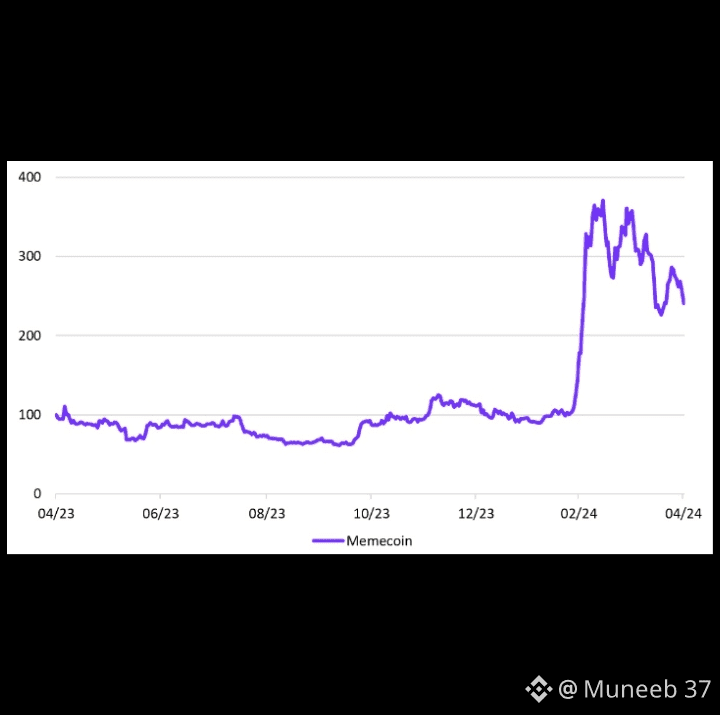

The $MEME token market is currently complex and highly volatile. Meme tokens continue to attract traders not because of strong fundamentals, but because of their strong community presence and social media influence. Prices often fluctuate wildly in short periods, making this sector risky but also appealing to short-term traders. Recently, with the overall recovery of the cryptocurrency market, Meme tokens have once again attracted attention. The persistently volatile trading volume indicates speculative buying and selling. Community interaction on platforms like X and Telegram plays a crucial role in price movements. Any viral trend or influencer mention can trigger a price surge. However, these rallies are often followed by pullbacks. Liquidity remains a key issue for smaller Meme tokens. Developers are trying to add practical features such as NFTs, games, or staking to maintain user interest. Market sentiment is cautious but opportunistic. Investors are closely watching Bitcoin's movements, as Meme tokens typically follow overall market trends. Risk management is paramount when trading Meme tokens. Their long-term stability remains uncertain.

#MEME