Yesterday, after Uniswap released its fee on/off and buyback/burn proposal, Uni started rising from $7.2. When I woke up and saw the news, it was around $8.8. I eventually bought in batches at an average price of $9. I chose to buy at a higher price because I felt the proposal was indeed a substantial positive, and Uniswap is the pioneer of DEXs with strong fundamentals. Also, a similar proposal previously boosted Uni from $7 to around $16, so my profit-taking plan was to sell in batches starting at $12. However, it only touched $10 three times before falling back down.

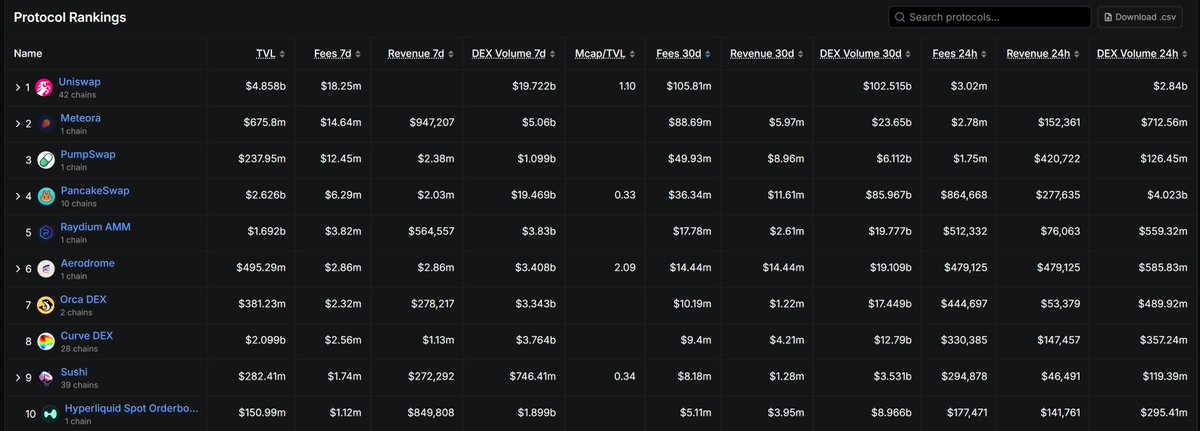

Ultimately, the stock that rose the most due to this news was Meteora. A comparison of the data revealed that Meteora's fees are 70-80% of Uniswap's, but $Met's market capitalization is only 3-4% of $Uni's. Although Meteora hasn't announced any buyback/burn plans yet, it can still be seen as a potential positive factor.

Therefore, in the current market, those who can make money are either top-tier traders who act decisively, take profits resolutely, and have no illusions, or top-tier intelligent traders who can think several levels deeper than most smart people.

Since clearing my long positions on October 13th, I've consciously controlled the number of trades I make. The few trades I've made were all opportunities I considered very good, such as chasing GGG in the first wave, bottom-fishing Ping, and chasing Uni yesterday, etc., but in the end, they all went from unrealized profits to losses. Perhaps only now are the consequences of the flash crash on October 11th slowly becoming apparent. A large number of long positions were liquidated, hot money has decreased significantly, and coupled with what Longwang said, almost everyone left with cash in the market is a smart person, making it much more difficult.