Original title:Trump First 100 Days: The Impact on Crypto

Original author: Connor Sephton, CryptoNews

Original translation: Felix,

It’s been 100 days since Trump returned to the White House, a period of turmoil and turbulent global markets, filled with uncertainty and chaos.

When Trump was successfully re-election, the crypto market was full of hope. However, despite some important positive Bitcoin statements issued after Trump took office, crypto people were disappointed.

Just before the inauguration ceremony, Trump released the official token $TRUMP, which made the market craze and also caused a lot of controversy. Some critics believe that the move has a clear conflict of interest and may even threaten national security.

$TRUMP has now fallen 82% from its all-time high of $75.35 set on January 19. But $MELANIA performed worse, plunging by nearly 97%.

source:Co ringecko

After Trump entered the White House, people have speculated that Trump will sign a series of executive orders supporting cryptocurrencies on his first day of taking office, including the establishment of strategic Bitcoin reserves. But these orders were not issued. Bitcoin soared to a record $109,000 on January 20, and has never returned to this level since.

Trump did quickly deliver on some of the campaign promises made at the 2024 Bitcoin Conference in Nashville. Ross Ulbricht, founder of the dark web market "Silk Road", received a comprehensive and unconditional pardon. In the photos circulating online, he smiled for the first time after being released from prison after 11 years. It is reported that Sam Bankman-Fried (SBF) is also lobbying for pardon, but the matter has not yet been achieved.

Meanwhile, several Bitcoin-friendly members in Trump's cabinet quickly received Senate approval. Among them is Treasury Secretary Scott Bessent, who once declared: “Cryptocurrency is about freedom and the cryptocurrency economy will last forever.”

Others face severe scrutiny. Commerce Secretary Howard Lutnick received heavy criticism at the confirmation hearing but underestimated the issue of his company's relationship with Tether's stablecoin.

The White House appointed David Sacks as the first "tsar" of artificial intelligence and cryptocurrency. Before taking office, he sold off his BTC, ETH and SOL. The appointment has won widespread praise, even Trump’s critic and founder of Sky Bridge Capital, Anthony Scaramucci.

In addition, Trump's businesses are increasingly involved in the digital asset field, with Trump Media Technology Group accumulating huge reserves of cryptocurrencies and launching a series of exchange-traded funds (ETFs).

There is a simple rule for Trump, that is, always be prepared for unexpected things. Back on March 2, Trump suddenly announced on Truth Social that he intends to create a “U.S. crypto reserve” that includes XRP, Solana and Cardano. As soon as the news came out, the prices of these altcoins soared sharply, with some even increasing by as much as 70%. However, BTC and ETH were not mentioned in the initial post, but subsequent supplementary statements stressed that these two flagship digital assets would also “become the core of the reserve.”

As soon as news that BTC would be confusing with other altcoins came out, it quickly sparked heated discussions, with experts calling the proposal “absurd” and “confusing”. There are also concerns about the feasibility of the plan, fearing it may require Congressional approval to start, and the details are few, and the allocation of funds, the source of the reserves, and when it will take effect have not been announced.

All of these issues end up becoming irrelevant. Trump made a big turn and soon signed an executive order to build strategic Bitcoin reserves as planned - while also stocking up other cryptocurrencies.

While this marks one of the biggest adoption milestones in Bitcoin’s history, BTC was sold off sharply as investors digest the news. Why? Because the Executive Order states that unless the acquisition can be completed in a manner that does not affect the budget, no new BTC shall be purchased as a reserve except for Bitcoin seized from criminals. This is also negative news for XRP, SOL and ADA, because the United States does not currently hold these tokens.

Bitcoin supporters have generally expected the United States to become a major buyer of Bitcoin — and achieve the ambitious goal of accumulating 1 million bitcoins in five years, proposed by Senator Cynthia Lummis. But using taxpayer money to do such things would be extremely hypocritical, especially given Musk's commitment to drastically cut federal spending.

