Author:BlockBeats

Original title: The Crypto CEO Who’s Become Enemy No. 1 on Wall Street

Original author: Amrith Ramkumar, Dylan Tokar, Gina Heeb, the Wall Street Journal

Compiled by: Peggy, BlockBeats

Editor's Note: When the crypto industry truly touches upon the core areas of finance—bank deposits and payments—the conflict ceases to be a clash of ideologies and becomes a struggle for interests. This article, using Brian Armstrong's confrontation with Wall Street as a thread, reveals the essence of the game between banks and crypto platforms behind the CLARITY Act. This is not only about the legality of stablecoin yields, but also about who will dominate the rule-making power of the next generation of financial systems.

The following is the original text:

Last week, during the World Economic Forum in Davos, Switzerland, Brian Armstrong, CEO of the largest cryptocurrency company in the United States, was having coffee with former British Prime Minister Tony Blair when Jamie Dimon suddenly interrupted.

“You’re talking nonsense,” said Jamie Dimon, a longtime skeptic of cryptocurrencies who has called Bitcoin a “scam,” while pointing his index finger directly at Armstrong’s face.

According to sources, Dimon's core message was simple: to stop Armstrong from lying on television. Just a week earlier, Armstrong had accused banks on several business television programs of attempting to undermine legislation aimed at establishing a new regulatory framework for digital assets.

This direct confrontation is clearly inconsistent with the Davos Annual Meeting's aim of "promoting cooperation among global leaders."

As the crypto industry rapidly integrates into the mainstream US financial system, some Wall Street heavyweights are beginning to realize that a threat is looming. While banks have already embraced crypto assets to some extent—for example, by assisting clients in investing in Bitcoin or using digital assets to improve the efficiency of cross-border transfers—they have chosen to draw a clear line when crypto business touches their core territory: household deposits.

Banks and Coinbase are locked in a direct confrontation over a key issue: should crypto trading platforms be allowed to offer users "holding rewards"? These so-called "rewards" typically refer to periodic payments of a percentage of value to stablecoin holders, such as an annualized 3.5%. Stablecoins are a class of digital assets pegged to real-world currencies like the US dollar.

Bank of America CEO Brian Moynihan, and JPMorgan Chase CEO Jamie Dimon.

Banks argue that these payments to users are essentially no different from bank account interest. Since banks offer significantly lower returns—typically below 0.1% for current accounts—they fear a massive shift of consumer funds into crypto assets. This outflow of funds, they claim, will weaken the viability of community banks and impact lending to businesses.

Brian Armstrong and other crypto industry figures argue that the free market should be allowed to function: banks can compete with stablecoins by raising deposit rates or simply enter the stablecoin business themselves.

This legislation, known as the Clarity Act, could reshape the future of everyday financial services, including bank deposits and electronic payments.

According to sources familiar with the matter, in the latest round of efforts to seek compromise, the White House plans to convene a meeting on Monday with banking and crypto industry groups, with David Sacks, the Trump administration's head of AI and crypto affairs, expected to attend. Kara Calvert, Coinbase's head of U.S. policy, is also among those invited.

Armstrong, 43, co-founded Coinbase in 2012 and has played a key role in pushing for the legitimacy and mainstreaming of the crypto industry. As the head of a company with a market capitalization of approximately $55 billion, Armstrong wields considerable influence in industry debates, particularly in the power struggle unfolding in Washington.

Just one day before a Senate committee was scheduled to vote on a version of the bill that could substantially prohibit companies like Coinbase from offering revenue to customers, potentially resulting in billions of dollars in losses, Armstrong posted on the X platform: "We'd rather have no bill than a bad one."

Hours later, the vote was suddenly postponed, much to the surprise of the financial community.

"It's more like Coinbase versus banks now than the crypto industry versus banks," said Ron Hammond, head of policy and initiatives at digital asset trading firm Wintermute.

Armstrong's counterattack didn't stop with the X post on January 14. He later reiterated his views on a television program, stating in an interview with Bloomberg that bank lobbyists were "trying to shut down competitors" and accusing banks of "essentially taking customers' deposits and lending them out without their permission."

According to sources, these remarks directly led to a series of uncomfortable confrontations with several bank CEOs in Davos.

