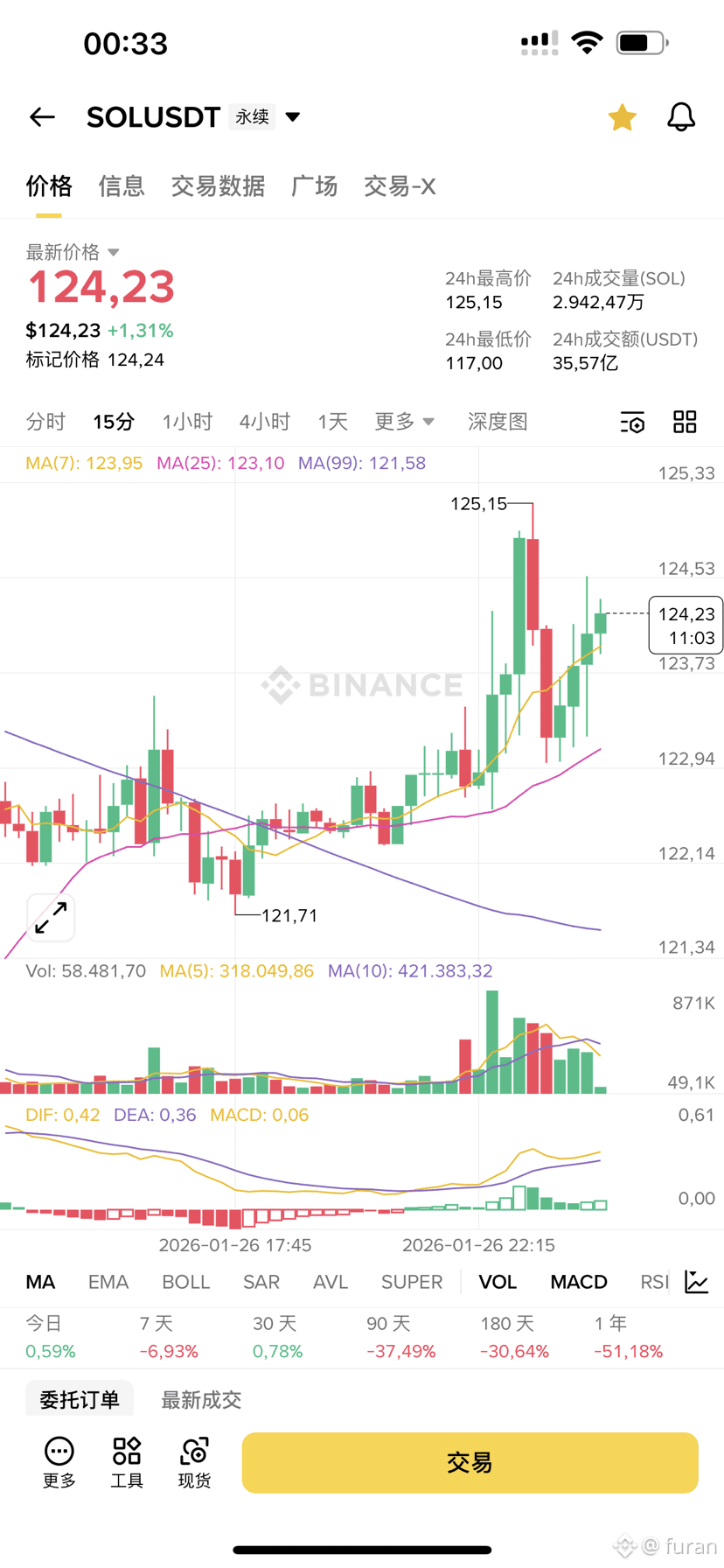

Yesterday, I chose to go long $SOL at around $122, primarily based on the "relative certainty" of the current market situation rather than emotional impulse.

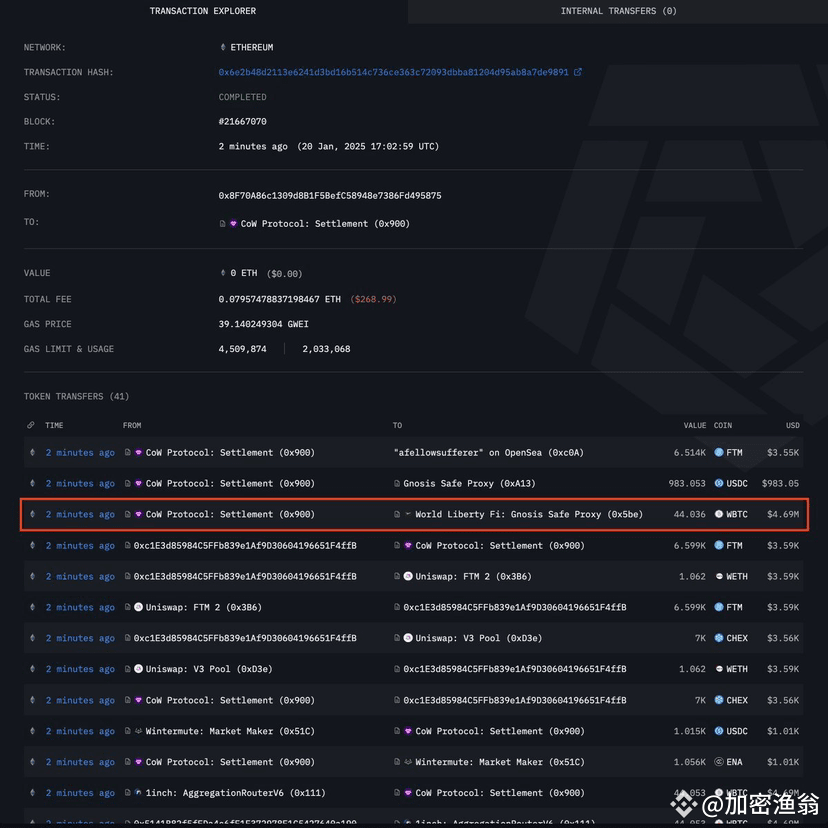

From a macro perspective, the market remains weak, but negative factors are gradually diminishing: expectations for the Fed have not worsened further, selling pressure on risk assets has eased marginally, and funds are shifting from "extreme defensiveness" to "selective speculation." In this environment, mainstream strong public chains are often the first areas where funds flow back.

Returning to SOL itself, firstly, the technical structure: the $120 level is a previously densely traded area and a proven effective support level, limiting downside potential; secondly, the fundamentals and narrative: the Solana ecosystem remains highly active, with Meme, DePIN, and application layer data all significantly outperforming most L1 cryptocurrencies; thirdly, the funding aspect: on-chain active addresses and DEX trading volume have not weakened simultaneously, indicating that there is no "complete withdrawal of funds."

In summary, the area around $122 seems to be a suitable entry point for speculation with a reasonable risk-reward ratio.

Short-term unilateral upward movement is not expected. The core idea is: as long as it doesn't decisively break below key support, SOL still has the potential for a "volatile rebound"; if overall market sentiment improves, SOL remains one of the most attractive and volatile assets for investment.

In short: this is a long position based on structure and probability, not a bet on the market trend, but a bet on the relative strength of SOL.

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data