There was nothing complicated about it, nor was it unexpected.

The 10/10 incident was caused by irresponsible marketing campaigns by certain companies.

On October 10th, hundreds of billions of dollars worth of cryptocurrency were liquidated. As the CEO of OKX, we clearly observed that the microstructure of the cryptocurrency market underwent a fundamental change afterward.

Many industry insiders believe that the losses caused by this incident were more severe than the FTX crash. Since then, there has been extensive discussion about the causes of the incident and how to prevent it from happening again. The root cause is not difficult to find.

⸻

The Incident's Course

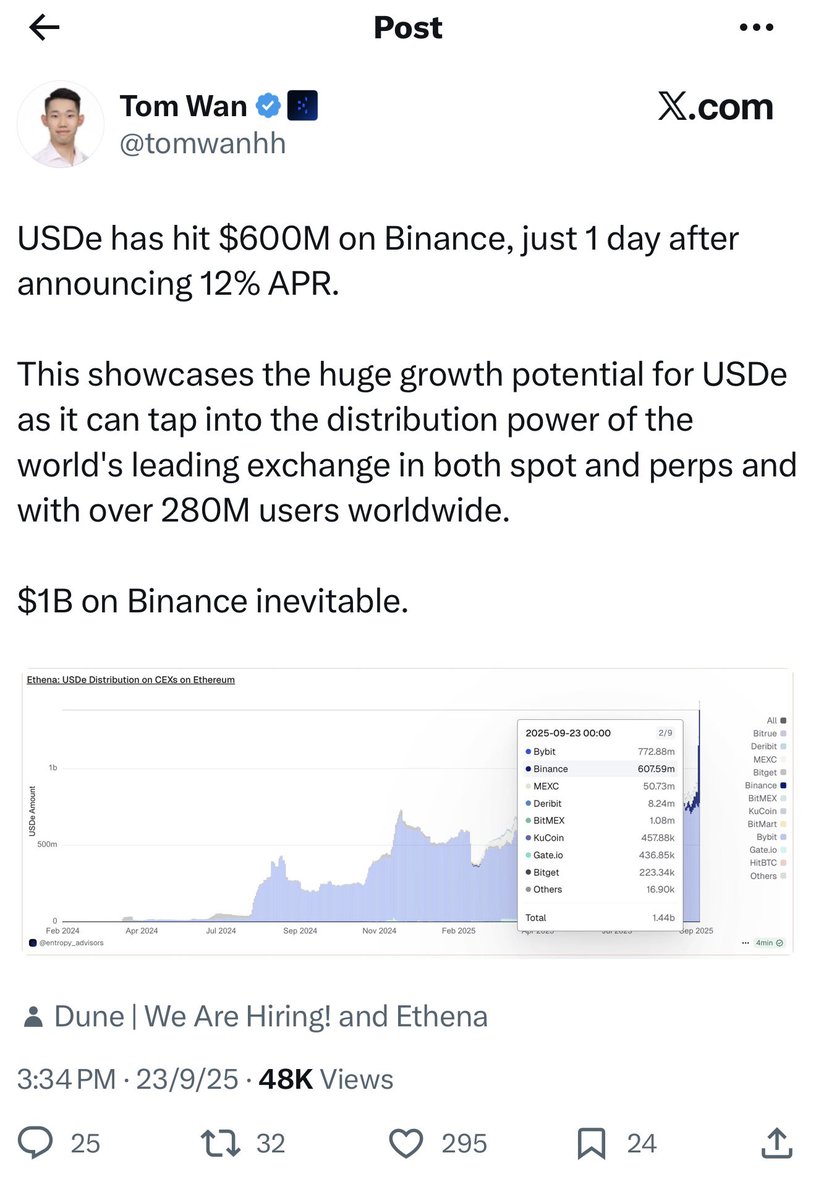

1. Binance launched a limited-time user acquisition campaign, offering a 12% annualized yield on USDe, while allowing USDe to be used as collateral, treated the same as USDT and USDC, with no effective limits.

2. USDe is a tokenized hedge fund product.

Ethena raised funds through so-called "stablecoins," invested them in index arbitrage and algorithmic trading strategies, and tokenized the resulting funds. Users could then deposit these tokens into exchanges to earn returns.

3. USDe is fundamentally different from products like BlackRock BUIDL and Franklin Templeton BENJI, which are low-risk tokenized money market funds.

In contrast, USDe carries hedge fund-level risk. This difference is structural, not superficial.

4. Binance encourages users to exchange USDT and USDC for USDe to earn attractive returns, but it doesn't adequately emphasize the potential risks. From a user's perspective, trading USDe is no different from trading traditional stablecoins, but the actual risk is much higher.

5. The risk is further amplified when users perform the following actions:

• Exchange USDT/USDC for USDe,

• Borrow USDT using USDe as collateral,

• Exchange the borrowed USDT back for USDe,

• Repeat the above cycle.

This leveraged cycle artificially creates annualized returns of 24%, 36%, or even over 70%, which are widely considered "low-risk" because they are offered by large platforms. Systemic risks have accumulated rapidly in the global cryptocurrency market. Even minor market shocks have been enough to trigger a crash.

Following increased volatility, USDe quickly decoupled from the US dollar. This was followed by a chain of liquidations, and deficiencies in risk management of assets like WETH and BNSOL further exacerbated the collapse. Some tokens were brought close to zero at one point.

The losses suffered by users and companies worldwide (including OKX users) have been severe, and recovery will take time.

⸻

Why this is crucial

I am discussing the root causes here, not blaming or attacking Binance. Openly discussing systemic risks can sometimes be uncomfortable, but it is necessary if the industry is to mature responsibly.

I anticipate a significant amount of misinformation and organized panic targeting OKX in the near future. Even so, speaking openly about systemic risks remains the right thing to do—and we will continue to do so.

As the world's largest platform and an industry leader, Binance wields enormous influence and bears corresponding responsibility. Long-term trust in cryptocurrencies cannot be built on short-term profit speculation, excessive leverage, or marketing tactics that conceal risks.

The industry needs leaders who prioritize market stability and transparency.

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data