作者:kimcookalts

On May 25, 2025, Pakistan’s Ministry of Finance unveiled a new policy to dedicate 2,000 MW of surplus electricity to Bitcoin mining and AI data centers. This move not only marks a critical step for Pakistan in the digital economy but may also have profound implications for the global mining landscape, AI computing resource distribution, and renewable energy utilization.

Innovative Utilization of Surplus Power

Pakistan has faced the challenge of electricity surplus in recent years. Despite significant improvements in the country’s energy infrastructure over the past decade, economic slowdown and insufficient industrial electricity demand have led to utilization rates of only about 15% for some power plants (e.g., Sahiwal, China Hub, and Port Qasim coal projects). This has forced the government to pay high capacity charges, creating substantial fiscal pressure.

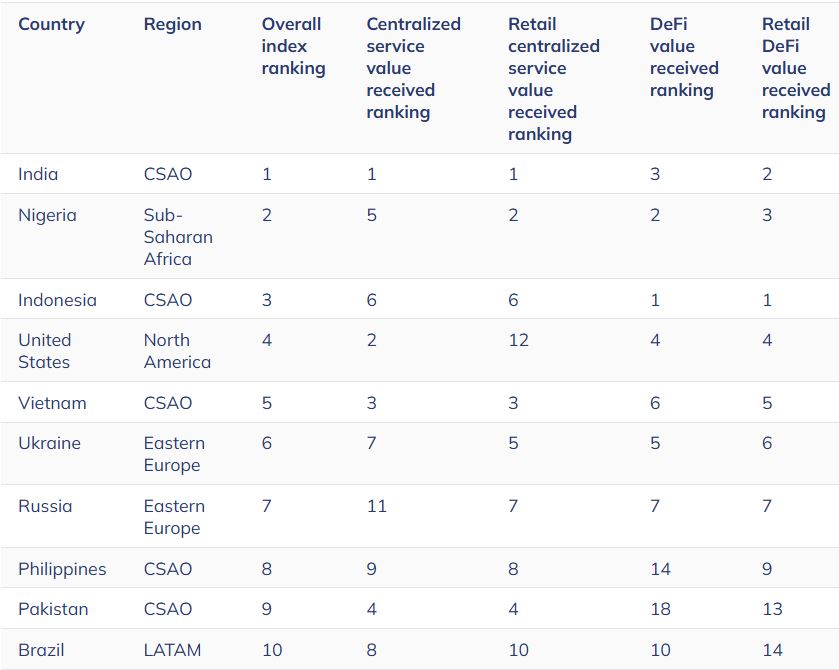

Against this backdrop, the energy-intensive nature of Bitcoin mining and AI data centers presents a potential solution to the surplus power issue. Bitcoin mining’s high energy consumption (estimated at 137–175 terawatt-hours annually for 2024–2025) is often likened to the extraction of “digital gold,” while AI data centers similarly demand vast electricity resources for computation. Pakistan ranks ninth in Chainalysis’ 2024 Cryptocurrency Adoption Index, driven by strong retail adoption and centralized service transactions.

Through this policy, Pakistan aims to transform idle electricity resources into a new engine for advancing digital assets and innovative economic development.

Reports indicate that the initiative is led by the Pakistan Crypto Committee (PCC), a government-backed body under the Ministry of Finance tasked with overseeing the integration of blockchain technology and digital assets. Finance Minister Muhammad Aurangzeb described the move as a “pivotal moment” for Pakistan’s digital transformation, projecting it will attract billions of dollars in foreign direct investment and generate significant government revenue.

Bitcoin Mining and AI Centers

To enhance the policy’s appeal, the Pakistani government has introduced several incentives. For instance, tax exemptions have been granted for AI infrastructure, and tariff waivers have been provided for Bitcoin mining companies. These measures aim to reduce operational costs and attract global miners and tech firms to set up operations in the country.

Additionally, the policy is accompanied by positive signals of international cooperation. Delegations from various countries, including Bitcoin mining firms, have recently visited Pakistan to discuss potential investment and collaboration projects. For example, the PCC has held preliminary talks with international mining companies to establish mining farms in regions with surplus power, such as Punjab and Sindh provinces. This open stance underscores Pakistan’s ambition to become an emerging hub for global cryptocurrency and AI computing resources.

Notably, the policy’s second phase will introduce renewable energy support. Future mining farms and AI centers in Pakistan will gradually tap into solar and wind energy resources. This aligns with global sustainability priorities and may mitigate criticism regarding the environmental impact of Bitcoin mining.

Renewable Energy and Global Hashrate Distribution

The implementation of this policy will significantly impact the global Bitcoin mining industry. Currently, Bitcoin mining is concentrated in regions with low-cost energy, such as Texas in the U.S. and Inner Mongolia in China. Pakistan’s entry, with its low-cost electricity resources, may attract some miners to relocate, potentially reshaping the global hashrate distribution.

Although 2,000 MW accounts for only 1%–2% of global Bitcoin mining’s annual electricity consumption, it holds strategic significance for establishing a regional computing hub. For small-scale miners and emerging mining firms, Pakistan’s tax incentives and electricity resources could spark a new “gold rush.”

Concurrently, the development of AI data centers will drive the regionalization of computing resources. In recent years, the surging demand for electricity and computing power in AI model training has strained traditional data center giants like Amazon AWS and Microsoft Azure. Pakistan’s policy could offer new infrastructure options for small and medium-sized AI enterprises, reducing computing costs and accelerating innovation.

Despite its potential, the policy faces multiple challenges. First is the environmental concern. Bitcoin mining has faced criticism for its high energy consumption, particularly in regions reliant on fossil fuel-based power generation. In 2023, Bitcoin mining’s carbon footprint reached an all-time high. Pakistan’s initial reliance on coal-based power may draw opposition from environmental groups.

However, the sustainable energy plan in the policy’s second phase offers a solution. By introducing solar and wind energy, Pakistan can reduce carbon emissions and attract more investors focused on ESG (Environmental, Social, and Governance) standards.

The second challenge is regulatory risk. Pakistan’s cryptocurrency regulatory framework is still evolving. While the establishment of the PCC signals a policy shift, the country’s stance on cryptocurrencies has fluctuated in the past. For instance, in 2023, the Ministry of Finance explicitly stated it would not legalize cryptocurrencies. This historical context may raise concerns about the policy’s long-term stability.

Investment Opportunities and the Web3 Boom

Pakistan’s policy is undoubtedly an investment opportunity worth noting. First, low-cost electricity for Bitcoin mining could boost miners’ profit margins, drawing more capital into related projects. Second, the development of AI data centers may give rise to new DeFi and Web3 applications. For example, AI data centers could foster innovations like decentralized AI-based prediction markets or data storage protocols.

For readers enthusiastic about meme coins and trading, this policy could trigger a new wave of FOMO. For instance, Bitcoin prices may experience short-term volatility following the policy announcement, presenting opportunities in secondary markets. Meanwhile, Pakistan may attract more blockchain startups, with related tokens (e.g., governance or platform tokens) potentially becoming the next wealth growth points.

The 2,000 MW power allocation policy reflects the proactive stance of developing nations like Pakistan in exploring new growth pathways in the Web3 era. From Bitcoin mining to AI infrastructure, this initiative is not only an innovative use of surplus energy but also a reshaping of the global digital economy landscape. Amid the convergence of AI and Web3, Pakistan’s move may be just the beginning. Looking ahead, with the integration of renewable energy and a refined regulatory framework, the country could emerge as a new global hub for blockchain and AI computing resources. Let us watch how this narrative unfolds on the global stage.

No Comments