Macro and economic focus this week - Early decline possibility analysis

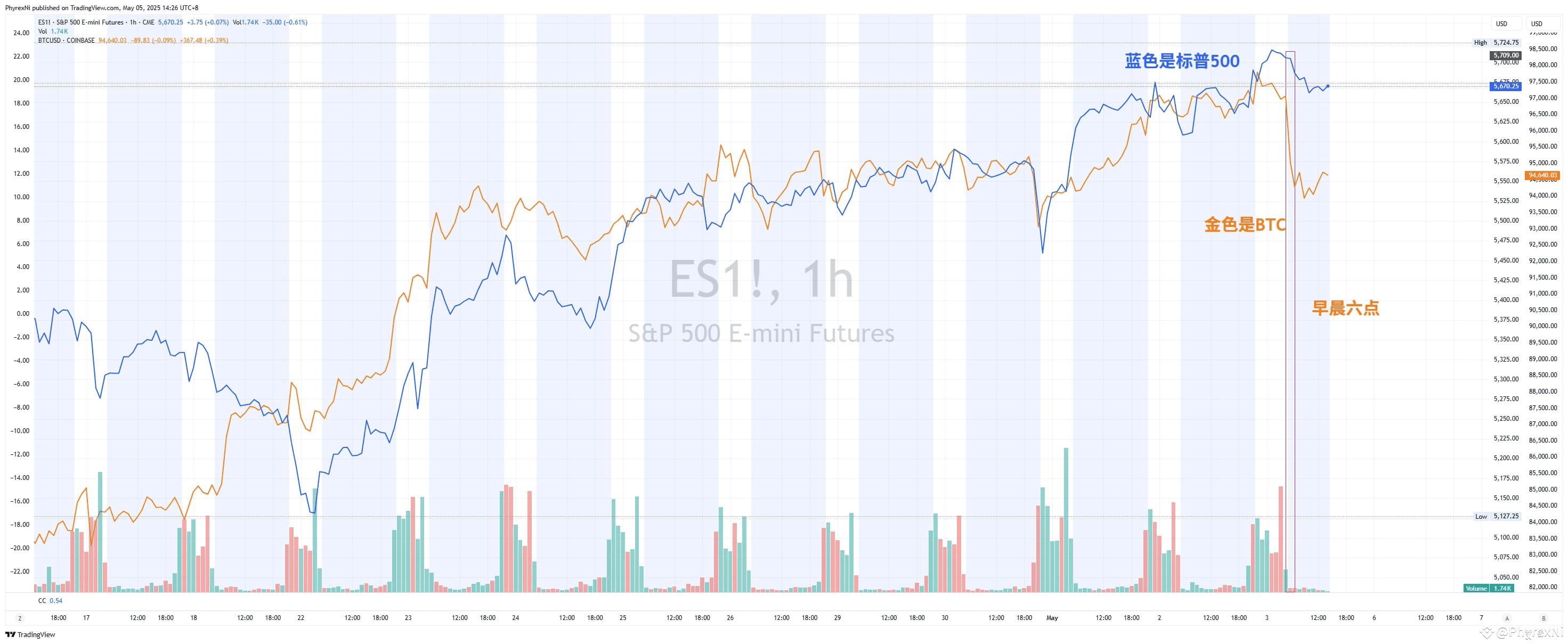

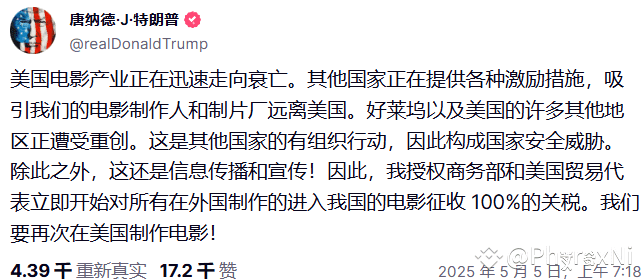

I saw the US stock futures downward early in the morning. Almost at the same time as the futures opened, $BTC also followed the downward trend. I flipped the market information and found no strong negative news. The S&P 500 and Nasdaq Futures fell by more than 0.7% in the morning and are now gradually recovering. That is, Trump announced in the morning that he would impose 100% tariffs on movies introduced by the United States.

This matter itself has little impact on the US economy. After checking the data, foreign films usually account for only less than 10% of the box office of US theaters, and the film and television industry accounts for less than 1.5% of the US GDP. The impact of imported films is more on Netflix, Amazon Prime, etc.

