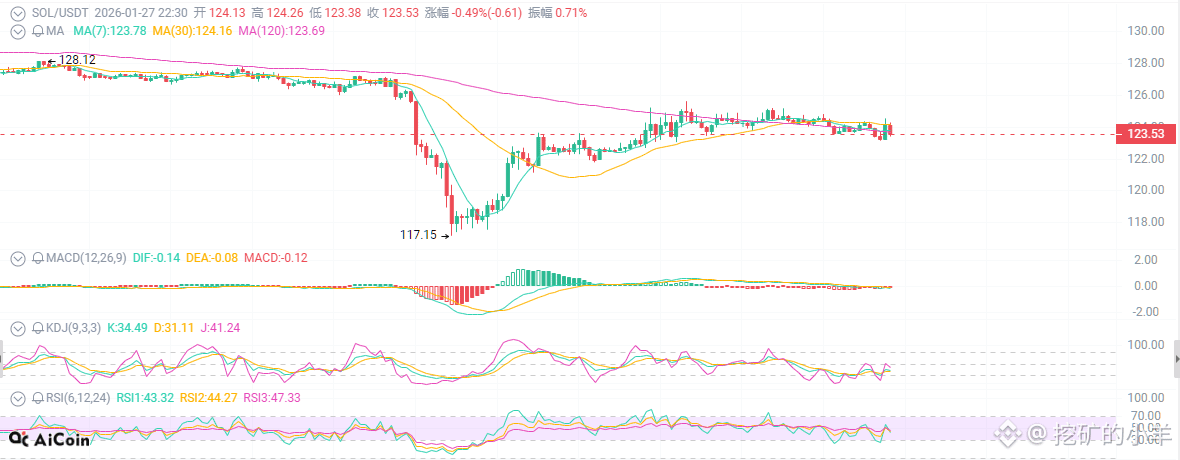

I just looked at the $SOL data and noticed something interesting.

Active addresses have doubled, and institutional funds have poured in 34 million, yet the price is falling. Isn't that strange?

Actually, I've seen this many times. The data looks great, but the market just doesn't respond. Galaxy Digital directly dumped 200,000 SOL onto exchanges.

No matter how good the fundamentals are, a whale dump can still cause a crash.

Currently, SOL is stuck around 120, with resistance at 125-130 and support at 112-115. In short, it's a choice.

I think the key is whether institutional funds can absorb the retail sell-off. If they can't, the support level is useless.

Recently, $PENGUIN has surged several hundred times, drawing all the attention. But this meme craze comes and goes quickly; the real value lies in SOL's underlying infrastructure.

22 months of zero downtime and 109 billion DEX trading volume—these figures are indeed impressive. However, good data doesn't guarantee a price increase.

Currently, there's an 81% probability of a US government shutdown, and the macroeconomic environment isn't great. Risk assets are on the sidelines.

My view is that SOL may continue to fluctuate in the short term. A break above 124 with significant volume could be a small position, but a drop below 115 should be exited.

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data