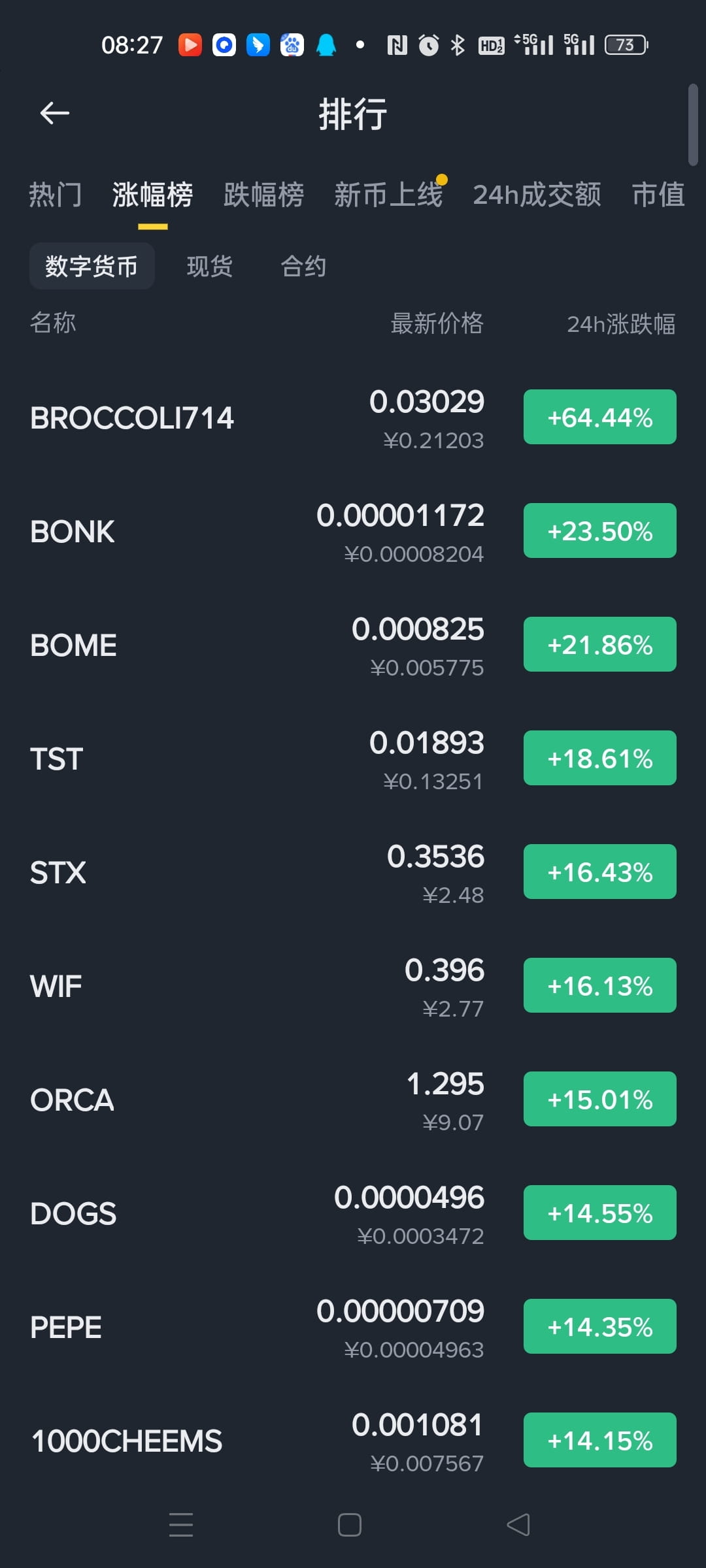

🚀🚀🚀Altcoins can no longer fall. This is the truth behind PEPE’s surge.

When BTC fluctuates and hits the bottom, you will find a key signal: a large number of altcoins refuse to reach new lows. This is not because the bulls are strong, but because the selling pressure in the market has dried up - the bloody purges in October and November not only got rid of retail investors, but also allowed bookmakers to complete the bottom layout. When all the people who should sell are sold out, a spark can ignite the entire grassland.

💥 Why was PEPE the first to break through? $BNB $PEPE

This is no accident. First of all, it has experienced a thorough cleaning of "cut in half and then cut in half", and floating chips are scarce; secondly, the market value is light, and a small amount of funds can leverage huge gains; finally, the core of MEME currency is pure emotional consensus, and it is the easiest to become an emotional outlet when the market wind direction switches.

As funds begin to rotate, the transmission path of the MEME sector is clearly visible:

1️⃣ $DOGE As a veteran leader, Whale continues to increase its holdings + the popularity of derivatives rises. With its strong community and Musk’s narrative, it is still an unavoidable safe haven for funds.

2️⃣ Liquidity will inevitably spill over to smaller and wilder targets. For example, the market is quietly paying attention to the "puppy" MEME (such as puppies). Once such assets are ignited, their explosive power often exceeds expectations.

📉 There are also undercurrents surging at the macro level:

The core logic of current market transactions is still the Fed's expectation of interest rate cuts. Any unexpected fluctuations in the recent non-agricultural and unemployment data may instantly reverse the trend of risk assets. If the rate cut is delayed or economic data overheats, the current rebound supported by liquidity expectations may quickly collapse before and after the interest rate meeting in late January.

🚨 Therefore, our strategy must be layered:

- You can participate in MEME rotation in the short term, but be sure to light your position, be quick, and only choose targets that are fully washed.

- Treat mid-January as an important time window, and gradually deploy hedging positions on rallies to prepare for potential sentiment reversals.

The feast of MEME is a carnival of emotions, but the carnival will eventually end. Do you choose to follow the wave now, or start preparing for a retreat?

Chat in the comment area:

👉 Which MEME do you think will be the next wave of rotation?

👉 Will the interest rate meeting at the end of January become a turning point in the market?

#MEME #cottage season #PEPE #DOGE # macro strategy