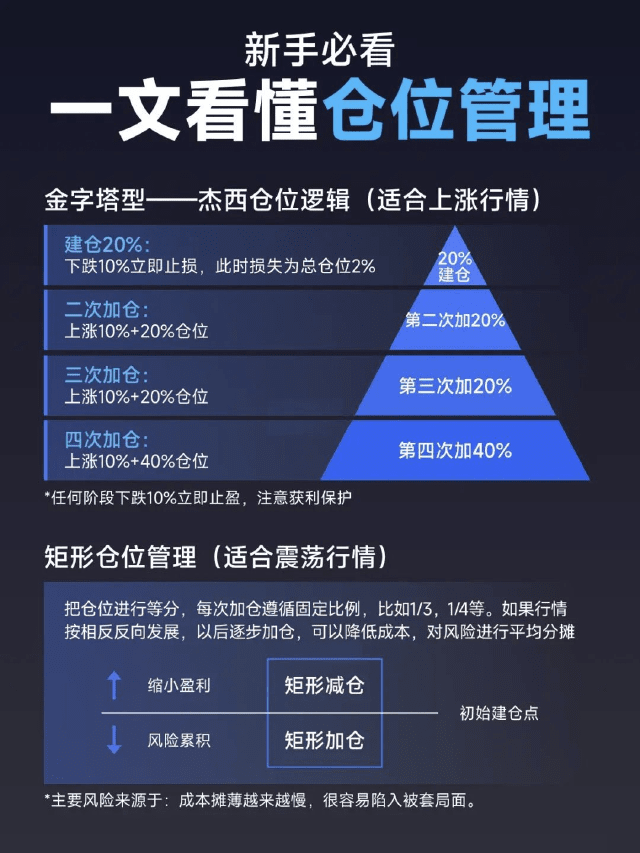

To survive long-term in this market, position management is a fundamental survival rule more important than any technical skill. Many people's understanding of position management is limited to the superficial question of "how much money was invested," which is far from sufficient.

The essence of position management is managing your emotions and human nature. Being fully invested during a sharp drop can trigger panic, leading to distorted trading decisions. However, if you only hold 10% of your capital, the same volatility becomes insignificant. Emotional stability allows for calm decision-making.

Don't assume that only large funds need position management. On the contrary, small funds need it even more. Because capital is limited, a single misstep can wipe out your chance to recover. Position management is essentially risk management, but even more so, it's mindset management. No technical analysis can replace it. Position management is strategy; technical analysis is merely tactics.

While managing your position, you also need to use tools to manage information and avoid being swayed by market noise. Use Ave.ai to view candlestick charts, check information, and trade smoothly, supporting your calm decision-making rather than creating anxiety.

#AVE #memecoin🚀🚀🚀#MEME