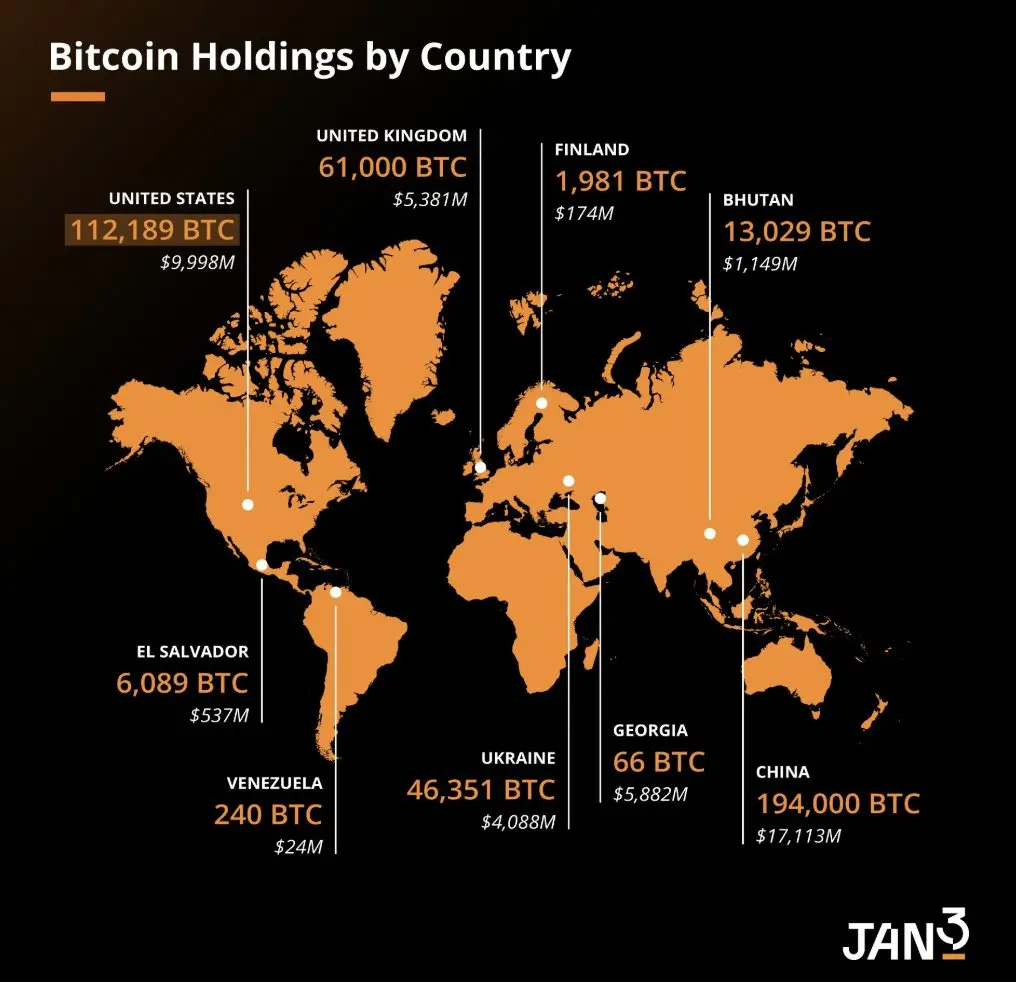

According to Arkham Intelligence data, there are currently about 198,000 bitcoins in the U.S. wallet, worth about $18.8 billion. But as JAN3 CEO Samson Mow points out, the actual scale of the U.S. strategic bitcoin reserves may be much smaller—because 95,000 of them will eventually be returned to Bitfinex. However, Mow is not pessimistic about this, and he believes that the significance of Trump's policy remains "significant" because it will encourage other major economies to follow suit.

Shortly after Trump announced the establishment of Bitcoin reserves, the White House held its first cryptocurrency summit on March 7, with industry giants including Michael Saylor of MicroStrategy and Brian Armstrong of Coinbase. But outsiders have mixed reviews of the summit, with some analysts saying “it’s more like a political stage than a meaningful policy forum.”

But investors have more difficult issues to deal with, and Trump faces allegations of deliberately suppressing the stock market, forcing the Fed to lower interest rates. The S&P 500 and the tech-based Nasdaq 100 have suffered a heavy blow, and the close link between the two means that Bitcoin’s sell-off is even bigger.