"If you want to be a bank, then just be a bank," Brian Moynihan said during a 30-minute meeting with Armstrong at the main venue in Davos last week. The meeting was superficially friendly, but somewhat awkward.

Citigroup CEO Jane Fraser gave Armstrong less than a minute. (Coinbase is a client of both Citigroup and JPMorgan Chase, and has business relationships with several banks.)

This "minute" was even longer than the time Wells Fargo CEO Charlie Scharf had given him. When Armstrong approached him, Scharf bluntly stated that the two had "nothing to talk about." This occurred while Scharf's former boss, Dimon, was nearby.

"Bank alternatives"

Armstrong attended Rice University in Houston, where he studied economics and computer science. He was an early advocate of digital currency and blockchain concepts. He read the Bitcoin white paper published in 2008 by a pseudonym, Satoshi Nakamoto. In 2011, while working at Airbnb, he also struggled with difficulties sending money to South America.

These experiences paved the way for the birth of Coinbase. The company initially sought to solve a core problem plaguing crypto investors: the lack of a secure place to store digital assets. Subsequently, when some users wanted to do more than just "store" their Bitcoin, but also trade it, Coinbase naturally evolved into an exchange.

Coinbase quickly grew from a small apartment in San Francisco (the company's first office). By 2017, when another co-founder left, Armstrong had become the undisputed leader of the company.

Former colleagues previously told The Wall Street Journal that Armstrong was introverted and sometimes struggled to communicate with employees, and was not very good at criticizing subordinates face-to-face. Some former employees felt that his style of doing things was quite similar to the Vulcans in Star Trek, known for their calmness and restraint.

Brian Armstrong, CEO of Coinbase in 2014.

However, Armstrong has never hidden his ambitions for Coinbase. He positions Coinbase as the American company that brings cryptocurrency into the mainstream. Today, Coinbase's business scope covers multiple areas, from electronic payments and stock trading to commodities and prediction markets.

"Fundamentally, we want to be an alternative to banks," he said on Fox Business last year. "We want to build a super app that offers all kinds of financial services."

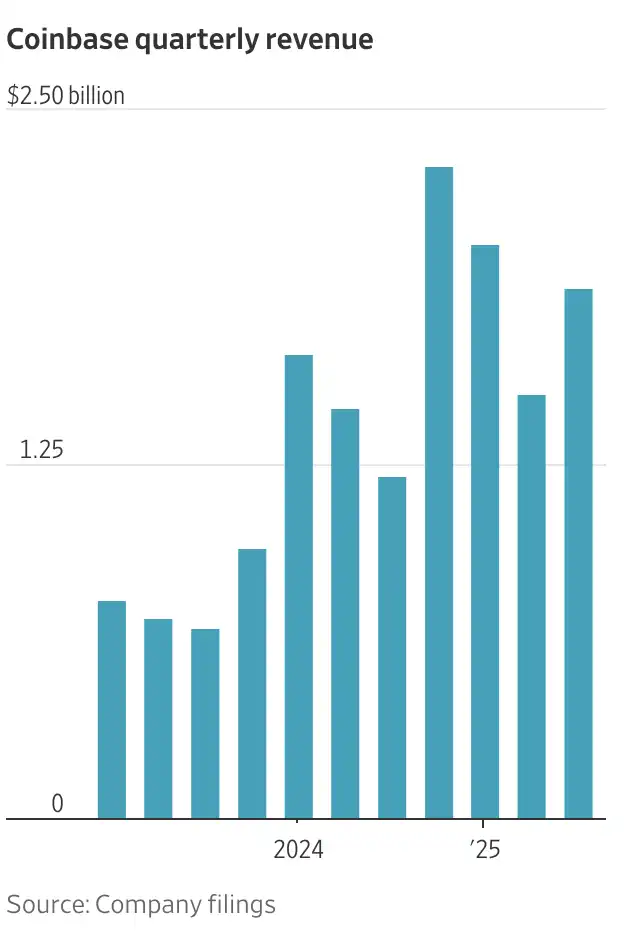

As the business expanded, Armstrong invested tens of millions of dollars to build the industry's largest lobbying machine. After several booms and busts in the crypto market, Coinbase went public in April 2021, with its market capitalization once reaching a high of $100 billion, and Armstrong's personal shareholding value also briefly rose to about $13 billion.

