作者:TechFlow

Author: David, TechFlow

Recently, documents related to the Epstein case have been released in rapid succession, and lists are being dug up everywhere on social media.

People in the cryptocurrency circle are also asking: Are there any people from our industry involved?

I'm quite curious too, so I'm planning to take a look. But the problem is that the published documents are too numerous—thousands of PDFs—making it impractical to manually flip through them, and I don't have much coding experience.

I did a lot of online surfing by accident until I found a project on GitHub.

This project is calledEpstein Doc ExplorerThe author used AI to structure the Epstein legal documents released by the House Oversight Committee, extracting the relationships between people, events, times, and places, and storing them all in a database.

It also has an online visual webpage for searching, but because there's so much data and my computer is a basic version, it's very laggy when I go in, and I can barely get the information I want.

What I want is a batch query to retrieve all people and events related to encryption at once.

Crawling methods

I gave this GitHub project to Claude and asked how to query this database.

After reviewing the project structure, Claude told me that the core data was in an SQLite database file called `document_analysis.db`, with a table called `rdf_triples`. Each record had a structure of "who-did what-to whom-when-where". For example:

However, the entire database contains more than 260,000 such records, covering all the publicly disclosed relationships in the Epstein files, and I only want the encrypted ones.

My initial thought was to filter relevant records using keywords. However, I encountered two pitfalls in the actual process.

The first pitfall: the file is "fake".

I downloaded the project archive from GitHub, extracted it, and tried to open the database, but my computer couldn't read it at all. Claude helped me troubleshoot and found that what I downloaded was just an index file, not the actual database. I went back to the GitHub page and manually downloaded the complete file, which totaled 266MB.

The second pitfall: the selection of search terms.

In the first version of the search, I used 25 keywords, including direct terms like Bitcoin, Crypto, and Blockchain, as well as names of people and organizations that weren't entirely related, such as Peter Thiel, Bill Gates, and Goldman Sachs. The idea was to err on the side of caution and avoid missing any potential opportunities.

The result was 1,628 records, but a lot of noise. For example, 90% of the results for searching "Goldman Sachs" were economic forecast reports, and the results for searching "Vigin Islands" were local tourism data.

So I had Claude do three rounds of searching to gradually narrow down the possibilities:

Round 1Broad keywords, 1628 results, lots of noise but it creates a comprehensive picture and targets a specific group of people.

Second roundAfter reviewing the first round of results, Claude realized that he hadn't found some crypto-specific terms, such as Libra, Stablecoin, and Digital Asset. He added them and ran the search again to confirm that nothing was missing.

Third roundSearch in reverse order. Don't search by name, only search for records where "what they did" contains Bitcoin, Crypto, or Blockchain.

The third round is the most crucial: filtering directly by behavior, and every result retrieved is strongly correlated.

After three rounds of cross-referencing and elimination of weak correlations, the following list was compiled.

