🦅 Eagle Catches Crypto 🦅 #ETH #Ethereum #Crypto #CryptoMarket #ETHPrice #EthereumPrice

Token Name: ETH

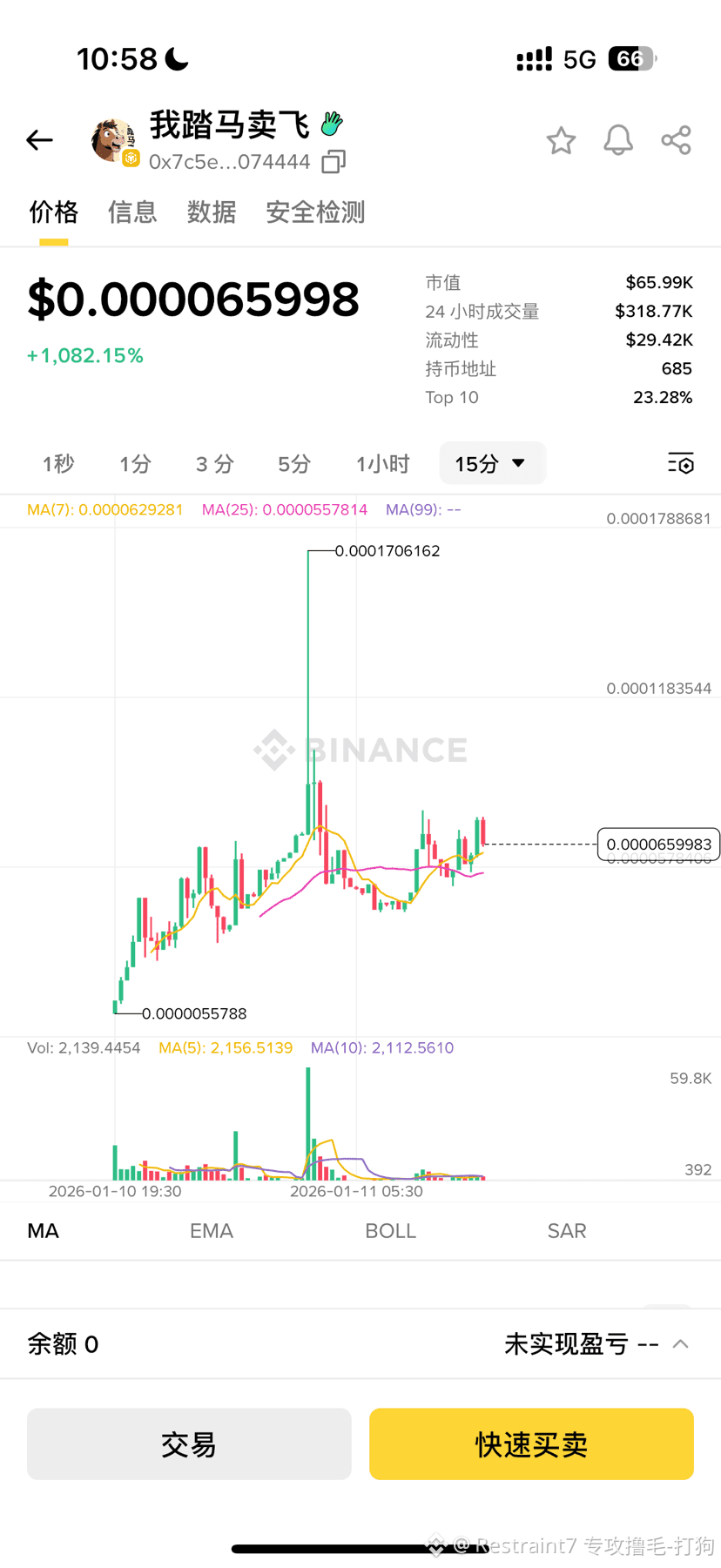

Current Price: $3,636 (Slight rebound of 0.33%, but down 11.9% this week, the market is still quite conflicted #ETHUSD)

Resistance Level (Short-term Profit Target): $3,800 (A breakout could push to $4,000-$4,200, ATH $4,955 is within reach #ResistanceLevels)

Support Level (Short-term Opening/Adding to Positions): $3,489-$3,500 (Firm support held; $3,300 next, break below triggers panic #SupportLevels)

Technical/Event-Driven/Market Sentiment (Key) Analysis:

Small rebound on the candlestick chart, 4-hour chart shows oscillation between $3,489 and $3,636, volume rebounded but MACD is neutral to weak, RSI is in oversold territory, overall trend is neutral with high downside risk #TechnicalAnalysis.

Sentiment is low, fear index is 22 (Extreme Fear), retail investors on Twitter are saying "panic" and "fear," but positive posts are increasing. November historically has seen gains of 30%+, everyone is hoping for a $4k-$5k rebound #MarketSentiment #FearAndGreed.

Whales are aggressively accumulating: 400K+ ETH worth $1.3B+ in 3 days, a single whale holding $137M long, and withdrawing 45K ETH worth $148M; 1.64M ETH ($6.4B) added in October, strong staking contracts holdings, and strong long-term confidence, but an older whale sold 6K ETH to suppress the price, resulting in a high-leverage liquidation of $1.33B. #WhaleActivity #EthereumWhales

Multiple policy benefits: The EPAA alliance protects $100B of the DeFi ecosystem; Fusaka hard fork will launch 11 EIPs on December 3rd, reducing gas fees and increasing scalability; JPMorgan invested $102M ETH; the FCA relaxed tokenization restrictions; US government uncertainty but strong rebound signals. #CryptoNews #PolicyUpdate #EthereumUpgrade

Overall, bearish pressure is heavy, but whale accumulation + upgrades + seasonal factors are brewing a major reversal. #BullishNovember

Trading advice: Brothers, don't rush to go all in. Patiently watch around $3,489 and add to your long positions with small positions, setting a stop-loss at $3,300 as a safety net. If it breaks through $3,800, then decisively add to your long positions, targeting $4,200 to lock in profits. In the short term, keep an eye on whale activity and the Fusaka trade. Don't use too large a position to control risk. The potential for a rebound in November is truly significant! #TradingTips #ETHTrading