In addition, the current drivers of US stocks are mainly in the technology and AI sectors, so the decline caused by film and television tariffs is unlikely, so I personally guess it is mainly caused by two reasons.

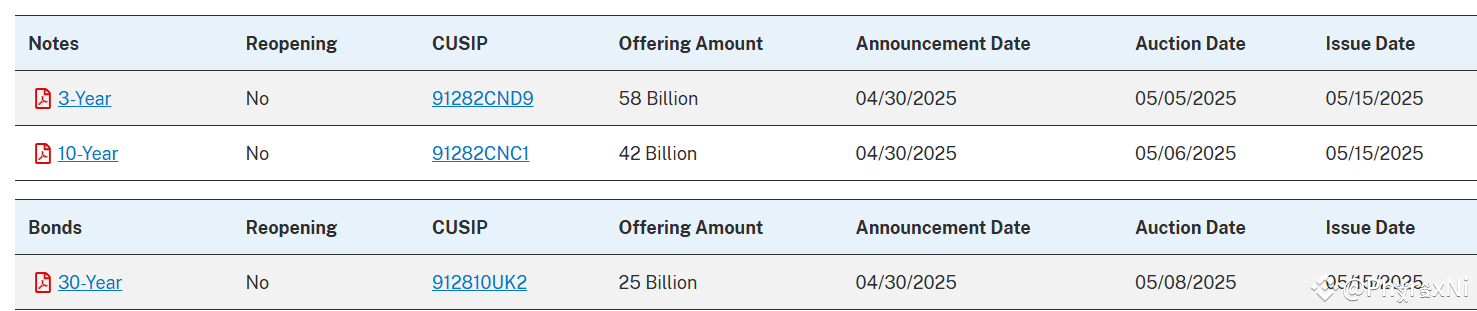

1. Auctions of 3-year, 10-year and 30-year U.S. bonds will begin this week. The total amount is US$125 billion, and under the current high interest rate environment, there is a high probability that liquidity will be drawn from the market.

Of course, I don’t think this is a big negative. After all, selling bonds has long been expected by the market, but although selling bonds itself is not a big negative, whether the bonds are bought smoothly will have an impact on the market.

Simply put, if demand is strong and interest rates are moderately won, the market will have limited short-term fluctuations, but if demand is insufficient or the winning rate soars, it means that the market lacks confidence in the sustainability of US debt or the future interest rate environment.

To be honest, if the winning bid rate for US bond auctions soars or insufficient demand, it may cause a plunge in the bond market, compressed US stock valuation, pressure on the crypto market, intensified US dollar volatility, and even trigger systemic liquidity concerns, triggering the Federal Reserve's intervention expectations. This is a typical risk window of "long-term interest rates suddenly get out of control".

To put it simply, the stock market fell. Of course, this is about the situation where the auction is unfavorable, but the overall performance of US Treasury bond auctions has been stable recently, especially the 10-year Treasury bonds (April auction) shows strong market demand. It is just that the decline in foreign investors' participation in short-term bonds may herald market concerns about the short-term economic outlook.