Having weathered the industry collapse of 2022 and the regulatory crackdown during the Biden administration in 2023, Armstrong began a strong counterattack and gradually found its voice. The founder, who once preferred to wear headphones, write code in the office, and was somewhat resistant to public speaking, has now become the most active advocate for the crypto industry in Washington—and the attitude of the US political establishment towards cryptocurrencies is undergoing a dramatic shift.

Coinbase is investing approximately $75 million in the 2024 election cycle through a network of Super PACs, aiming to counter skeptical candidates and build grassroots organizations to garner public support for crypto-related legislation. The Super PAC group stated on Wednesday that it currently has $193 million in funding.

Trump's 2024 victory opened a policy window that Armstrong had been pursuing for a decade. He praised Trump for ushering in "the dawn of a new era of crypto" and attended a "Crypto Ball" featuring Snoop Dogg around the time of Trump's inauguration. Now, the executive swaps his signature T-shirt and black jacket for a suit at least every two months to visit politicians on Capitol Hill.

"Coinbase is at the forefront of all crypto-related matters in the United States," commented Anthony Scaramucci, founder of SkyBridge Capital and a long-time crypto investor.

Last summer, Trump signed the Genius Act into law, paving the way for numerous companies to issue stablecoins. This law fueled the rapid growth of stablecoin activity. While the act prohibited issuers from paying interest directly to users, it did not cover trading platforms or third parties like Coinbase. This "omission" was seen as a regulatory loophole by banking groups and is the catalyst for the current conflict surrounding the Clarity Act.

A long legislative journey

The House passed its version of the Clarity Act last year, but its advancement in the Senate is widely considered more difficult, partly due to significant disagreements over which rules should apply to crypto companies. The Senate Agriculture Committee, which oversees provisions related to the Commodity Futures Trading Commission, advanced its own version on Thursday. Ultimately, lawmakers will need to pass a full Senate vote on the text and reconcile it with the House version.

According to sources familiar with the matter, Brian Moynihan's core argument to Armstrong is that if crypto companies like Coinbase want to offer deposit-like services, then many banks believe they should be subject to the same regulatory burdens. Regulators, including the Federal Reserve and the Office of the Comptroller of the Currency, review banks' risk profiles, regularly examine their operations, and set stringent requirements for the capital required for lending and investments.

"The controversy surrounding the 'reward mechanism' is actually an exception to our overall relationship with banks," said Faryar Shirzad, Chief Policy Officer of Coinbase. "We maintain close cooperation with banks and have announced several partnerships."

Coinbase has established a lucrative partnership with stablecoin issuer Circle, enabling it to receive a substantial revenue share from the mainstream stablecoin USDC. Through this unique arrangement, Coinbase is able to offer a 3.5% yield to select USDC holders, a practice uncommon in the industry. The company states that such incentives help attract users and provide consumers with more options in an environment of extremely low demand deposit rates.

"There is no reason to prohibit paying interest to consumers," Armstrong said in an interview with The Wall Street Journal last year.

On January 15, 2026, Brian Armstrong appeared on Capitol Hill.

As the Clarity Act moved toward a congressional vote, banks began a fierce lobbying effort behind the scenes. According to a government estimate cited by the banks, approximately $6.6 trillion in deposits could be "drawn" from the traditional financial system if restrictions were lifted. This lobbying quickly paid off: the nearly 300-page draft bill included a series of provisions and potential amendments, which Armstrong viewed as tantamount to a failure for the crypto industry. He immediately withdrew his support, and Senate Banking Committee Chairman Tim Scott (Republican, South Carolina) cancelled the scheduled vote hours later.

According to sources familiar with the matter, Armstrong already has ideas on how to break the deadlock. He told Brian Moynihan that a new category of stablecoin issuers could be created: those meeting stricter regulatory standards would be allowed to pay yields to users. This would theoretically allow banks to compete under the same regulatory framework as Coinbase.

Other proposals advocate for a broad ban on revenue payments, but with a few exceptions reserved for institutions like Coinbase.

Regardless of the final plan, the legislation will almost always require Armstrong's endorsement to proceed.

"The current situation is that everyone believes whether or not this legislation is passed ultimately depends on whether Coinbase agrees," said Hilary Allen, a professor of law at an American university, a securities law expert, and a crypto skeptic. "This is a truly shocking reality."

No Comments