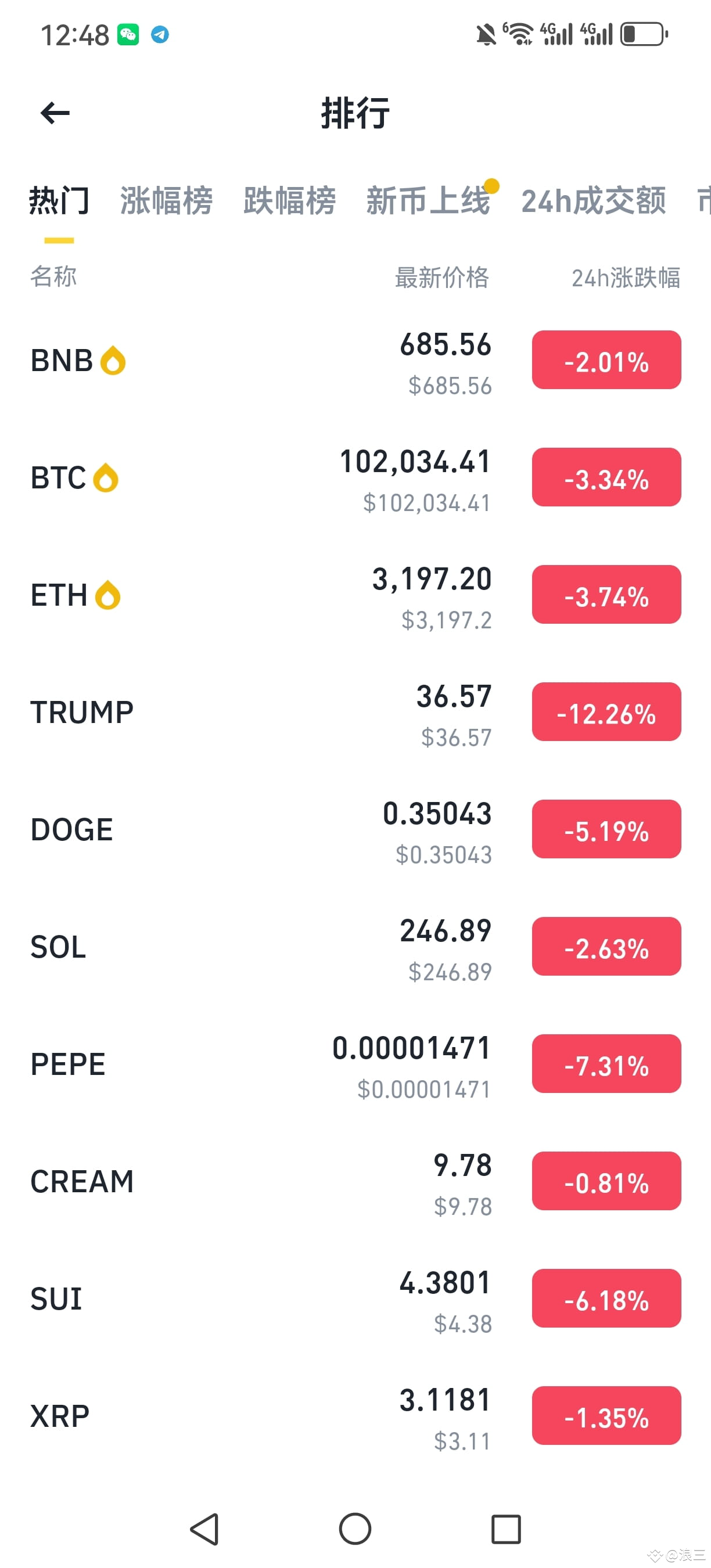

Based on past market trends, every time a market fully launches, only one asset typically experiences a dazzling primary uptrend, while the others are mostly just accompanying. For example, if BTC, BNB, ETH, and SOL all rise simultaneously in this cycle, only one asset will ultimately become the "star," while the others will merely follow suit and fail to profit significantly.

Why is this so? Because for Bitcoin to surge, it must rely on a "combined force," meaning that the entire market's liquidity is concentrated in one direction to generate momentum. However, if funds are diverted to other currencies, such as ETH, BNB, and SOL, this combined force is weakened, and Bitcoin's gains are naturally limited. Conversely, if market funds are concentrated in other leading currencies, such as BNB or SOL, BTC's gains will appear relatively weak.

The consensus of capital is simple: when returns are similar, capital will choose assets with lower risk and less volatility; when risks are similar, capital will pursue assets with potentially higher returns. This is why, whenever BTC takes off, other currencies are mostly forced to "follow the trend" rather than "jump in with the rally." Once someone competes for capital, the leader can't escape.

The current market focus is primarily on the BNB ecosystem. Short-term themes like BSC's Tugou and Perp DEX are trending, indicating that some funds are being diverted. If BNB continues to absorb the market's momentum, it will be difficult for BTC to achieve a sustained, upward trend. At best, it will be a slow climb or fluctuating market. Similarly, Sol and ETH are unlikely to perform significantly in the short term unless the focus shifts and the market regains its momentum.

Why is it easy to profit in trending markets? Because once a trend is established, the underlying financial support is very strong. If the trend is still in major currencies, it's even more stable. At this time, I generally monitor the 1-hour and 4-hour EMA20 lines. When the trend hasn't broken and the market retraces to these levels, it's often a good opportunity to enter.

However, it's important to note that the market has two phases: trending and fluctuating. Using a fluctuating strategy in a trending market can easily lead to selling out; while using a rigid trend strategy in a fluctuating market can easily lead to being trapped. So what should we do? There's actually no solution, as you can only see the most clearly after the event. This is how the market works. There's no absolutely correct strategy; only strategies that adapt to the current situation.

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data