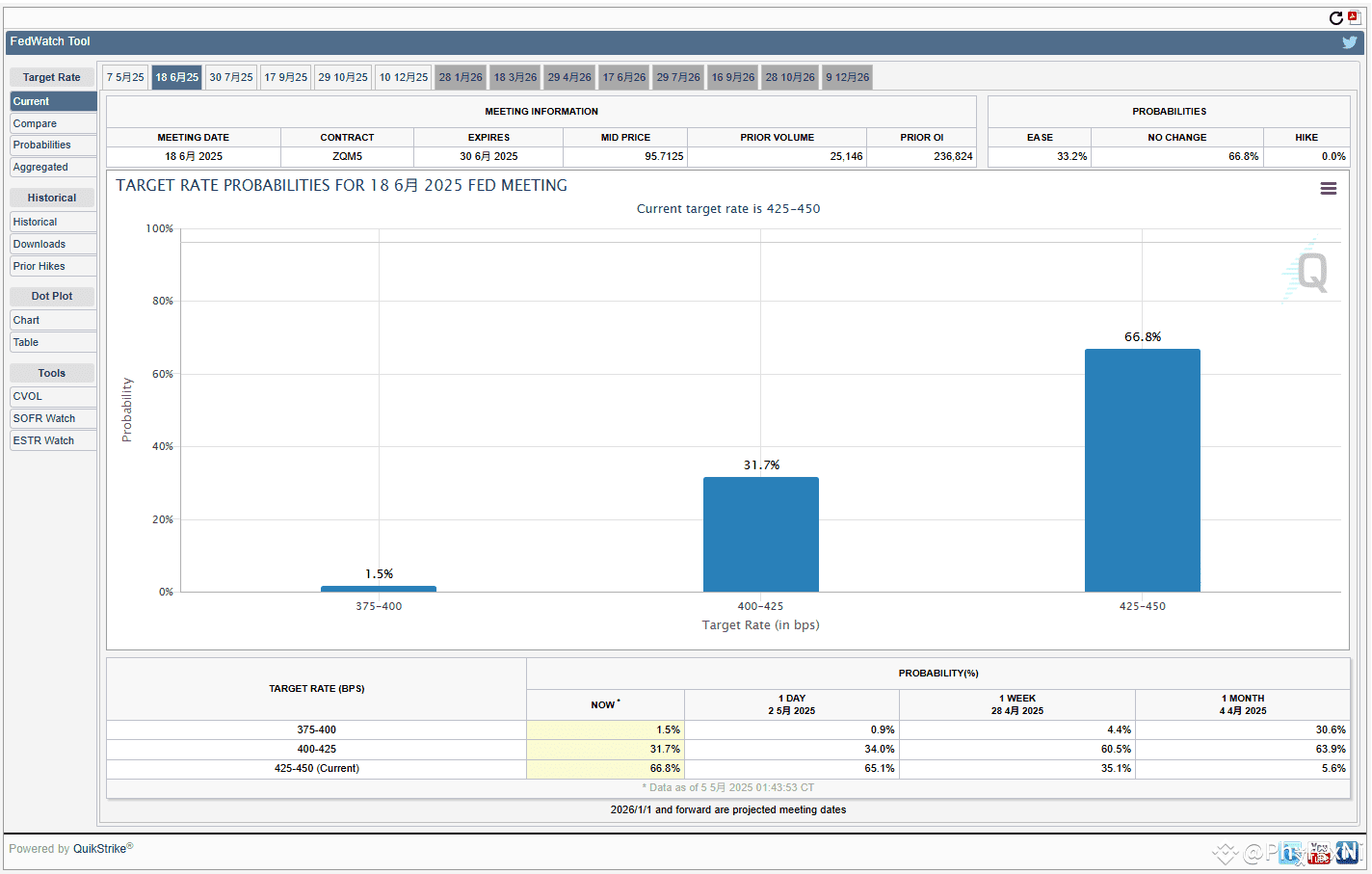

2. The Federal Reserve's interest rate meeting in the early hours of Thursday morning. There should be no doubt that interest rates will not be adjusted in May. The key point is whether there will be adjustments in June and July. Judging from the data provided by CME, the expectation of not cutting interest rates in June has risen to 66.8%. After GDP and non-farm data, the market no longer predicts that the Federal Reserve will cut interest rates in June.

This has been expected by the market, so not reducing interest rates itself is not a bad news. Powell would say at the interest rate meeting what investors are nervous about. In the morning, I read an interview with former Fed official and current Goldman Sachs chairman Kaplan. The title is "Talking about the dilemma of interest rate cuts", so I think everyone knows what it is.

In the interview, Kaplan even quoted a warning from Powell in 2022, "In order to reduce inflation to 2%, we may have to accept the recession." And he believes that the main reason why the United States has not entered a recession is that government fiscal spending has been at an all-time high, and the fiscal deficit accounts for more than 6.5% of GDP. But the United States is currently reversing this situation and reducing fiscal spending.

Therefore, Kaplan believes that the probability of economic risks in the United States is quite high, and said that if he is still in the Federal Reserve, he supports only two interest rate cuts in 2025. He also believes that the Federal Reserve will take more reactive measures than preemptive measures.

To be honest, the Fed will still focus on looking at data, and will only intervene in the market after the clear result of an economic downturn (recession). Focus on Powell's statement on tariff inflation in his speech. If he explicitly regards inflation driven up by tariffs as "temporary", it may alleviate market concerns about hawkish policies.

So in general, although there is a lack of clear negative data this week, the long-term interest rate is unstable + the Fed's environment of data dependence determines that the market will continue to be driven by macro events, and sentiment is affected by information. If the positive news decreases, the FOMO will gradually cool down. Risk assets (such as BTC and technology stocks) lack clear upward action. Unless there is an unexpected dovish Fed turn or oversubscribed by U.S. Treasury auctions, it is likely to enter a support level fluctuation period of $93,000 to $98,000.

This tweet is sponsored by @ApeXProtocolCN|Dex With ApeX