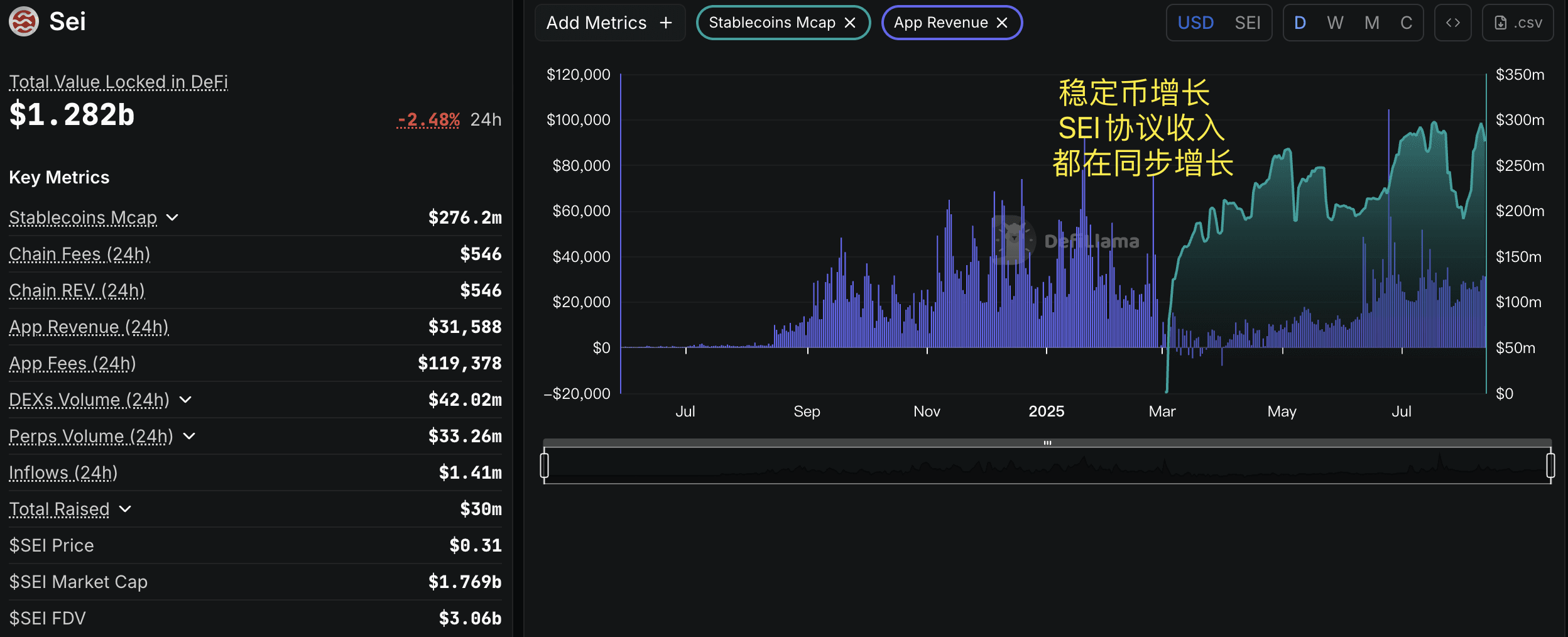

After the Genius Stablecoin Act, the fastest-growing public chain in the stablecoin space is undoubtedly @SeiNetwork. Riding on the coattails of #Circle's native USDC, #Sei is rapidly rising!

#Circle not only invested in #Sei, but also listed the #Sei token as its largest crypto asset holding in its IPO documents. What does this mean? It means #Circle isn't just casually buying coins for investment; it's making a significant bet. Naturally, it will fully support the implementation of #USDC on #Sei.

The results are clear—in just two weeks after launching its native #USDC, #Sei has minted $160 million. This speed is a rocket-like growth rate in the industry, instantly eclipsing many established public chains like Hedera, Polkadot, Tron, and Algorand. Remember, these chains have been offering stablecoins for a long time.

More importantly, at this rate of growth, stablecoin trading volume is expected to exceed $1 trillion annually. This is no small amount, demonstrating that #Sei is rapidly evolving from a "high-performance public chain" to a "stablecoin settlement layer."

Therefore, #Circle's strategic partnership with #Sei shouldn't be viewed simply as a financial investment; rather, it aims to transform it into a "highway" for high-performance USDC transactions. #Sei's inherent trading performance advantages (sub-second block times and parallel processing) are a natural fit with future potential sectors like stablecoin payments, #DeFi settlement, and #RWA. This will attract core financial players involved in high-frequency trading, cross-border payments, and institutional players in TradFi.

Currently, #Sei's early adoption curve is steep. Given this, if the #Sei ecosystem can quickly expand its stablecoin application scenarios (DEX, lending, RWA, and payment gateways), I believe the rate of capital accumulation could far exceed that of similar chains. 🧐 Worth watching and anticipating long-term!

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data