Although history should not serve as an indication for future price movements, one cannot help but ask it for advice, especially in times of indecision and lack of a clear trend.

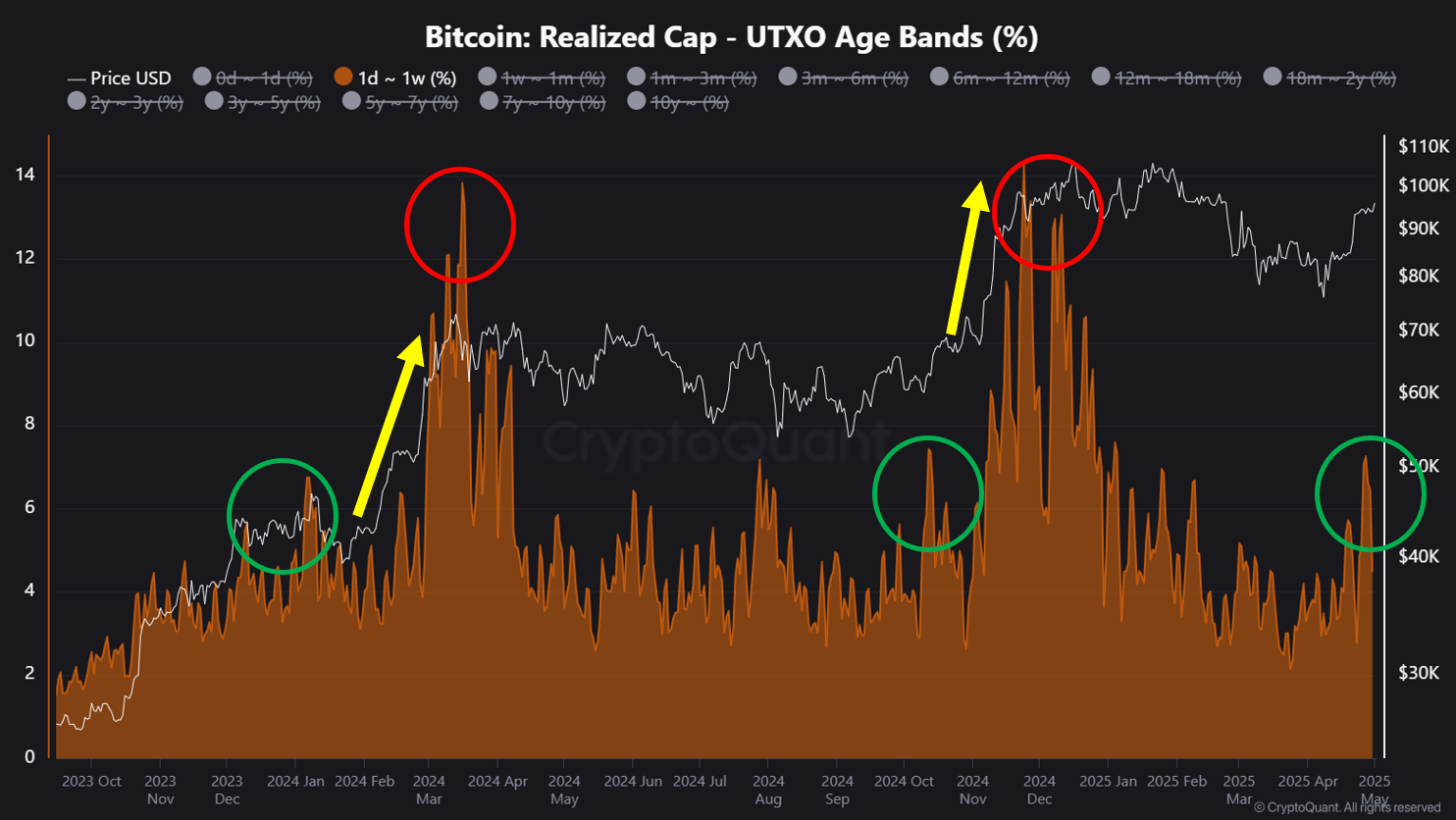

CryptoQuant’s latest analysis shows a promising picture when it comes down to the behavior of short-term holders (those holding their assets for somewhere between a day and a week), which have been growing in the past few weeks – something that was observed ahead of the two significant rallies in 2024.

A Glimpse Into the Past

The accumulation trend mentioned by CryptoQuant’s Crypto Dan hints back at the developments that took place in January and October last year. Back then, STHs, which were absent from the BTC market, at least until recently, went on a buying spree, which was confirmed by the growing number of active addresses.

What followed both times were rather quick price upticks for bitcoin, which soared to a new all-time high in March 2024 after the launch of the ETFs, and a new peak down the line in January 2025 ahead of Trump’s inauguration.

“Now, a similar increase in short-term holder activity is once again being observed, which could signal the beginning of another bullish phase, just like in the past.

Notably, this indicator has historically moved ahead of major price surges, making it a reliable signal of accumulation,” said the CQ analyst.

BTC Above $96K

After the April 7 and 9 lows of under $74,000, the primary cryptocurrency went on the offensive hard and exploded by over $20,000 to tap $96,000 last Friday. Its run, even though quite impressive, was stopped there, and the asset spent the following week or so in a tight range between $93,000 and $95,000.

The lower boundary was tested on a couple of occasions, including yesterday, but it managed to hold. As such, BTC bounced off and spiked above the upper one earlier today. As of now, the cryptocurrency trades close to $96,500, which is the highest price since February 23.

Aside from the STHs’ behavior, there are a few more bullish signals on the BTC front, including whale and institutional accumulation. We published another report as well about the most probable scenarios for BTC for 2025, which you can check here.

No comments yet