羡慕不,用6700美金,5分钟赚了90000美金

1.两天前大表哥在推上回复一条推文“能教育你孙子”,#MEME 市场马上有Dev发行了“孙子”这个meme

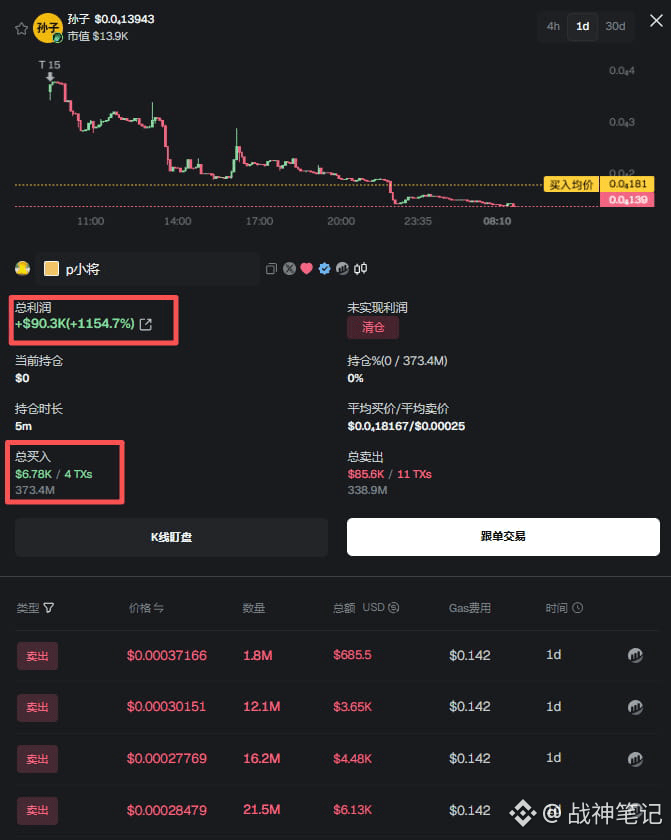

2.P小将通过扫链,在市值1万美金的时候开始买入2200美金,GAS花费266美金

2.市值2.2万美金,继续买入2200美金,GAS花费251美金

3.市值3.6万美金,买入第三笔2200美金,GAS花费251美金

4.市值8万美金,买入35美金,GAS花费266美金

市值在16万美金到37万美金,陆续卖出。总计买入3.73亿枚,均价0.000018,卖出均价0.00025,获利9万美金

这么低的市值他都能掏出来9万美金,有几个关键点:

1.低价拿到够多的筹码37%,这也是很多人喷他的点。

2.怎么能拿到这么多低价筹码,而且还是手动操作。这才是他的核心竞争力。你学会了,你可能比他还狠!

有想看的么,详细拆解了他整个科技树。从硬件配置到链上工具设置共7大板块。

Price Converter

- Crypto

- Fiat

USD美元

CNY人民币

JPY日元

HKD港币

THB泰铢

GBP英镑

EUR欧元

AUD澳元

TWD新台币

KRW韩元

PHP菲律宾比索

AED阿联酋迪拉姆

CAD加拿大元

MYR马来西亚林吉特

MOP澳门币

NZD新西兰元

CHF瑞士法郎

CZK捷克克朗

DKK丹麦克朗

IDR印尼卢比

LKR斯里兰卡卢比

NOK挪威克朗

QAR卡塔尔里亚尔

RUB俄罗斯卢布

SGD新加坡元

SEK瑞典克朗

VND越南盾

ZAR南非兰特

No more data