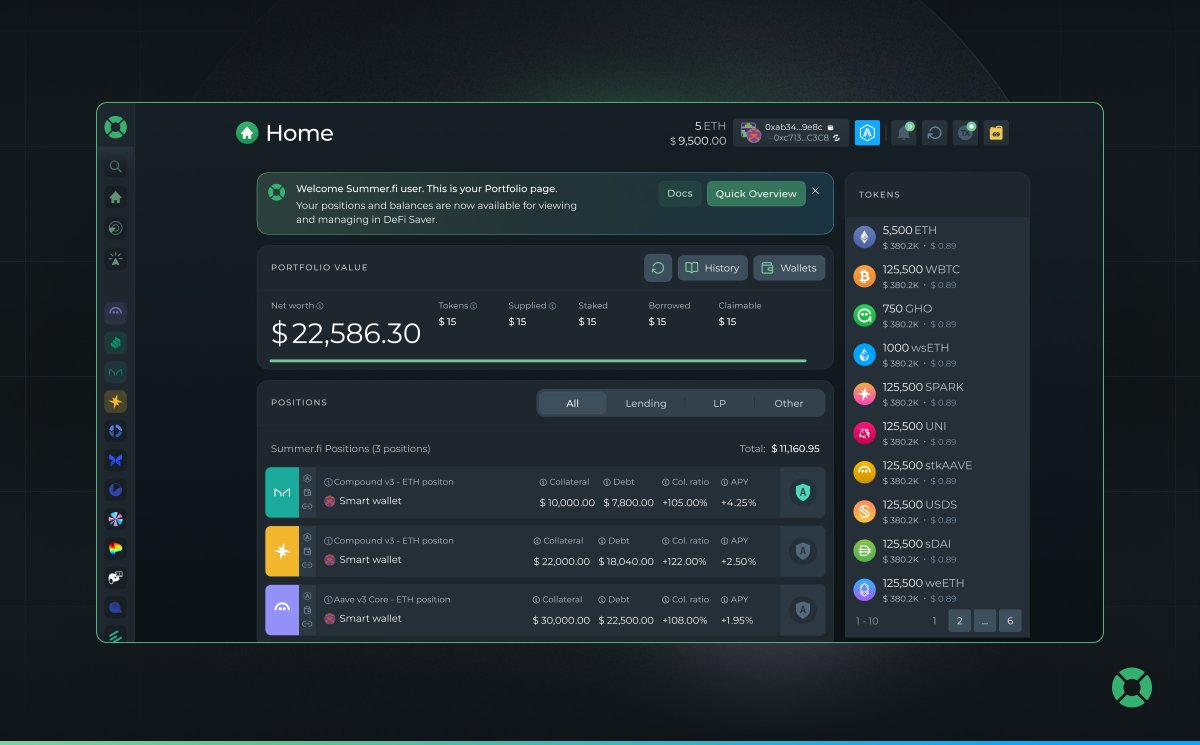

Over the past four days, more than $5 billion in crypto assets have been liquidated, and we've just had an extremely volatile weekend.

Despite this, DFS Automation once again protected hundreds of positions amidst the market's dramatic volatility.

Quick statistics for the past 48 hours:

