Original author: Sam Kessler, Coindesk

Original title:Inside Movement Token-Dump Scandal: Secret Contracts, Shadow Advisors and Hidden Middlemen

Compiled: Scof,

Event points:

- Movement Labs is investigating whether it was misled to sign a market maker agreement without its full knowledge. The agreement handed over control of 66 million MOVE tokens to an unidentified middleman, resulting in a large-scale sale of $38 million after the token went online.

- Internal contracts show that Rentech, a company with almost no digital footprint, appeared on both parties to the transaction: on the one hand, as a subsidiary of Web3Port, and on the other hand, it appeared as an agent of the Movement Foundation, which triggered doubts about the behavior of "self-dealing".

- Movement Foundation insiders initially warned the deal, saying it might be "the worst agreement they have ever seen"; experts pointed out that the agreement could structurally induce first to artificially raise the price of tokens and then dump the tokens to retail investors.

- The incident exposed serious disagreements within Movement’s senior leaders: executives, legal counsel and project consultants, among others, pushing the deal despite internal opposition, and their actions are currently under full scrutiny.

A financial agreement originally designed to boost the launch of MOVE crypto tokens eventually turned into a token selling scandal, which not only caused Binance to ban transactions, but also triggered fierce disputes within the team.

The contract documents obtained by CoinDesk reveal the key to the crisis and explain how the incident went out of control step by step.

According to internal documents reviewed by CoinDesk, the blockchain project Movement — the developer of the MOVE cryptocurrency — is investigating whether it was induced to sign a financial agreement without its full knowledge. This protocol gives a single entity an unusually centralized control over the MOVE token market.

This agreement led to the day after the MOVE token first went online on the exchange on December 9, 66 million tokens were quickly thrown into the market, triggering a plunge in the currency price and arousing strong doubts from the outside world about "insider trading". It is worth noting that the project has been endorsed by World Liberty Financial, a Trump-backed crypto venture capital platform.

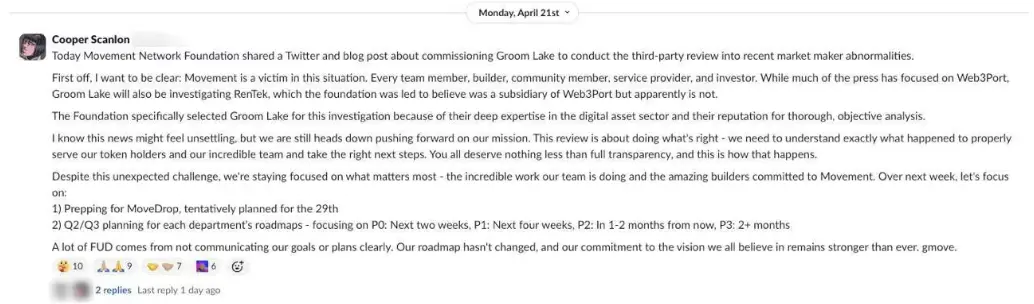

Cooper Scanlon, co-founder of Movement Labs, said in an April 21 Slack employee message that the company is investigating why more than 5% of the MOVE tokens originally reserved for market maker Web3Port will be transferred through a middleman called Rentech. He noted that “the foundation was originally directed to believe that Rentech is a subsidiary of Web3Port, but it is obviously not the case.” Rentech denies any false statements or misleading.

Slack news from Movement co-founder Cooper Scanlon. Rentech is spelled "Rentek". (Acquired by CoinDesk)

According to an internal memorandum from the Movement Foundation, the contract Movement signed with Rentech actually lends about half of the publicly circulated MOVE tokens to a single counterparty. This gives the entity an extremely huge control over this early stage token. Several experts told CoinDesk that this arrangement is very unusual.

What is even more worrying is that the contract version obtained by CoinDesk shows that it contains an incentive mechanism that "induces manipulation of token prices to fully dilute valuations of more than $5 billion, and then throws the tokens to retail investors and divides profits proportionally." "Even if you just participate in such a contract written in black and white is crazy," Zaki Manian, a senior crypto project founder, said after reviewing the documents.

Market makers were originally hired to provide liquidity for newly issued tokens, and usually buy and sell funds lent out of the token issuer on the exchange, thus stabilizing the price. But this kind of role is also very easy to abuse, allowing insiders to quietly manipulate the market and cash out large amounts of tokens without immediately arousing the outside world's alertness.

