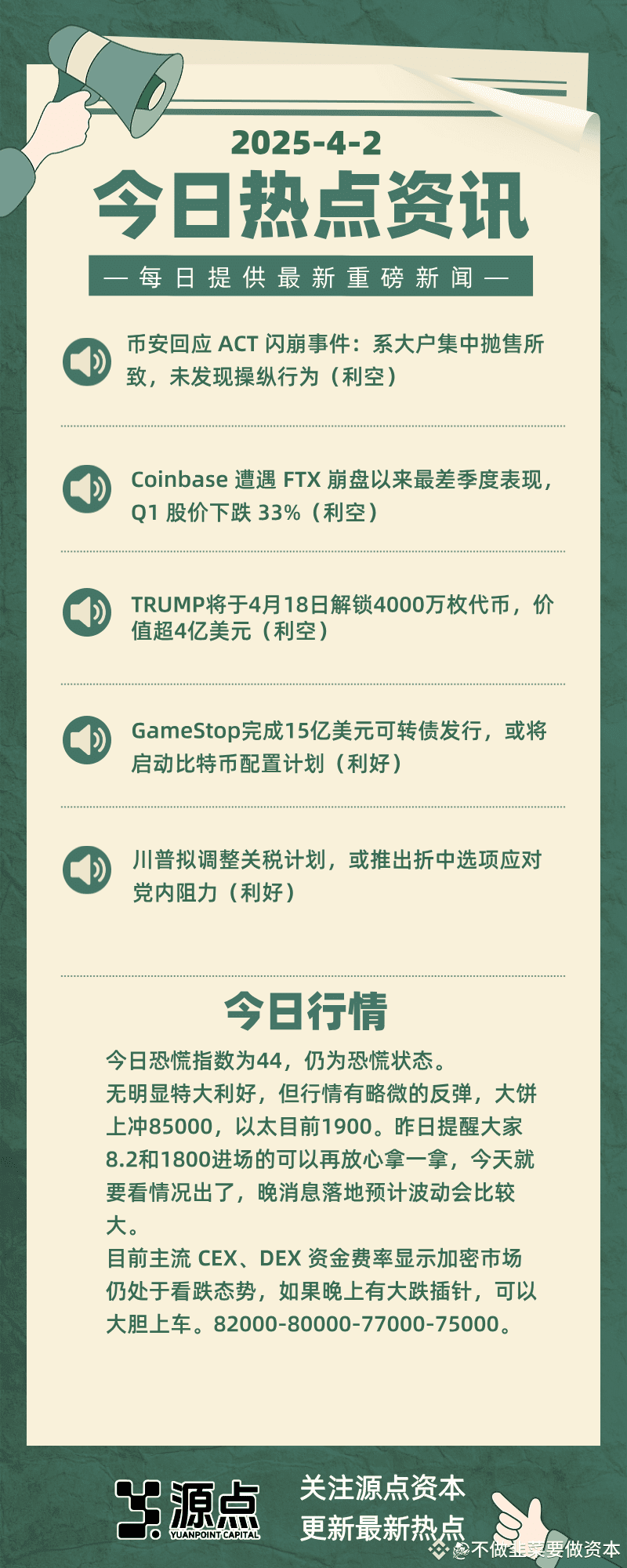

According to ChainCatcher, data from Coinglass shows that after today's further decline in the crypto market, funding rates indicate a generally bearish market sentiment. Bearish sentiment is stronger for BTC and ETH than for altcoins. Currently, funding rates for BTC and ETH contracts are negative on almost all platforms, while altcoin rates, although still bearish, are mostly positive. Specific funding rates are shown in the attached chart.

Funding rates are fees set by cryptocurrency trading platforms to maintain balance between contract prices and the underlying asset price, typically applicable to perpetual contracts. It's a mechanism for exchanging funds between long and short traders. The trading platform does not charge this fee; it's used to adjust the cost or profit of traders holding contracts to keep the contract price close to the underlying asset price. A funding rate of 0.01% represents the base rate. A funding rate greater than 0.01% indicates a generally bullish market. A funding rate less than 0.005% indicates a generally bearish market.

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data