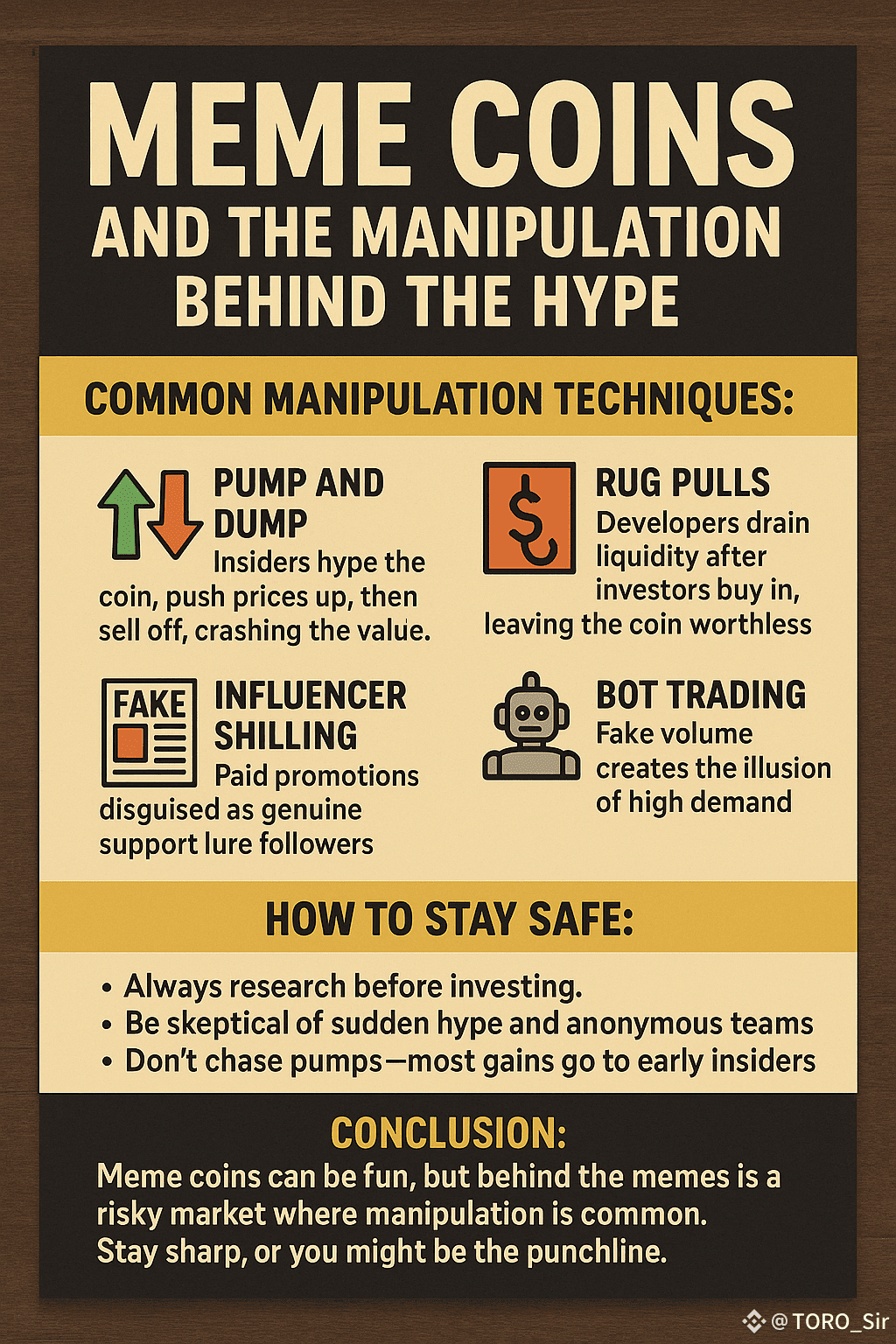

#Emoji coins and the manipulation behind the hype

Emoji coins like Dogecoin, Shibacoin, and Pepecoin started out as online jokes, but many have quickly become popular and seen their market caps soar. Despite their fun image, the emoji coin space is often plagued by manipulation.

#Common manipulation techniques:

Pumping: Insiders hype a coin, driving up the price, then sell it off, causing the value to plummet.

Fake news: False information about partnerships or celebrity endorsements misleads investors.

Pulling: Developers drain liquidity after investors buy into a coin, rendering the price worthless.

Influencer peddling: Paid promotions in the name of real money to attract followers.

Bot trading: Fake trading volumes create the illusion of high demand.

These strategies exploit hype, fear of missing out (FOMO), and inexperienced investors. Because emoji coins are generally unregulated and volatile, they are easy to abuse.

#How to stay safe:

Always do your research before investing.

Be wary of sudden hype and anonymous teams.

Don’t chase the pump — most of the gains went to early insiders.

Conclusion: Meme coins may be fun, but behind the memes is a risky market where manipulation is rife. Stay vigilant or you might become a laughing stock.

#BinancePizza