As you all know, I disappeared for months, completely out of the public eye.

I took a break to reset my dopamine levels, rebuild my nervous system, reconnect with my body, and truly remind myself of the meaning behind all my previous hard work.

Today, after six months, I finally turned on my computer.

During these months, I knew I had to overcome my "fear of missing out" (FOMO). Even though I wasn't online, my friends would still tell me about surging on-chain trades—not easy to hear when I wasn't participating and was experiencing intense FOMO.

My problem was FOMO and the idea that "I have to participate in every profitable trade."

Yes, when the whole "pump and dump" frenzy swept in, it felt amazing; money was snowballing, and my ego was inflated.

For a time, I even forgot who I really was because I associated my identity with predicting profitable trades and making money.

True clarity comes only when you distance yourself from charts, positions, profits and losses, alerts, and adrenaline for a sufficient amount of time to truly understand yourself.

Being in the cryptocurrency space means being surrounded by money 24/7.

That's powerful, but it can also be dangerous if you lose your senses.

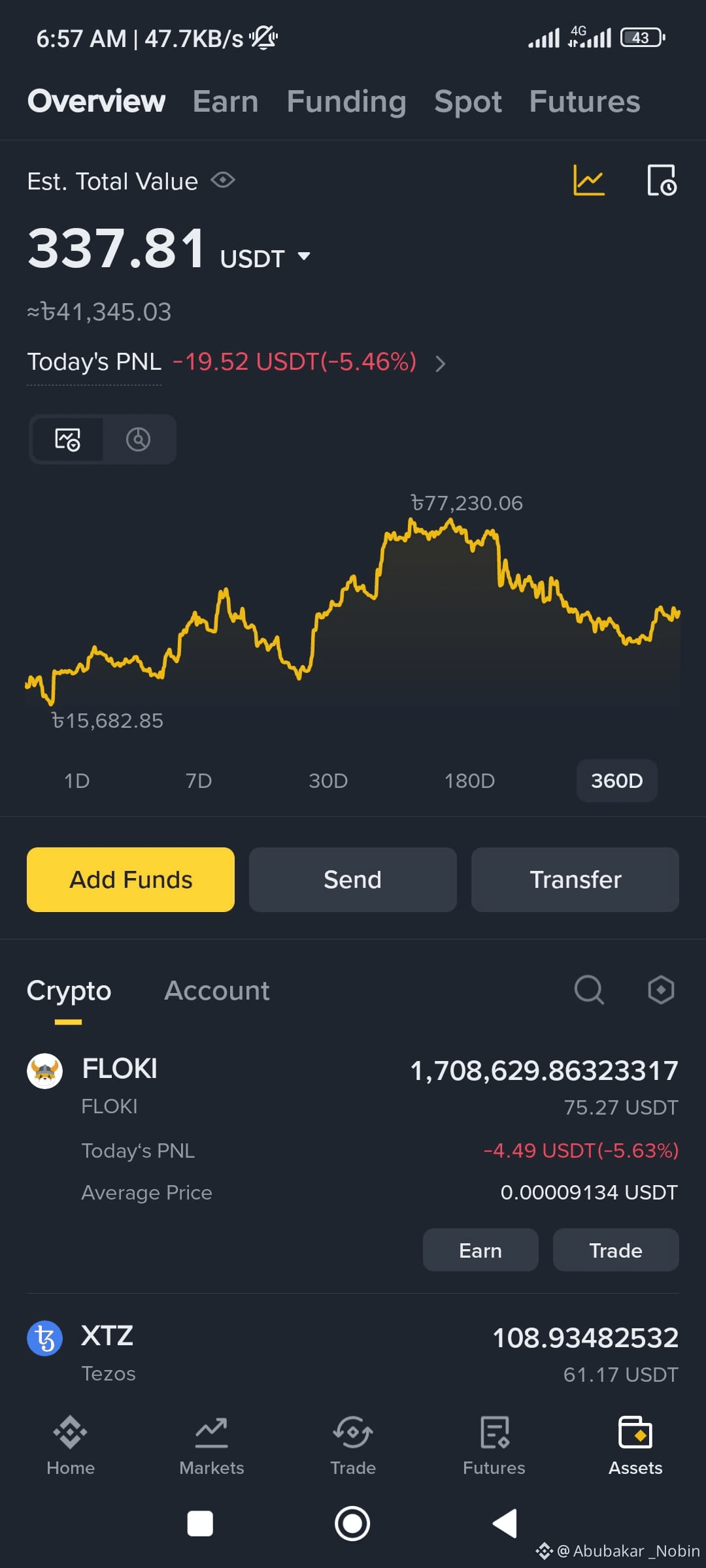

At the peak of the cycle, losing $300,000 because of a meme was "nothing" to me; I genuinely didn't care because I knew how easy it was to make money in this space.

Those months, I started making friends with ordinary people, which for the first time made me re-examine my perspective. I learned that some girls I knew worked six days a week, eight to ten hours a day, earning only $5,000 a month. For them, going out for a meal was a huge deal. Owning a Chanel bag was like a life-changing event for them. This was a complete shock to me because if I wanted to buy a bag, a watch, or something like that… I could just walk into a store any Monday afternoon and buy it, no problem. But I felt completely numb. I no longer appreciated anything around me, not even the people around me.

Every conversation felt utterly boring. All I wanted to talk about was the next act. If they didn't talk about it, the conversation was pointless.

The only thing that excited me was seeing my portfolio numbers grow.

I realized I was completely out of touch with reality.

Here are the truths most people are unwilling to admit:

Making money is meaningless,

if you're too stressed to enjoy life,

too anxious to rest,

too numb to feel,

too busy to live,

or too disconnected from life to love.

Money is meant to enrich your life, not replace it.

During this break, I rediscovered these wonderful feelings:

– No more anxiety when waking up

– No more striving for results when exercising

– No more guilt when falling asleep

– No more pressure when creating

– Focused on the present moment, undisturbed

I thought that to escape boredom, I had to do the most mundane things—grocery shopping, cooking, painting, making friends with ordinary people, etc.—things with extremely low returns…

But it actually worked.

These past few months I've learned…

True wealth isn't money.

True wealth is capability.

The ability to feel, enjoy, live in the present, and continuously create without exhaustion.

If your nervous system breaks down, your decision-making ability suffers.

If your identity is tied to profit and loss, your sense of self-worth becomes fragile.

This leads to revenge trading, excessive leverage, overworking, and even self-destruction.

So I'm returning to a different approach.

No more chasing, no more demanding, no more proving myself.

Just precise execution, patience, clear thinking, and respect for timing.

Looking to the future, it's not about how much money I can make.

It's about:

– Sustainability

– Clear thinking

– Emotional neutrality

– Long-term commitment

So, we're starting again… but this time, my nervous system is more stable. I think this also aligns with the current stage of the market cycle we're in.