Before buying Circle, you need to understand these 3 basic facts 👀

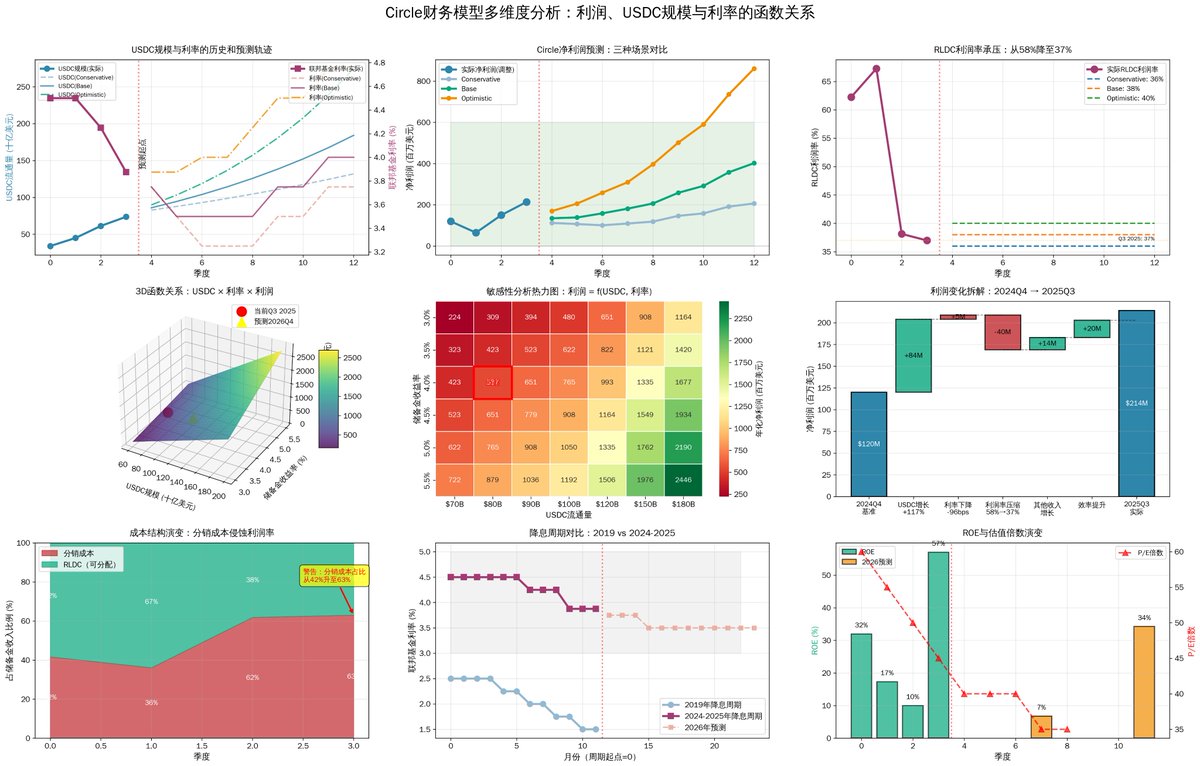

1⃣ USDC's net profit is strongly correlated with three factors: USDC size, the Federal Reserve's benchmark interest rate, and distribution channel costs. According to historical financial data, the elasticity coefficient of USDC size's impact on profit is 2.1, the Federal Reserve's benchmark interest rate is 1.9, and distribution channel costs are 1.3. Every $10 billion increase in USDC size → profit +$114M (+21%).

2⃣ The average P/E ratio for US fintech stocks is 30x, while Circle's current P/E ratio is 60x, indicating a significantly high valuation. Circle's profit margin is currently under severe pressure; RLDC has plummeted from 62% to 37%, and Coinbase's revenue sharing is severely eroding its profits.

3⃣ Given the high probability of a steepening of the US Treasury yield curve, the Federal Reserve's benchmark interest rate may stabilize at 3.5% in 2026. Therefore, the impact of a rate cut in 2026 on Circle's profits may be lower than market expectations.

However, the positive impact of regulatory favorable measures such as the GENIUS Act and the MICA Act on the growth of USDC's scale is subject to diminishing marginal returns, making it difficult for USDC's scale to achieve the 100%+ growth of 2025 in 2026.

Given the multiple uncertainties and complex interactions between factors, a wise approach is not to buy Circle now, but to wait 2-3 quarters for earnings growth to justify the valuation.

That's all.