How to scale the global validator set without creating permanent dependency?

The Solana Foundation Delegated Program (SFDP) accelerates network resilience through a clear market-driven, autonomous path.

In 2020, Solana faced a cold start challenge: while many powerful validators existed, there was a lack of initial staking required for sustainable operation.

SFDP was introduced as a temporary economic intervention to fill this gap, with 100 million SOL as its initial funding pool.

As the network matured, some validators still rely on staking from the Foundation.

In April 2024, SFDP's strategy was adjusted as follows:

- Reduced long-term reliance on Foundation staking

- Incentivized external delegation through 1:1 matching

By October 2025, with the maturation of the MEV mechanism and the robust development of the third-party delegation mechanism, SFDP began its final transformation:

- SFDP matching ratios began to gradually decrease in 10% increments

- Matching ratios were adjusted from 1:1 to 0.5:1

This plan succeeded by reducing its central role in network operations.

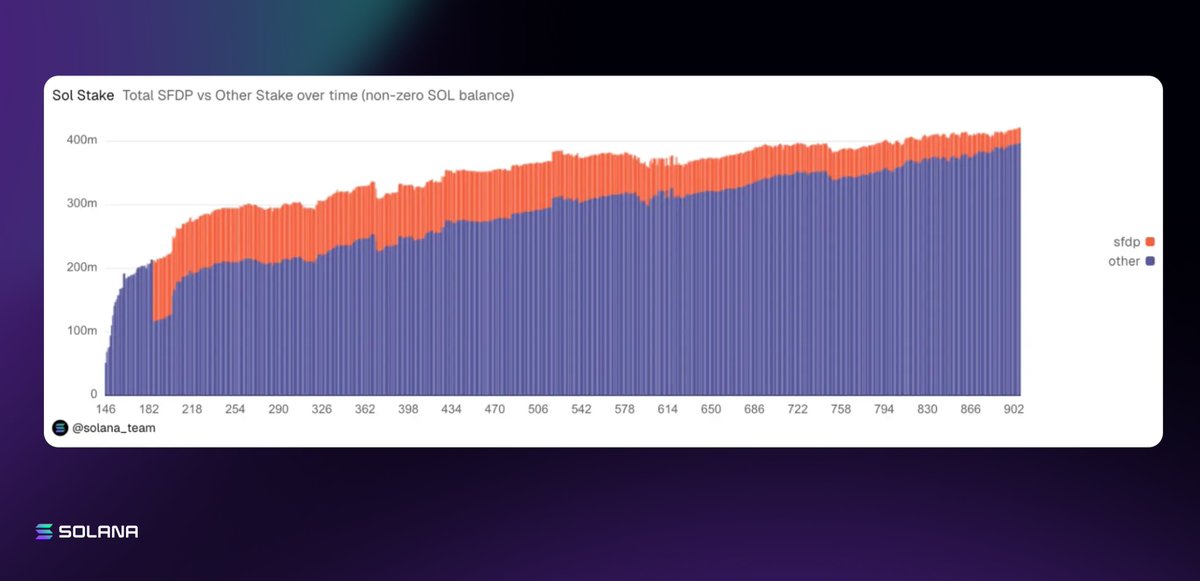

Since launch:

- Non-SFDP delegated staking has increased by approximately 230%

- Foundation staking share has decreased from 44.4% to approximately 5.9%

Since the transformation in 2024:

- The number of independent validators has increased by 121%

SFDP demonstrated how it can function through temporary performance support mechanisms without creating permanent reliance.

Read the full case study below 👇