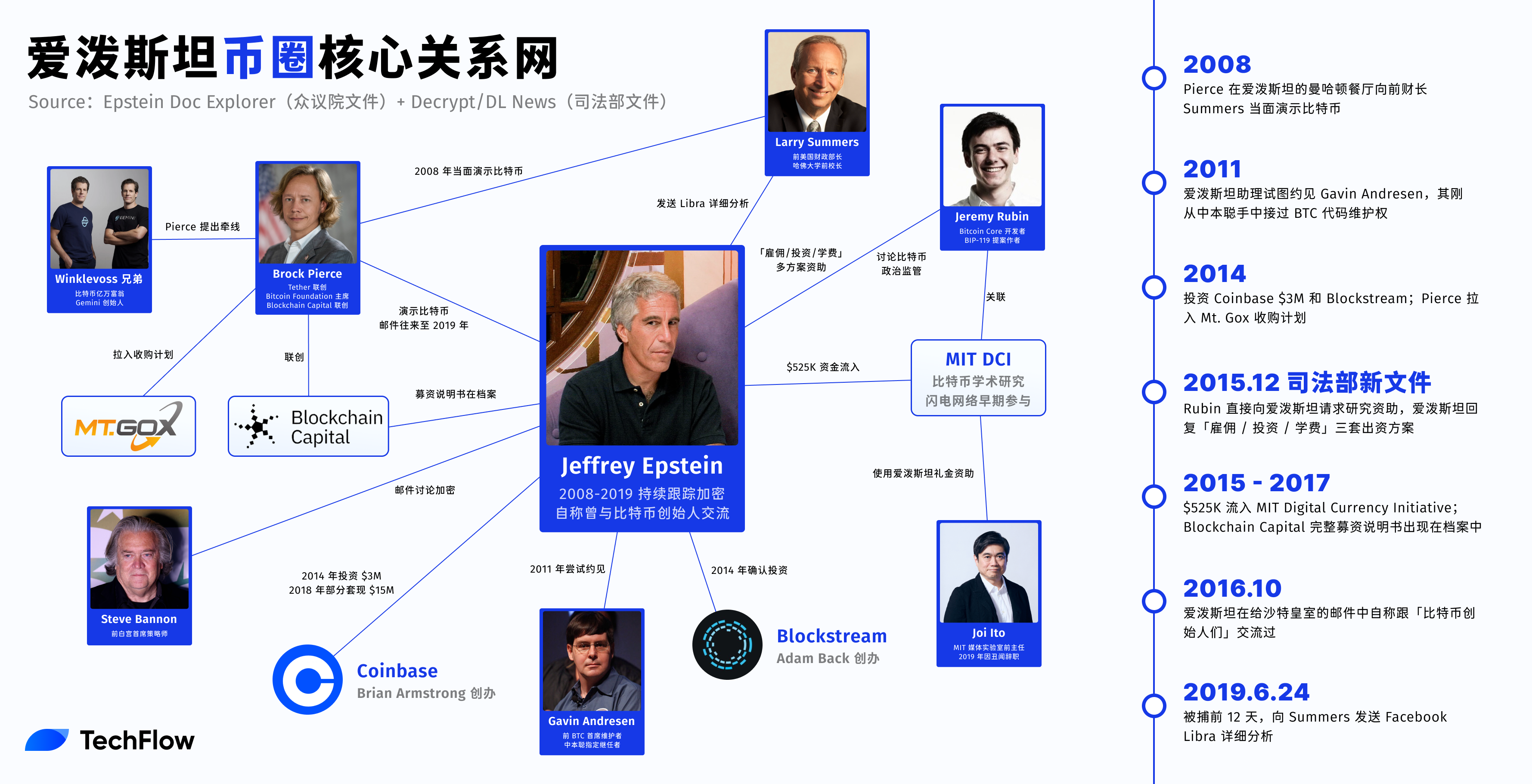

1. Brock Pierce: Demonstrating Bitcoin to Epstein at his restaurant.

identityCo-founder of Tether, Chairman of the Bitcoin Foundation, and Co-founder of Blockchain Capital.

How to contact EpsteinMultiple face-to-face meetings took place at Epstein's Upper East Side mansion in Manhattan.

Cryptographic topics involvedBitcoin demonstrations, blockchain discussions, cryptocurrency volatility.

TimelineThe earliest record is dated 2008, and several records lack specific dates but share the same location. Email records from March 2015 indicate that someone arranged a subsequent meeting.

The reason I'm writing about Pierce first is because Pierce's record has the most vivid imagery in the entire database.

Records show that he gave a Bitcoin demonstration in the dining room of Epstein's mansion, in front of former U.S. Treasury Secretary Larry Summers. After listening, Summers expressed concern about the investment risks but also "offered an opportunity" to Pierce.

Epstein didn't just listen from the sidelines; he proactively called Pierce into the lobby for a private talk, and later invited him back to the dining room to continue the conversation. The two also discussed the volatility of cryptocurrencies separately.

This was not a casual chat at a dinner party.

An email dated March 31, 2015, shows that a man named Alex Yablon wrote to Epstein specifically asking if he could arrange for Pierce and Summers to discuss Bitcoin.

The fact that someone is acting as a middleman indicates that these meetings are deliberately organized.

Epstein's Manhattan mansion during that periodIt served as an informal roadshow venue.Pierce brought his project to Pierce's door, and the guest of honor was the former finance minister.

For a crypto entrepreneur, this kind of resource channel is virtually nonexistent in normal business channels. Conversely, by arranging these meetings, Epstein positioned himself as a connector between the crypto industry and policymakers.

Our database only processed documents from the House Oversight Committee, and the trail of Pierce that could be pieced together ended there. However, while this article was being written, the U.S. Department of Justice released another batch of Epstein documents, exceeding 3 million pages. Decrypt then analyzed these new documents...ReportThis reveals that the relationship between the two is much deeper than what the database shows.

Several key additions:

The two exchanged emails from 2011 until the spring of 2019, and met at restaurants far more often than they did a few times.

Pierce excitedly messaged Epstein saying, "Bitcoin has broken $500!", pulling him into the plan to acquire the then-current Mt. Gox exchange, and even offering to connect Epstein with the Bitcoin billionaire Winklevoss brothers.

Epstein said he didn't know Winklevoss, but wanted to send someone to find out what they were up to in the crypto space.

The starting point of their relationship became clearer.

In early 2011, Pierce attended a small, invitation-only conference called Mindshift in the Virgin Islands, which aimed to help Epstein repair his image after his 2008 sex crimes conviction.

After the meeting, Epstein's administrative assistant, Lesley Groff,Pierce was listed as one of Epstein's "favorites".He then handed over his contact information.

