The leading Bitcoin ETF suppliers are becoming a sink for the supply of BTC. In April, the top ETF bought up a net 32,521 BTC, adding to other signs of demand from whales.

Bitcoin ETFs keep buying up the free supply, adding another 32,521 BTC in April. The turbulent month saw significant de-leveraging events and price fluctuations, but buyers returned after BTC showed signs of recovery.

ETF now holds 6.4% of the entire supply of BTC, or around 1,337,814 BTC. Of those purchases, 87% are held by US-based ETFs, mostly due to jurisdiction restrictions. Coinbase holds over 70% of ETF custodian activity, reflecting the rapid growth of crypto-based ETFs.

BlackRock’s IBIT fund is the leading holder, with 604,042 BTC and a habit of buying more when all other funds are selling. IBIT is also the strongest holder, with expectations of becoming one of the largest ETFs this decade.

I completed the monthly summary of all global Bitcoin ETFs for 4/30

✅ ETF holdings increased by +32,521 BTC in April

🧮 ETFs HODL a record 1,337,814 Bitcoin worth $128 Billion

🏛️ ETFs now hold 6.4% of all BTC that will ever exist

🇺🇸 USA dominates with 87% share👇 pic.twitter.com/PyE43PSDLt— HODL15Capital 🇺🇸 (@HODL15Capital) May 1, 2025

Bitcoin ETFs often behave irrationally, with traders selling near local lows. BTC remains a highly volatile asset, and buying only resumes when the coin shows a strong directional trend. For now, ETF entities and Strategy are the strongest buyers, creating a baseline of demand for physical coins. Signs of buying often improve BTC sentiment but do not always erase attempts at shorting or cautious sentiment.

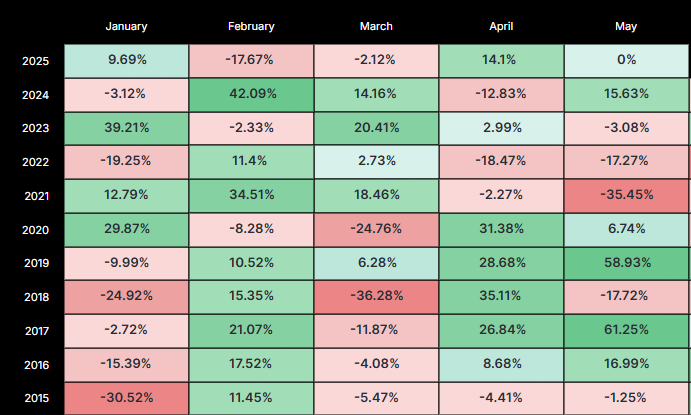

In April, BTC gained a total of 14.4%, in a historically strong month. BTC had net gains in April in 6 out of the last 10 years. The Bitcoin fear and greed index is at 53 points or neutral, signaling cautious trading.

After a week of active ETF buying, BTC recovered to $96,355.95, dominating 61.4% of the market. Currently, BTC remains the major attractor for the crypto market despite attempts to launch ETF based on Solana, XRP and other niche assets.

ETFs are the most active for the US market, with new products recently launched for the European market. European ETP have been trading for years, but the launch of the IBIT ETF was the catalyst for wider crypto investments.

BTC whales and ETF keep creating a supply crunch

Demand for BTC is slowly chipping away at the remaining OTC coins, exchange reserves, and newly mined assets. Currently, demand far surpasses the new creation of coins, slowly creating a supply crunch.

Both retail and institutional buyers acquired BTC in the past month. The retail to institutional ratio rose slightly, signaling that even small-scale holders were not capitulating and were still holding or acquiring coins.

In April, most of the BTC volatility was due to the derivative market, while accumulation wallets retained their balances. Spot trading still saw some selling and profit-taking from whales, but overall, accumulation wallets continued to grow their balances. While some whales with over 10,000 BTC sold their positions, wallets with over 1,000 BTC increased their number and balances.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More

No comments yet