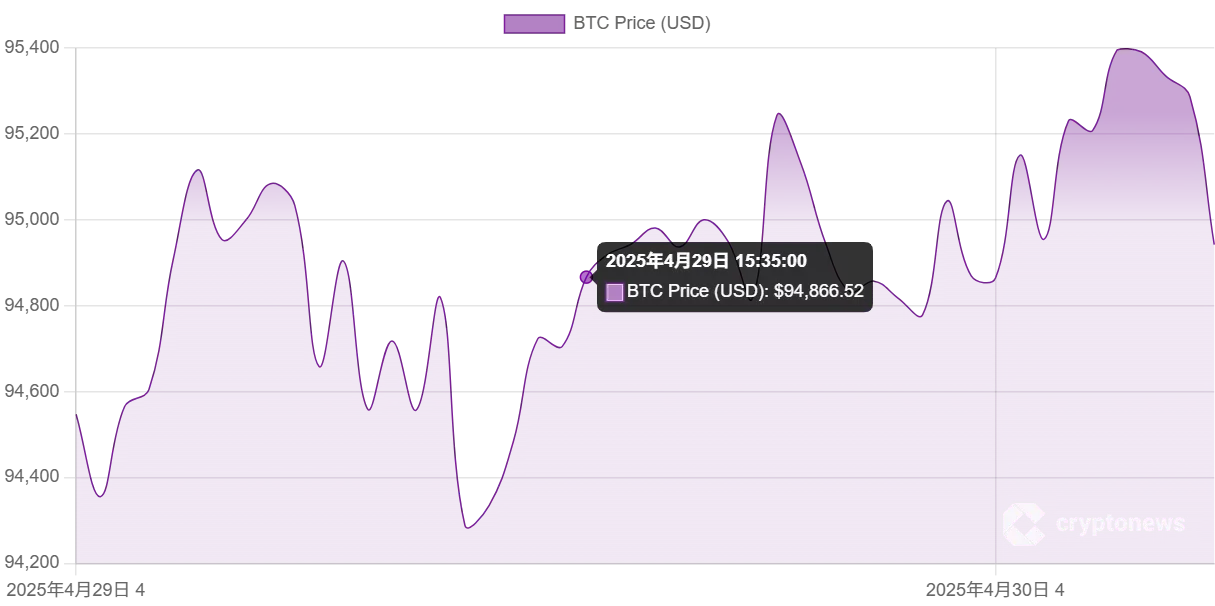

After the "Liberation Day", the situation became even worse. The president announced comprehensive and punitive tariffs on some of the closest trading partners in the United States, causing a sharp increase in the cost of imported goods. Bitcoin fell to around $80,000 in early April as the possibility of a recession rose and the war of words between Washington and Beijing escalated.

Bitcoin once faced the risk of falling below $75,000, a discount of 30% from the all-time high set on the inauguration day. But Trump confirmed that the reciprocity tariffs were suspended for 90 days on most countries, and the tariffs on China were raised to 145% again, temporarily bringing some relief to the market. Optimism further aroused when smartphones and computers were exempted from these radical trade policies. However, the White House has been constantly backfiring, leaving investors feeling anxious and exhausted, and many have now reduced their holdings in U.S. assets and invested in gold.

Nowadays, it is almost impossible to keep up with the endless news in Washington. Just as this happened, Trump stepped up his attack on Fed Chairman Jerome Powell—who posted on Truth Social, “The faster Powell is fired, the better!”

Although the president does not usually have the authority to fire the heads of independent federal agencies, a Supreme Court case could change that precedent, allowing Trump to begin interfering in the Fed’s affairs. Critics from various political factions worry that this could lead to another plunge in the market, with the S&P 500 on the verge of bear markets.

There was a slight delay in a key appointment, confirmation by SEC Chairman Paul Atkins, who was chosen to replace anti-cryptocurrency Gary Gensler. The appointment was finally completed last week, and one of his top priorities will be to decide whether to approve ETFs that track altcoins such as XRP.

Meanwhile, while the price of $TRUMP has been falling all the way, the team behind it has come up with a novel way to attract attention. They will host a “exclusive” dinner for the 220 people holding the token, which triggered a hoarding boom between now and May 12. As soon as the news came out, the value of $TRUMP soared by 64%.

But some on crypto Twitter were upset by this, believing the dinner was “a trap to sell out and make more profits from those who bought because of FOMO.” An analyst urged those who bought $TRUMP at high prices to get out as soon as possible.

Bitcoin has fallen 12% over the past 100 days, while the S&P 500 has fallen 8.6%. The tariff threat remains undead. A new CNN poll shows that 59% of Americans believe Trump’s policies have made the U.S. economy worse. About 60% believe he has exacerbated the cost of living crisis, and more consumers are worried that the recession may be imminent.

Meanwhile, expectations for Bitcoin to hit a new high this year are rapidly fading. On the Polymarket platform, only 67% believe that Bitcoin can exceed $110,000 by the end of 2025, while the probability of breaking through $120,000, $130,000 and $150,000 will drop to 54%, 40% and 30% respectively. And in January this year, these goals were seen as quite conservative expectations, which shows that the situation is changing rapidly.

Trump's political turbulence and turbulence makes it hard to predict what will happen next week, let alone next month or next year. This makes predictions of Bitcoin's future trend more difficult. Those bold and confident price predictions should be treated with caution.

The past 100 days have changed drastically, but there are 1361 days left.

No comments yet