2. Blockchain Capital: A fundraising document for a crypto VC has surfaced, with Epstein possibly being an investor.

identityFounded in 2013, this crypto venture capital fund is headquartered in San Francisco. Its co-founders include Bart Stephens, Brad Stephens, and Brock Pierce (mentioned above). It is one of the earliest professional crypto VCs in the industry.

How it relates to EpsteinThe full investment prospectus for the CCP II LP fund appears in Epstein's file archives.

Cryptographic topics involvedThe fund's complete investment portfolio, service provider system, and investment strategy.

TimelineThe prospectus is dated October 2015, and the investment record covers the period from 2013 to 2015.

There are 82 records for Blockchain Capital in the entire Epstein public database.

It's not like scattered mentions of names; it's more like a complete fundraising document broken down into structured data.

A quick look at the data reveals that Blockchain Capital's investment portfolio is very detailed: Coinbase's Series C, Kraken's Series A, Ripple's Series A, Blockstream's Series A, as well as more than a dozen projects including BitGo, LedgerX, itBit, and ABRA.

The fund's service provider network is even listed: legal counsel Sidley Austin, banking relations Silicon Valley Bank, and crypto asset custody services Xapo and BitGo.

The appearance of a fundraising prospectus in someone's documents has only one conventional explanation in the financial world:

This person was approached as a potential LP.

Given that Pierce is both a co-founder of Blockchain Capital and demonstrated Bitcoin at Epstein's restaurant, these two lines are likely connected.

My imagined scenario is that Pierce first demonstrates Bitcoin to pique interest, then presents his fund's fundraising materials—a complete roadshow process...

(The above is just a reasonable guess and is not guaranteed to be true.)

In the process of writing this article, I have not been able to find any evidence that Epstein actually provided the funding.

But Decrypt answered this question based on new Justice Department documents:Epstein did indeed invest in Coinbase.,The opportunity was initially brought about by Pierce.

Blockchain Capital told Decrypt that Epstein's investment was ultimately made by a company independent of Pierce. The same documents also show that...Epstein invested in Blockstream—A Bitcoin infrastructure company founded by Adam Back.

3. Jeremy Rubin: Bitcoin Core developers sought funding from Epstein.

identityHe is a Bitcoin Core contributor, author of the BIP-119 (OP_CTV) proposal, and affiliated with MIT's Digital Currency Initiative. Within the Bitcoin technical community, he is among those who write the underlying code.

How to contact EpsteinDirect communication, with discussions explicitly involving Bitcoin.

Cryptographic topics involvedBitcoin regulatory prospects, Bitcoin political speculation, teaching Bitcoin courses in Japan, requesting research funding.

TimelineIn February 2017, the records were concentrated in four days.

On February 1, 2017, Rubin discussed "Bitcoin regulatory outlook" and "Bitcoin regulatory and political speculation" with Epstein.

Three days later, he reported to Epstein on his progress in teaching Bitcoin to engineers in Japan.

This set of records has the highest information density in the entire database.

The topic of their discussion was not "how Bitcoin works," but rather the direction of regulation and political maneuvering, indicating that Epstein had already passed the stage of being educated about Bitcoin by 2017.

Isn't Rubin's behavior pattern quite suspicious?

His initiative to report on his work progress to Epstein suggests a continuous exchange of information rather than a one-off social interaction.

As for what Rubin received from Epstein, we have no way of knowing.

However, according to a report by DL News based on Department of Justice documents, in December 2015, Rubin sent an email directly to Epstein requesting funding for his encryption research.

Epstein's reply was very specific, offering three funding options: 1. Pay Rubin a salary directly; 2. Rubin start a company, with Epstein making the investment (requires further documentation); 3. Fund Rubin's research (with tax benefits).

Bitcoin Core developersActively requesting funds from EpsteinEpstein, however, provided a systematic response.

Here, we need to explain the MIT Digital Currency Initiative. DCI is a research project initiated in April 2015 by Joi Ito, director of the MIT Media Lab, to conduct academic research on Bitcoin and digital currencies. Later, it participated in the early work on infrastructure such as the Lightning Network.

In the Bitcoin technology community, DCI is not a fringe academic institution; its research directly influences the development direction of the Bitcoin protocol. Rubin is one of the developers associated with this project.

4. Joi Ito: Launching MIT's digital currency project with Epstein's money.

identityFormer director of MIT's Media Lab. He resigned in 2019 after it was revealed that he had received funding from Jeffrey Epstein.

How it relates to Epstein: Accept funds and communicate directly.

Cryptographic topics involvedFunding sources for the MIT Digital Currency Initiative.

TimelineThe digital currency plan was launched in April 2015, and there are still communication records in 2017.

The fact that Ito received funding from Epstein was reported by media outlets such as The New Yorker in 2019, so it's not exactly a new discovery. However, the database records add a detail that was somewhat unclear in the original reports:

Where exactly did that money go?

