🔥Bull Market Begins! Strategy's Victory: MSCI Decides to Retain Companies Holding Crypto Assets in its Indices

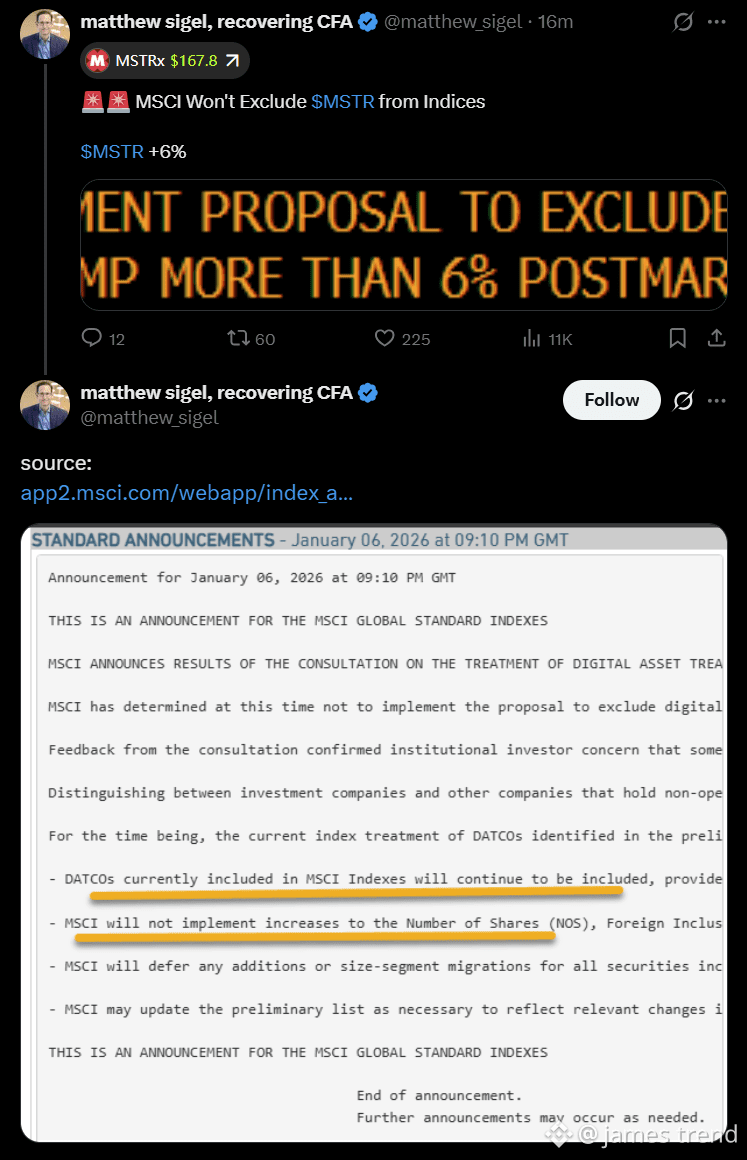

MSCI announced that it will retain companies holding digital assets as treasury reserves in its global indices, citing investor feedback and the need for further research into non-operating companies.

Shares of Michael Saylor's Strategy rose 5% after MSCI decided not to exclude companies holding digital assets as treasury reserves from its market indices for the time being.

In a statement released Tuesday (January 6), MSCI said it will conduct a broader consultation to clearly distinguish between investment companies and other types of companies that have digital asset holdings as a core part of their business.

MSCI defines Digital Asset Treasury Companies (DATCOs) as companies where digital assets account for 50% or more of their total assets.

Continuing inclusion in the indices means that such companies still meet the allocation criteria for passive index funds, which not only maintains market demand and liquidity but also helps broaden the institutional holdings of digital assets.

According to Google Finance data, Strategy, the publicly traded company holding 673,783 Bitcoins, the largest cryptocurrency reserve, fell 4.1% on Tuesday but rose 5% in after-hours trading following the announcement.

Currently, over 190 publicly traded companies hold Bitcoin on their balance sheets, and dozens more have established reserves of Ethereum (ETH), Solana (SOL), and other altcoins in the past 12 months.

#meme

$ETH

{spot}(ETHUSDT)