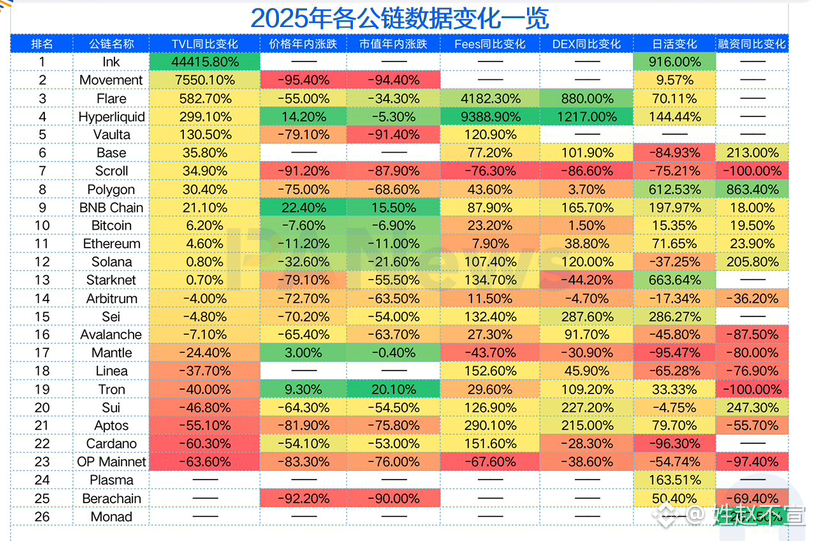

Annual Data Comparison of 26 Public Chains:

Prices and TVL (Total Value Limit) are generally under pressure, but on-chain activity and user behavior show strong divergence, indicating the industry is shifting from "narrative-driven" to "sustainability verification."

Among mainstream public chains:

BNB Chain achieved positive growth in four dimensions: price (+22%), market capitalization (+14%), fees (+47%), and transaction volume (+3.7%), making it the most stable performing comprehensive public chain this year;

Bitcoin maintained +23% in fees despite a price correction (-7.6%), and on-chain activity also showed steady growth;

Ethereum, although its price fell, maintained resilience in transaction fees and activity, and its ecosystem usage did not decline significantly.

Solana: Price -32.6%, Market Cap -21.6%, Daily Active Users (DAU) -37.6%, but fees still increased by +38%, presenting a contradictory ecosystem of "high-intensity usage + decreased activity."

Polygon: Price -75%, but DAU +612%, indicating a reshuffling of its on-chain user structure.

OP Mainnet and Arbitrum saw significant declines, with OP TVL -63.6% and price -83%, showing the real retention pressure after the incentive wanes.

Funding data also points to the same trend: increased capital concentration and a decrease in the number of funding rounds, but leading ecosystems such as Movement and Hyperliquid still receive significant attention.

TVL growth slowed across the board, with an average increase of only a slight, but a few chains still bucked the trend and performed exceptionally well:

Ink TVL +44415%, Movement +7550%, and Flare +582% ranked as the top three in terms of growth;

However, their tokens still experienced year-to-date declines of -55% to -95%, indicating significant structural risks;

Hyperliquid was a true "dark horse": TVL +299%, price +14%, DEX trading volume +1217%, and daily active users +144%, with multiple core metrics showing counter-cyclical growth.