The database directly labels it as "Joichi Ito used gift funds to finance MIT Media Lab Digital Currency Initiative," as mentioned above.

So, Epstein's funds didn't go into the Media Lab's regular operating pool,Instead, the funds flowed into cryptocurrency research.

This connects to the clue about Rubin mentioned above.

Rubin is associated with the MIT Digital Currency Initiative, which in turn used Epstein's money.

While we cannot directly conclude that Rubin met Epstein through Ito, these two clues point in the same direction:Epstein's infiltration of the crypto industry went beyond social interactions; he also gained access to core developers in the crypto community by funding academic research.

Now let's connect these clues together:

Epstein's money flowed into DCI, an important institution for Bitcoin core technology research. Rubin, a developer associated with DCI, was directly discussing regulatory politics with Epstein and reporting to him.

This funding chain raises an uncomfortable question:

Did Epstein gain access to Bitcoin Core developers, or even indirectly influence the direction of research at the Bitcoin infrastructure level, by funding academic research?

Current data cannot prove this. However, this chain of "money → institution → developer → direct communication" does exist in the database records, and readers can judge for themselves how strong the causal relationship is.

5. Epstein himself: He has been tracking Bitcoin and Libra for at least ten years.

Arranging Epstein's own records involving encryption chronologically reveals a clear evolutionary line:

If you look at this table together, there are two judgments.

First, Epstein's interest in cryptography was not a sudden curiosity from one year..

The earliest record dates back to around 2008, when the Bitcoin white paper had just been released and there were probably no more than a few thousand people around the world paying attention to crypto.

His access to Bitcoin at that stage indicates his information network reached some of the earliest people in the field. There has been a continuous stream of crypto-related activity for the past decade.

Second, his focus is becoming increasingly deeper.

In 2008, he was "listening to demonstrations"; in 2017, he was discussing regulatory politics with developers; in 2018, he was placing cryptography on the same geopolitical agenda as John Kerry and Qatar; and in 2019, he was able to produce a detailed analysis within six days of the Libra white paper's release...

This is no longer the trajectory of an amateur onlooker; it's clear he's someone trying to build influence in the crypto industry.

The last record, regarding the timing of the Libra analysis, is also interesting.

He finished his analysis on June 24, 2019, and was arrested on July 6. In the last two weeks of his free time, he was still analyzing Facebook's stablecoin proposal.

It's both funny and sad to see someone in such a role being so concerned about encryption.

People who did not appear in the database

Add a reverse discovery feature.

CZ, Sam Bankman-Fried, Brian Armstrong, Vitalik Buterin, the Winklevoss brothers…

These most prominent figures in the crypto industry have not been found to have had any direct interactions with Epstein within the scope of the documents currently being processed.

Vitalik Buterin does have a "authored What is Ethereum" statement, but the publicly available information cited in the document does not involve personal relationships.

Not being in the database doesn't mean there's no connection; it simply means there's no evidence within the current data scope. The House of Representatives is still releasing documents, and this database is being updated.

What do these clues, pieced together, signify?

Epstein was not an investor in the crypto industry.

He was not a technical participant either; he had never written code, issued coins, or gone online.

However, he was clearly not a passive bystander.

After scraping through these records, I feel that what he did was more like a...Information broker.

He had Pierce demonstrate Bitcoin to the former Treasury Secretary at his restaurant, possessed complete fundraising materials from Blockchain Capital, discussed regulatory politics with Bitcoin Core developers, funded digital currency research at MIT, and was analyzing Facebook's Libra just two weeks before his arrest...

The common characteristic of these behaviors is:Position yourself at the intersection of information flows, acting as a connector between crypto entrepreneurs, policymakers, and academic researchers.

This is consistent with his behavior patterns in other areas.

Epstein didn't directly conduct scientific research, but he funded scientists; he didn't directly influence policy, but he arranged meetings between politicians and businessmen. Encryption was just another area he infiltrated using the same methodology.

The possible difference is that the crypto industry was in a critical window of opportunity between 2008 and 2019, transitioning from the underground to the mainstream. During this period, the industry relied heavily on informal networks to access policy information and capital.

And isn't that exactly what Epstein excelled at providing?

However, we have done our best. There is a distance in reasoning between "contact records" and "substantial impact." What this article can do is present the former.

To reiterate, all findings come from an open-source database and auxiliary analysis by Claude. This article is not a final conclusion; it's more appropriate to consider it a snapshot of data at a particular stage.

If you find any encryption-related clues in this database that I may have missed, please let me know.

-

References:

1. Epstein's Browser Open Source Project:

https://github.com/maxandrews/Epstein-doc-explorer

22,600 key text database locations:

https://github.com/maxandrews/Epstein-doc-explorer/blob/main/document_analysis.db

No Comments