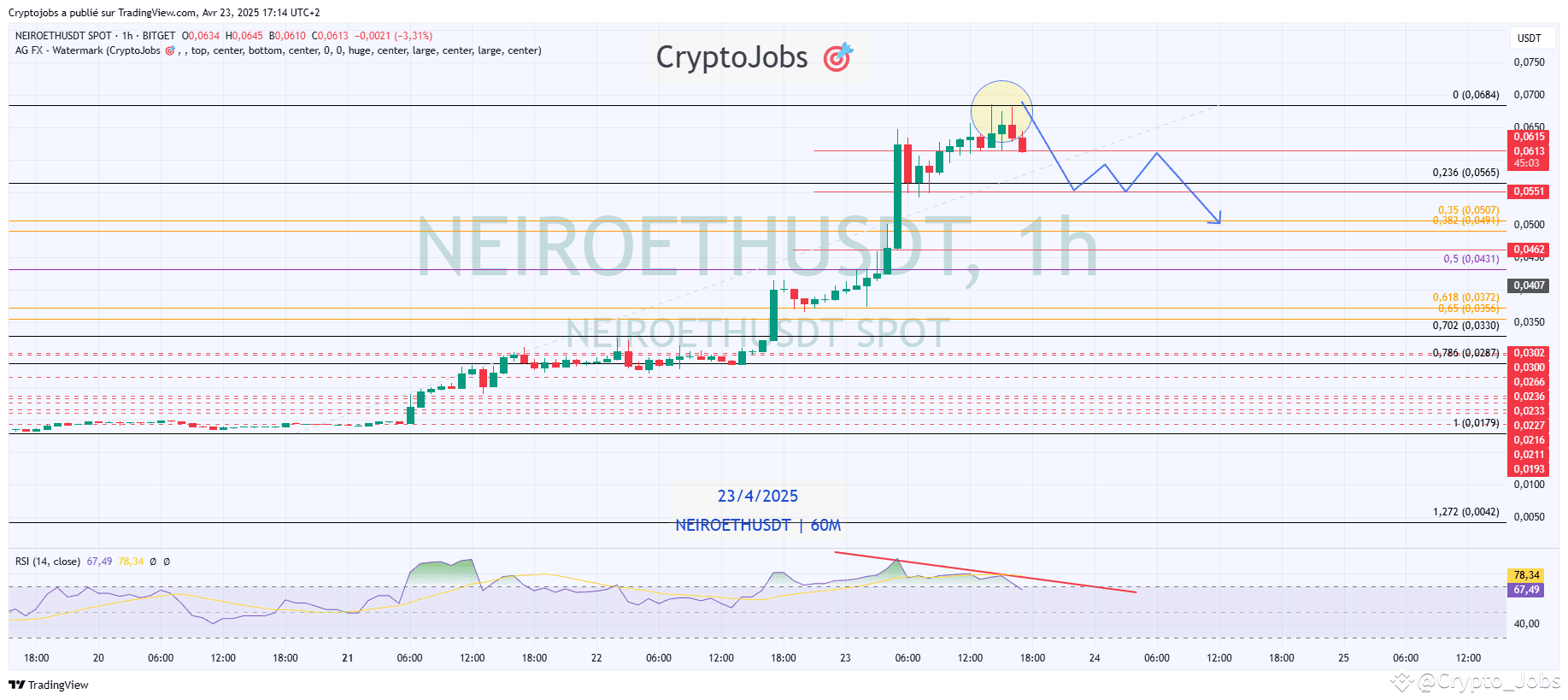

The chip structure of DOGE can be clearly presented through URPD data, and its chips are mainly concentrated in four price ranges. Among them, 30 billion DOGE are gathered at the price of $0.073, which is the area with the most chips. Since DOGE has never seen this low price since December 2023, it means that the holding period of these chips is at least close to 2 years, which belongs to long-term precipitation chips.

(Figure 1)

The other three major chip concentration areas are: $0.18 (13.9 billion pieces), $0.20 (10.9 billion pieces) and $0.36 (5.6 billion pieces). Compared with the data on July 14, it can be seen that during the strong rise in DOGE prices in the past week, the long-term chips of $0.073 have not changed, while the chips at the price of $0.18 have decreased by 2.4 billion pieces, becoming the main source of chip changes.

(Figure 2)

These four high-chip areas are likely to include the chip cost area of the main DOGE. Considering that DOGE lacks DEX on the chain to provide sufficient liquidity, these outflow chips are likely to be transferred to the platform. The current balance of DOGE on the platform has reached 26.1 billion, setting a record high, but the price has not set a new high at the same time.

(Figure 3)

Looking back at the historical trend, from October 2023 to April 2024 and from September to November 2024, there have been two periods of continuous growth in platform balance and simultaneous strengthening of prices. When the growth momentum of the balance slowed down, the price also weakened.

This leads to speculation: Is this the main force shipping while pulling up liquidity? If the main chip cost is mainly US$0.18, the current DOGE price is around US$0.26, and the theoretical profit margin is about 50% (the actual profit may be lower). From this perspective, the price may still have room to rise, after all, the growth of platform balance has not shown any obvious signs of slowing down. #DOGE