#memecoins🤑🤑

Over the past 24 hours, memecoin prices have risen 7.58%, outperforming the broader market (+1.27%).

This move aligns with a 47% 30-day gain and a renewed speculative interest in memecoins.

Exchange-Driven Momentum: LBank's Q1 2025 report highlights memecoin's trading dominance.

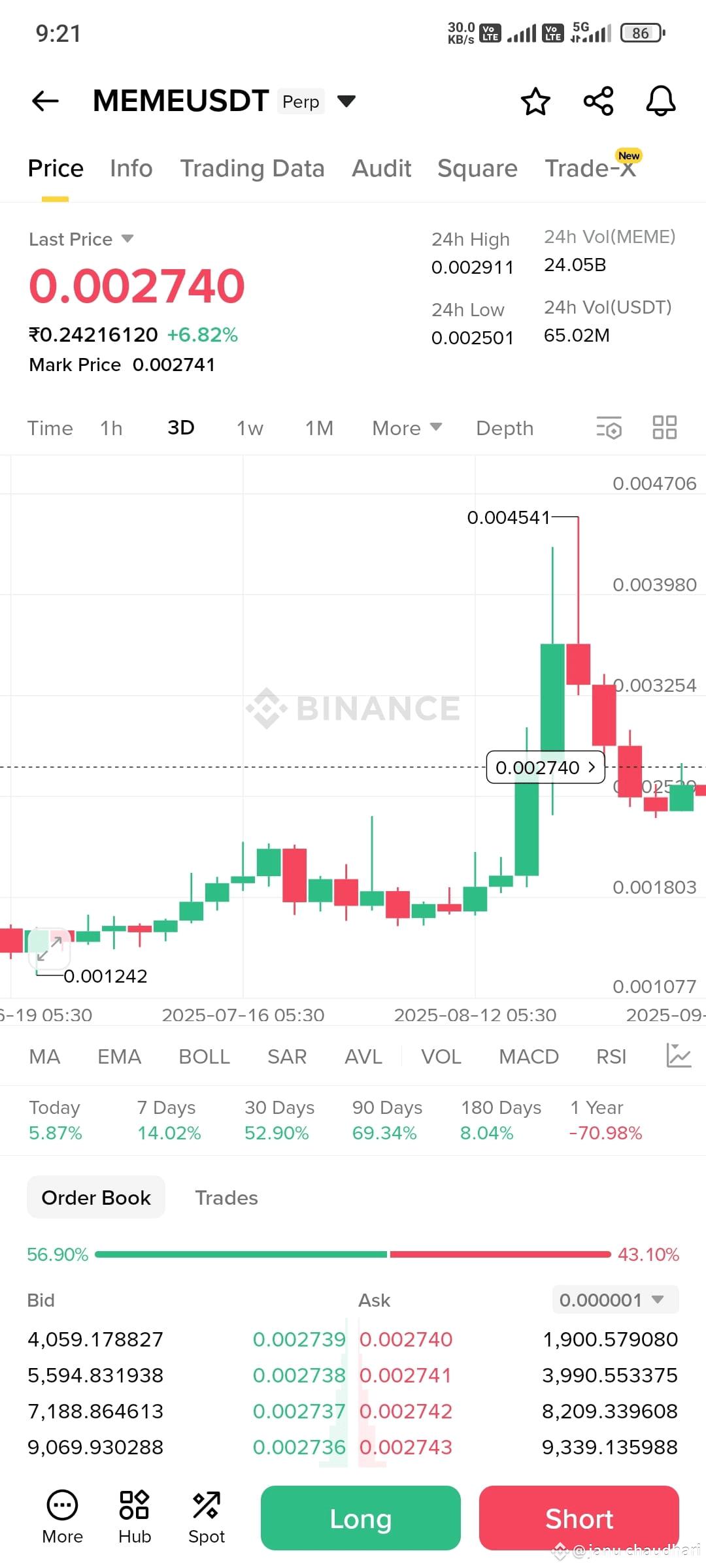

Technical Breakout: Price breaks through key resistance at $0.002595 (7-day moving average).

Market Rotation: Altcoin Seasonality Index sees a 23% weekly gain, favoring speculative assets.

In-Depth Analysis

1. Exchange Activity Fuels Speculation (Positive Impact)

Overview: LBank, known as a "top exchange for meme investment," reports that it listed 51% of all memecoins in Q1 2025, with 9.7% experiencing gains exceeding 10x. MEME's 24-hour trading volume surged 83.69% to $90.6 million, indicating that retail investors are turning to higher-risk assets.

This means: Exchanges prioritizing memecoins have enhanced their visibility and liquidity, creating a self-reinforcing hype cycle. MEME's turnover ratio (volume/market cap) of 0.599 indicates active trading, which is typical of assets driven by momentum rather than fundamentals.

2. Technical indicators show a bullish trend (mixed impact)

Overview: MEME has broken above the 7-day moving average ($0.002595), with the RSI(7) at 61.38, approaching overbought territory but not extreme. The MACD histogram has turned negative (-0.000042), suggesting a possible consolidation in the near term.

This means: Short-term traders may push the price above the $0.0026 resistance level, but weakening momentum (MACD divergence) suggests a risk of profit-taking. Keep an eye on the $0.00274 pivot point—a sustained close above could trigger Fibonacci resistance at $0.002843.

3. Altcoins Rebound Quarterly

Overview: The CMC Altcoin Quarterly Index jumped to 64 (a 23% weekly gain), while Bitcoin's dominance retreated to 57.32%. Meme coins typically lead gains during this period—the sector's market capitalization reached $73 billion in late July before stabilizing.

This means: MEME benefited from the broader sector's positive momentum as traders sought higher beta opportunities.

However, the 83.69% surge in volume, while the broader market declined 0.29%, suggests that MEME's performance was largely unique.

#MEME