Dogecoin ETF applications are currently flooding the SEC as Nasdaq has officially requested approval to list a fund holding the popular meme cryptocurrency. This important filing adds significant momentum to previous applications, potentially expanding Wall Street crypto trading opportunities and also highlighting both Dogecoin investment risks and possibilities for broader crypto market adoption in the near future.

Also Read: Will Dogecoin Reach $1? Price Analysis and Expert Predictions

Nasdaq’s Dogecoin ETF Could Redefine Wall Street Crypto Access

Multiple Dogecoin ETF Filings Under Review

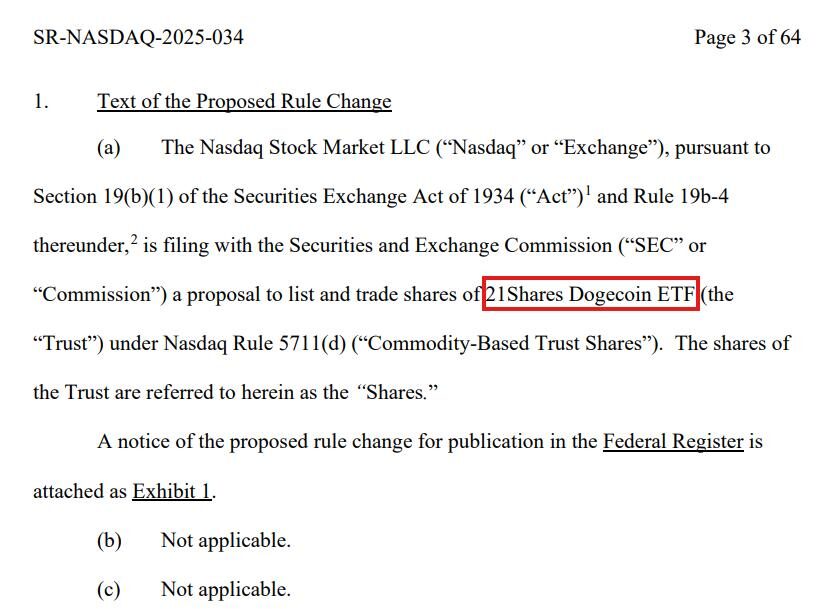

The financial institution Nasdaq filed its official 21Shares Dogecoin ETF listing application and then proceeded to join other financial institutions such as Bitwise and Grayscale in such applications. At present the SEC assesses more than 70 cryptocurrency ETF applications as Wall Street shows growing interest in digital assets and alternative investment trading.

Cointelegraph experts stated:

“The surge in ETF filings aligns with the Trump administration’s push for more crypto-friendly regulation.”

The NYSE Arca files an application for a Dogecoin ETF through Bitwise which will use Coinbase Custody for storing assets and Bank of New York Mellon for cash management. Serious institutional interest in future cryptocurrency market adoption becomes visible through these Dogecoin ETF partnerships.

DOGE’s Technical Foundation

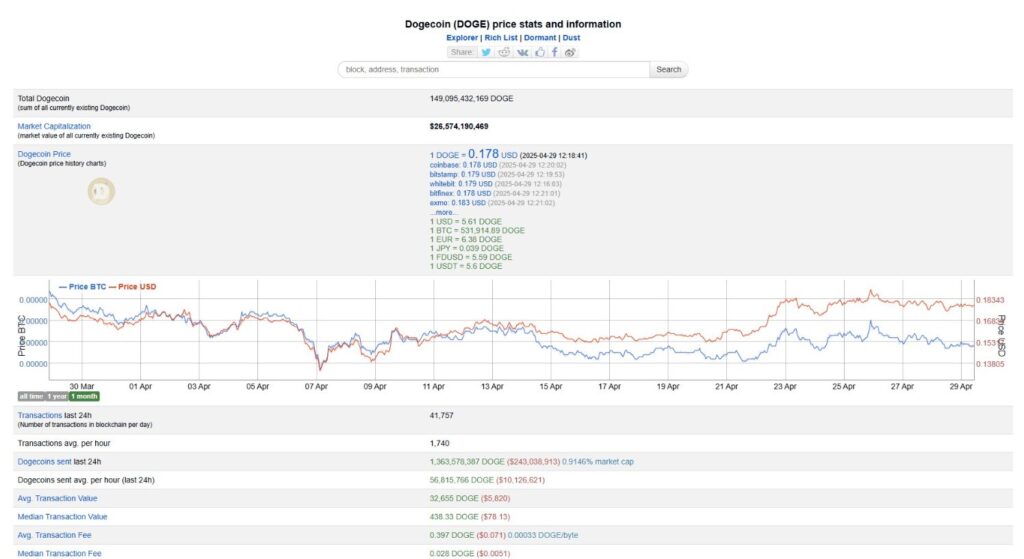

The Dogecoin network operates autonomously with its custom blockchain foundation which follows proof-of-work functionality like Bitcoin but has its distinctions. Dogecoin continues to operate with a $26 billion market value by processing more than 40,000 transactions each day at a current price point of $0.17.

Also Read: Crypto ETFs: Understanding the New Investment Landscape

Regulatory Considerations

While actively pursuing Dogecoin ETF listings, Nasdaq is also advocating for more consistent regulatory oversight. This balance between innovation and regulation addresses inherent Dogecoin investment risks while potentially expanding Wall Street crypto trading options for both retail and institutional investors alike.

In an April 25 letter, Nasdaq argued:

“Digital assets resembling securities should be held to the same regulatory standards.”

Market Impact Potential

Dogecoin ETF products under consideration will allow investors to participate in the market without owning cryptocurrencies directly thus spurring adoption across various investor groups. QED Protocol and Nexus use technical innovation to develop a layer-2 scaling solution for Dogecoin.

Cointelegraph noted in their recent analysis:

“The growing interest in altcoin-backed funds suggests a broader shift in how traditional finance engages with crypto.”

Also Read: Meme Cryptocurrencies: Investment Strategy or Gamble?

The Dogecoin ETF approval timeline remains somewhat uncertain as the SEC continues to balance investor protection concerns with market innovation in evaluating these Wall Street crypto trading vehicles throughout the review process.

No comments yet