[January 13 Market News and Data Analysis]

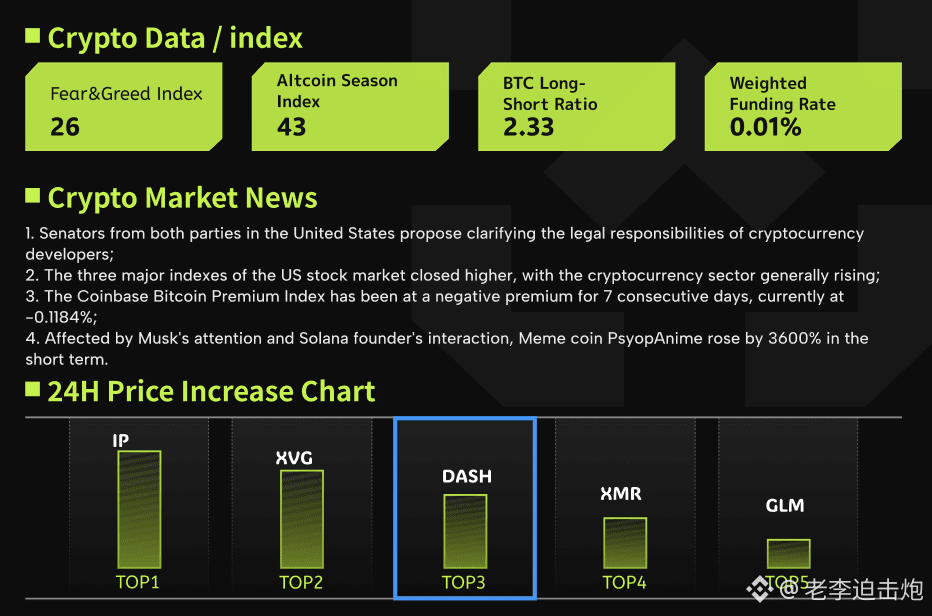

1. US senators from both parties proposed clarifying the legal responsibilities of crypto developers;

2. US stocks closed higher across the board, with crypto stocks generally rising;

3. The Bitcoin premium index has been in negative territory for seven consecutive days, currently at -0.1184%;

4. Influenced by attention from #Musk and interaction from the founder of #solana, #MEME coin PsyopAnime surged by 3600% in a short period.

The price of #BTC briefly broke through $92,000 twice yesterday. The market initially saw panic buying due to the criminal investigation launched by US federal prosecutors against Federal Reserve Chairman Powell. Some investors misinterpreted this as a crisis of confidence in the fiat currency system, thus flocking to the scarce Bitcoin for safe haven. However, this rise lacked macro-level support. Data shows that although Bitcoin briefly attempted to break through the $92,500 mark, Bitcoin spot ETFs saw net outflows of $1.38 billion for four consecutive trading days, and demand from leveraged long positions remained weak. The basis in the futures market remained in a neutral-to-bearish range of around 5%, without the significant premium typically seen when the market turns bullish (usually requiring a break above 10%). Meanwhile, while large funds like Strategy& have increased their Bitcoin holdings by approximately $1.25 billion over the past month, the price has still failed to hold above key support levels.

From a market structure perspective, Bitcoin is facing a double squeeze from both liquidity and sentiment. Compared to precious metals like gold and silver, which are expected to reach all-time highs in 2026, where demand is primarily driven by traditional safe-haven demand and inflation hedging, Bitcoin's rise lacks support from real demand and relies solely on investor bullish sentiment. With continued outflows from ETFs and weakening leverage demand, market confidence in Bitcoin as a "digital store of value" is beginning to waver. Considering both liquidity flows and deteriorating market sentiment, the likelihood of Bitcoin's price returning to $105,000 or even higher in the short term is relatively low, and market sentiment has shifted from blind optimism to cautious observation.