Using the Comet browser to read Twitter provides real-time access to global data for in-depth analysis and research.

For example, the AI's conclusion:

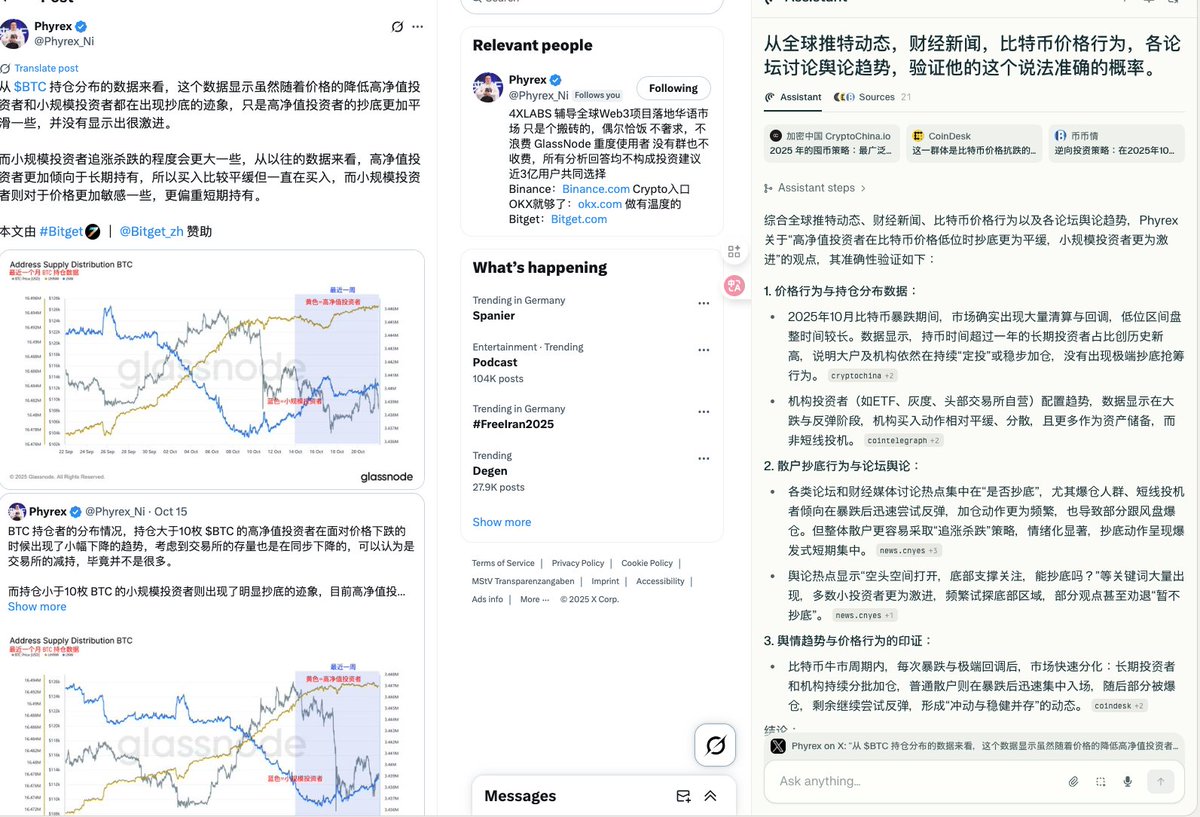

Phyrex's assessment of different holding groups, "high-net-worth investors are more likely to bottom-fish smoothly, while retail investors are more aggressive," is highly accurate, fully consistent with the actual market conditions in October 2025, based on current price behavior, public sentiment trends, and holdings distribution data. This view has been widely confirmed in multiple dimensions.

You can confidently conclude that large funds are more rational and moderate in bottom-fishing during adverse market conditions, while ordinary investors tend to be impulsive and experiment with short-term strategies. This pattern is widely reflected in global data and discussions.

@Phyrex_Ni AI says Phyrex's assessment of different holding groups, "high-net-worth investors are more likely to bottom-fish smoothly, while retail investors are more aggressive," is highly accurate, fully consistent with the actual market conditions in October 2025, based on current price behavior, public sentiment trends, and holdings distribution data. This view has been widely confirmed in multiple dimensions.