🤖 1227 auto-adjustments completed

🛡️ 467 unique positions automatically protected

🔵 @arbitrum remains the most popular network for automation users

👻 @aave remains the top choice for automated traders

💱 DFS's total leveraged swap trading volume reached $320 million

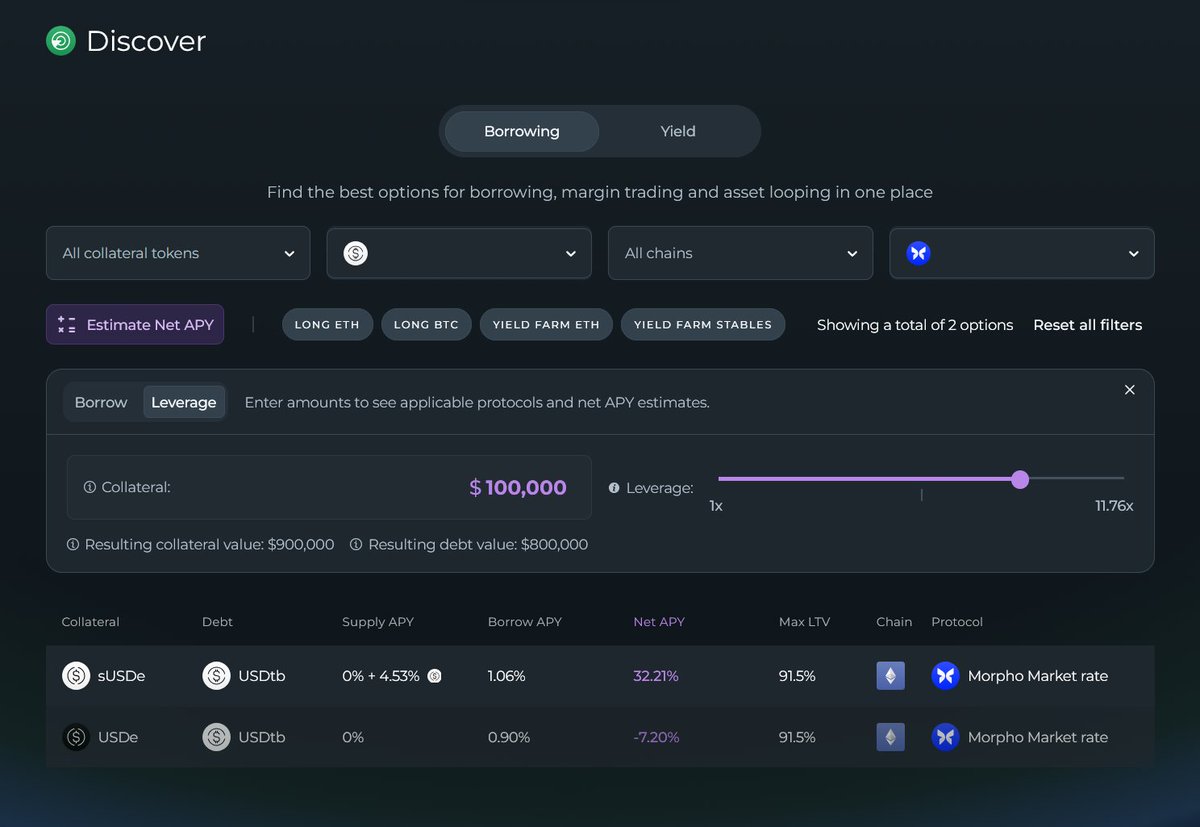

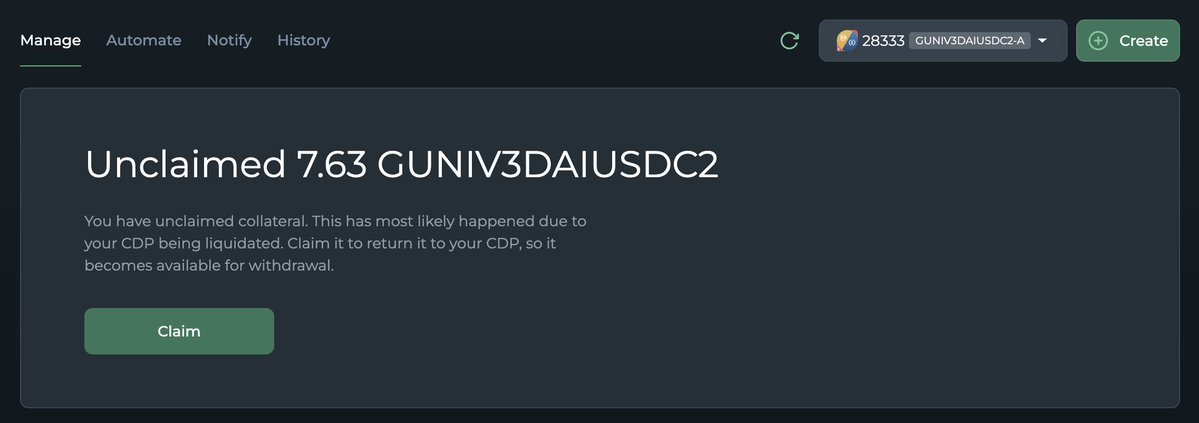

Regarding the most commonly used options, our automatic liquidation (partial liquidation) remains the most prevalent choice, but given the magnitude of the decline, we also saw a large number of users execute full stop-loss orders.

DFS Automation remains the top choice for lending protocols in the Ethereum DeFi ecosystem, and we are proud that it has helped so many people sleep soundly amidst this market uncertainty.

For anyone looking to set up liquidation protection for their positions in Aave, Compound, Maker/Sky, Morpho, Fluid, Spark, CurveUSD, or Liquity V2, you can find details on all available automation options in our knowledge base:

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data