Author:TechFlow

Author: Deep Tide TechFlow

Yesterday's Market Dynamics

BTC fell below $84,000 this morning, and ETH fell below $2,800.

HTX market data shows that BTC fell below $84,000 this morning and is currently trading at $84,520; ETH fell below $2,800 and is currently trading at $2,813.

The number of Americans filing for initial jobless claims for the week ending January 24 was 209,000, compared to an expected 205,000.

According to Jinshi Data, the number of initial jobless claims in the United States for the week ending January 24 was 209,000, compared with an expected 205,000 and a revised previous figure of 210,000 from 200,000.

US Senate Republican Leader: We are one step closer to reaching an agreement to avoid a government shutdown.

According to Jinshi Data, Senate Republican Leader Thune stated that the country is one step closer to reaching an agreement to avoid a government shutdown. Under the latest agreement, the Department of Homeland Security will receive temporary funding.

US SEC Chairman: Now is the right time to allow cryptocurrencies into 401k retirement accounts

According to Crypto Rover, U.S. Securities and Exchange Commission (SEC) Chairman Paul Atkins stated, "Now is the right time to allow cryptocurrency into 401k retirement accounts."

Moonbirds: BIRB applications are now open.

According to an official announcement, Moonbirds has announced that the birb token claim and Nesting 2.0 are now live.

BitMine has staked another 314,496 ETH, worth $887 million.

According to on-chain analyst Onchain Lens (@OnchainLens), BitMine, the largest holder of Ethereum, has staked an additional 314,496 ETH, worth $887 million.

BitMine's total staked amount has risen to 2,831,392 ETH, worth $7.98 billion.

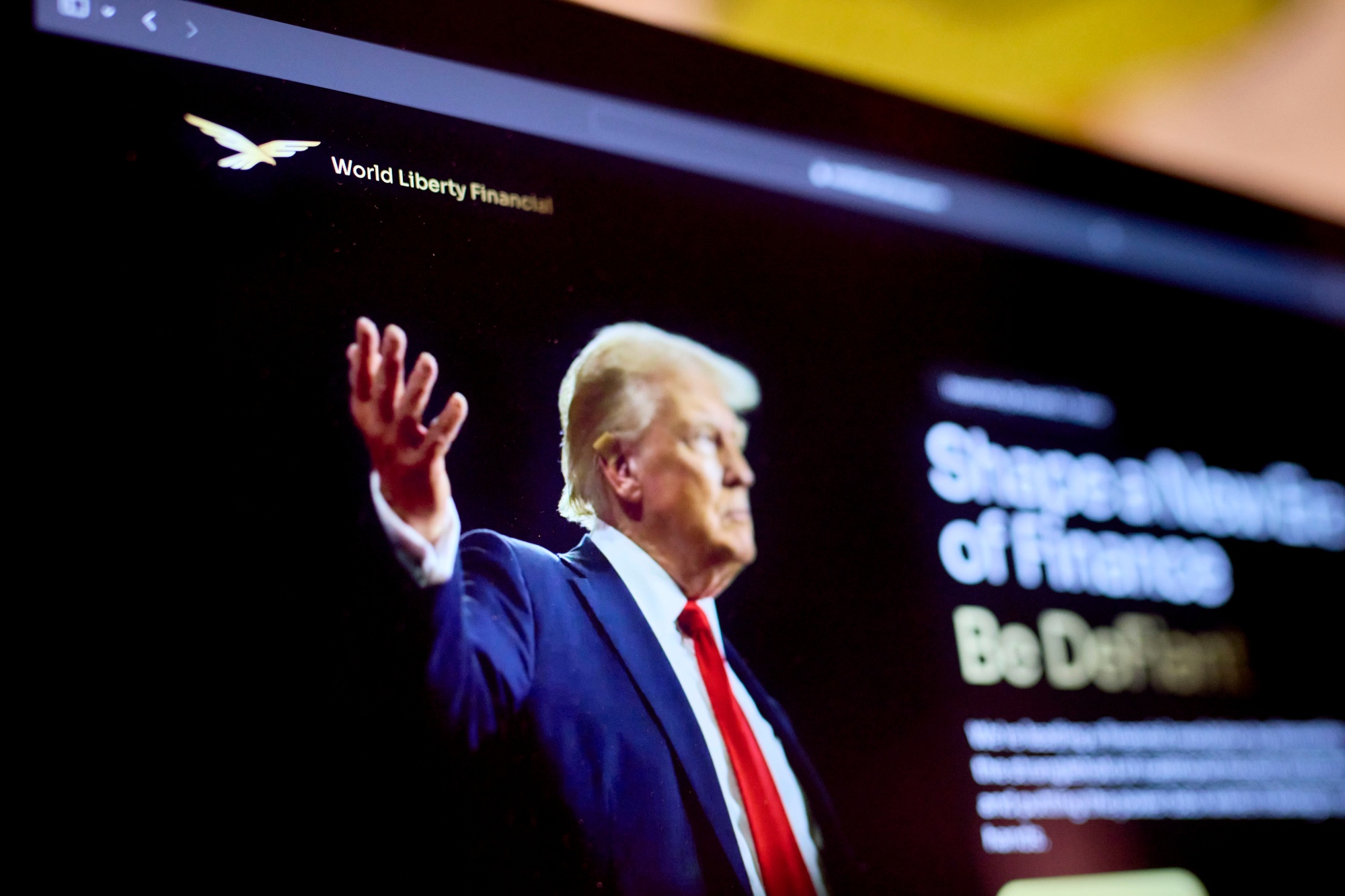

ALT5 Sigma's board of directors approved a share buyback program of up to $100 million and a WLFI shareholding increase plan.

