Do not easily intervene in other people's karma. The Dharma should not be lightly transmitted, and the Way should not be cheapened.

Many people do not understand this principle: they act as guarantors for others' car loans; they lend money to others for down payments on houses; they lend money to others for gambling and prostitution; they even take on all the housework and debts for their children, and choosing jobs and marriages for their children—all of these involve interfering in other people's karma.

Sometimes, even if you help others, things may not get better. The saying "a small favor is appreciated, but a large one breeds resentment" is actually interfering in other people's karma. Giving someone food when they're hungry is fine, but if you have to support them for three months or a year, that's your problem.

Relationships between people are an exchange of energy. Poor people who are with rich people will absorb their energy; ordinary people who are surrounded by powerful people will naturally have their energy increased.

Follow the natural way; do not intervene in other people's karma with a savior mentality. Everyone, including your loved ones, children, and parents, has their own purpose and mission. Do not affect others' experiences of joy, sorrow, highs, and lows.

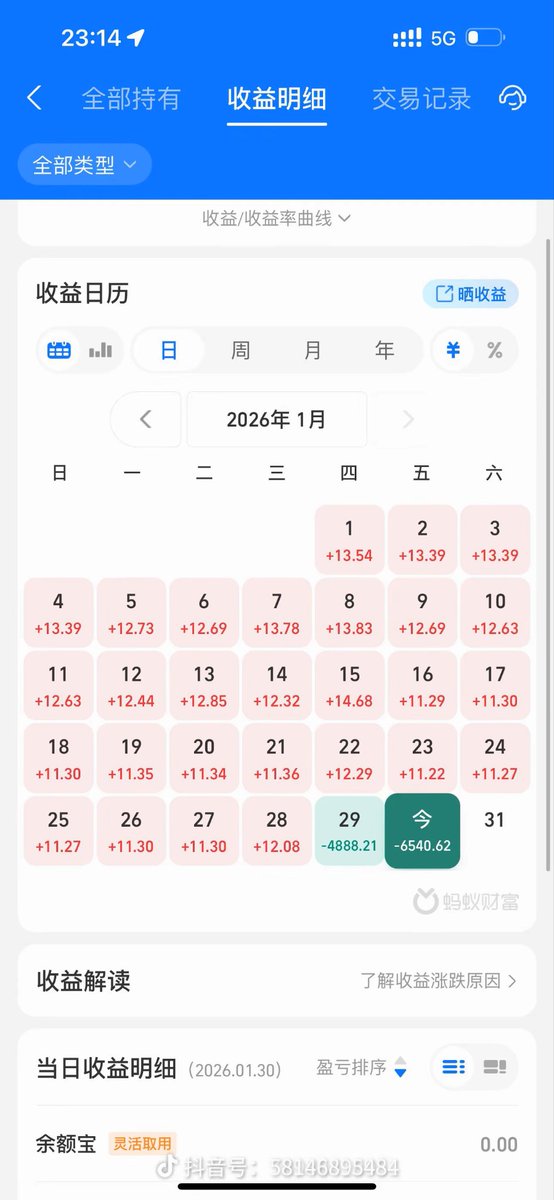

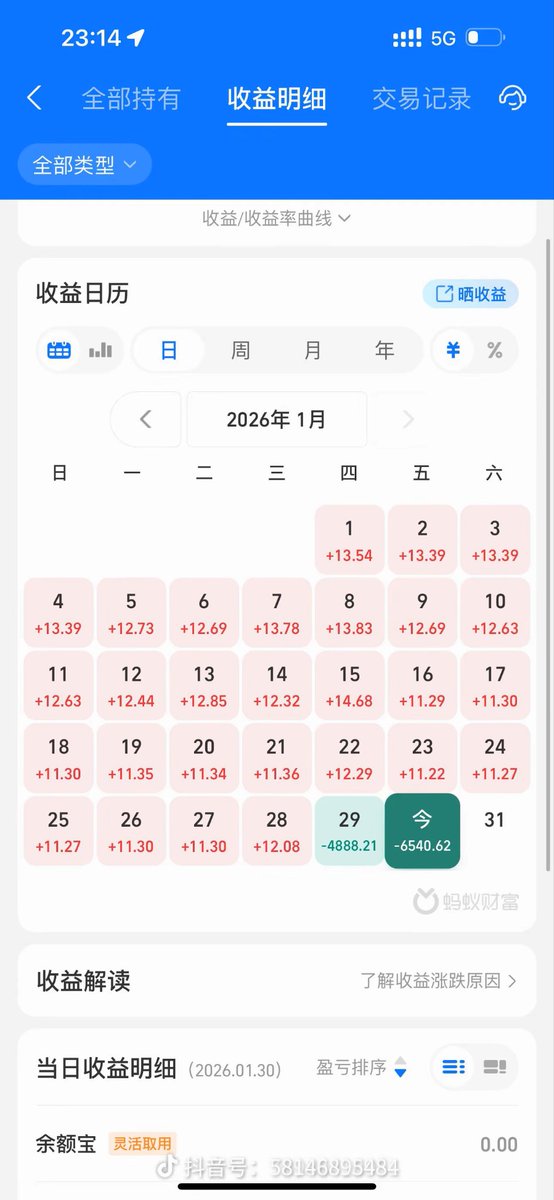

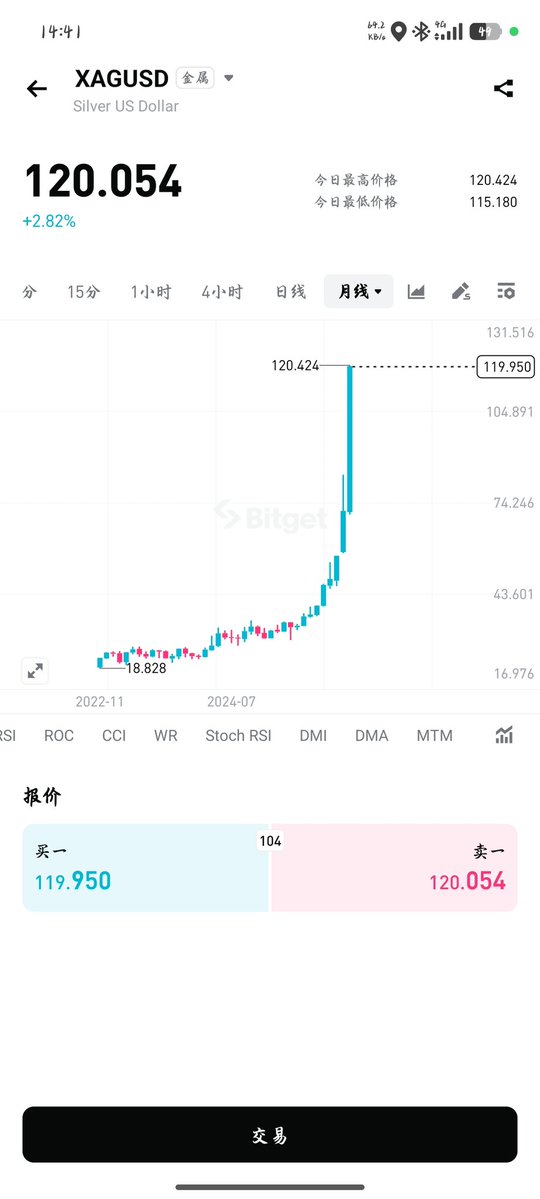

Just like when we do Bitcoin... For those analyzing ETH market trends, feel free to express your subjective opinions, but don't give advice to others. If someone loses money, that's their own problem.