According to Businesswire, the board of directors of ALT5 Sigma (NASDAQ: ALTS), the US-listed WLFI treasury company, has authorized a stock buyback program of up to $100 million at a price below net asset value, with a maximum repurchase of 50 million shares, representing approximately 40% of the outstanding shares. The board also approved increasing its holdings of $WLFI tokens; the company currently holds approximately 7.3 billion $WLFI tokens, worth approximately $1.5 billion.

ALT5 CEO Tony Isaac stated that the company will continue to expand USD1-related integrations to increase enterprise utility, trading volume, and long-term revenue opportunities.

Crypto hosting service provider Copper is in talks for an IPO, with Goldman Sachs, Citigroup, and Deutsche Bank potentially participating.

According to CoinDesk, cryptocurrency custody service provider Copper is in preliminary talks regarding a potential public offering. Sources familiar with the matter revealed that Goldman Sachs, Citigroup, and Deutsche Bank may participate in the listing, with the final decision depending on the company's recent revenue performance.

Copper reportedly provides institutional-grade crypto infrastructure based on multi-party computation (MPC) technology, including custody, settlement, and prime brokerage services, designed to reduce counterparty risk for banks and trading firms.

Crypto trading software provider Talos raises $45 million, with Robinhood, a16z, and others participating.

According to CoinDesk, Robinhood participated in the Series B funding round of crypto trading platform Talos, valuing the company at approximately $1.5 billion. The total funding round raised $45 million, with new strategic investors including Sony Innovation Fund, IMC, QCP, and Karatage, as well as returning investors such as a16z crypto, BNY, and Fidelity Investments.

Johann Kerbrat, senior vice president and general manager of Robinhood’s crypto business, said Talos’ flexibility and rapid adaptability will help Robinhood deepen liquidity and provide crypto customers with more advanced features.

Metaplanet announced it will raise approximately $135 million, primarily to increase its Bitcoin holdings and invest in its Bitcoin yield business.

According to an official announcement, Metaplanet's board of directors has resolved to issue common stock and 25th tranche of share options through a third-party placement, with a planned total financing amount of approximately US$135 million.

Metaplanet stated that the proceeds from the funding round will primarily be used to increase its Bitcoin holdings and invest in Bitcoin yield-generating businesses, while also repaying some of its credit line borrowings. The company held 35,102 Bitcoins as of the end of 2025.

OSL Group completes $200 million equity financing, which will accelerate the expansion of its global stablecoin and payments business.

According to PRNewswire, OSL Group (863.HK), a Hong Kong-listed stablecoin trading and payment platform, announced the completion of a US$200 million (approximately HK$1.56 billion) equity financing round. The net proceeds will be used for strategic acquisitions, expansion of its global payments and stablecoin business, product and technology infrastructure development, and general working capital.

In 2025, OSL Group made significant progress in developing a compliant stablecoin trading and payment ecosystem, including the acquisition of Web3 payment service provider Banxa, the launch of OSL BizPay, a B2B payment solution for enterprise clients, and the issuance of the compliant USD stablecoin USDGO.

Market Dynamics

Recommended reading

When CZ was collectively condemned

This article discusses the controversies and criticisms surrounding Binance founder Changpeng Zhao (CZ) and his trading platform during the bear market, particularly focusing on the flash crash of October 10, 2022, and the listing issues of the Binance Alpha project. The article analyzes the background of these criticisms, market sentiment, and their impact on CZ personally and Binance.

Ledger IPO: A Dark Humor About "Security"

This article focuses on the security issues, data breaches, and upcoming IPO of cryptocurrency hardware wallet company Ledger. Despite using "security" as a core selling point, multiple major security vulnerabilities and the resulting trust crises have profoundly impacted its users and brand. However, thanks to its leading position in the cryptocurrency wallet market and industry trends, Ledger has still garnered favor from the capital market.

This article discusses the anticipated IPO wave in the crypto industry in 2026, with numerous crypto companies planning to go public, including leading players in exchanges, wallets, custody, and security auditing. The article provides a detailed analysis of these companies' valuations, business models, and IPO plans, and explores the challenges crypto companies face in establishing themselves in the public market.

This article analyzes current market dynamics, including the Federal Reserve's interest rate policy, stock and precious metal trends, and the volatility and divergence in the cryptocurrency market. The Fed's decision to maintain interest rates indicates a wait-and-see approach to monetary policy, while also facing political pressure. The storage sector continues to benefit from strong AI demand, but its excessive gains may lead to a correction. Precious metals such as gold and silver have recently performed exceptionally well, but speculative risks are increasing. The cryptocurrency market is showing divergent performance, with Bitcoin and Ethereum fluctuating, while some tokens, such as HYPE, have seen significant gains. The overall market is heavily influenced by political uncertainty and the returns on AI investments.

This article explores the current state and future of cryptocurrency and privacy, analyzing privacy technologies, user experience, governance mechanisms, and privacy challenges in the AI era through an interview with Zcash founder Zuko. The article emphasizes that privacy is an indispensable tool for survival in the digital age and proposes the new concept of "static value privacy."

No Comments