A series of contract documents obtained by CoinDesk reveals a grey area of weak regulation and opaque legal structure in the crypto industry – vulnerabilities that often turn public-facing projects into personal tools for a few.

Although rumors about the abuse of market making mechanisms are common in the encryption circle, the specific details behind them are rarely disclosed.

The market maker contract reviewed by CoinDesk this time shows that Rentech appeared as the Movement Foundation agent and Web3Port subsidiary in the agreement signed with the Movement Foundation - this "dual identity" arrangement makes it theoretically capable of leading the terms and making profits from it.

Finally, Movement’s cooperation with Rentech enabled the wallet associated with Chinese financial company Web3Port to quickly sell off $38 million worth of MOVE tokens the day after the MOVE token was launched on the exchange. Web3Port claims to have worked with projects such as MyShell, GoPlus Security, and Trump-backed World Liberty Financial.

Due to misconduct, exchange Binance subsequently banned the market-making account, and Movement also announced that it would launch a token repurchase program.

Similar to the stock option mechanism in startups, tokens in crypto projects usually have lock-up periods to prevent insiders from selling large tokens during the early trading phase of the project.

However, Binance's decision to ban has sparked market doubts about Movement - a widely believed project parties may have reached some kind of early unlock agreement with Web3Port, although Movement denied this claim.

Mutual accusations

Movement is one of the highly-watched crypto projects in recent years. It is positioned as the new generation of Layer 2 blockchain, aiming to improve the scalability of Ethereum based on the Move programming language launched by Facebook.

Founded by two young men, Rushi Manche and Cooper Scanlon, a 22-year-old who dropped out of Vanderbilt University, the project has successfully raised $38 million to join the World Liberty Financial portfolio and has attracted widespread attention on social media.

Movement Labs was close to completing a $100 million round of financing, with a valuation of $3 billion, according to a Reuters report in January this year.

CoinDesk interviewed more than a dozen people familiar with the internal operations of Movement (mostly requested anonymity to avoid retaliation), and there were many conflicting statements about who led the Rentech transaction - an arrangement that industry experts generally believe is extremely unusual.

Rentech’s head Galen Law-Kun denied that the foundation was misled during the signing process and insisted that the overall structure of Rentech was constructed with the full assistance of YK Pek, general counsel for the Movement Foundation.

However, according to an internal email and other communication records reviewed by CoinDesk, Pek denied that he was involved in the establishment of Rentech and had initially strongly opposed the deal.

Movement Labs co-founder Scanlon said in a message to employees that Movement was “the victim of this incident.”

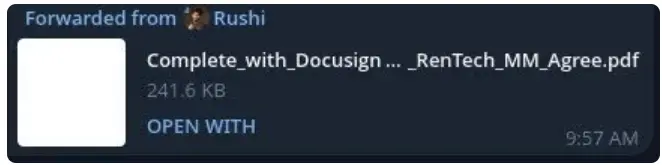

Movement is also investigating the responsibilities of its co-founder Rushi Manche — who initially forwarded the Rentech deal to the team and promoted the scheme internally; in addition, informal consultant Sam Thapaliya, who is also a business partner of Law-Kun, was included in the investigation, according to four people familiar with the matter.

Web3Port did not respond to multiple requests for comment.

"Probably the worst agreement I've ever seen"

Although Movement initially rejected a high-risk market-making agreement with Rentech, it eventually signed a similar revision, relying solely on the guarantees provided by an unrecognized middleman.

In the crypto industry with extremely loose supervision, project parties usually divide their operating structures into non-profit foundations and for-profit development companies. The developer (here is Movement Labs) is responsible for the technology construction, while the foundation manages tokens and community resources.

The two should theoretically remain independent to avoid securities regulatory risks. But according to internal communication records reviewed by CoinDesk, Movement Labs employee Rushi Manche also appears to be playing a leading role in the nonprofit Movement Foundation at the same time.

Movement’s co-founder Rushi Manche forwarded the first Rentech contract to an employee in the Movement ecosystem. (Acquired by CoinDesk)

On March 28, 2025, Manche sent a draft market maker agreement to the foundation on Telegram, saying it needed to sign it as soon as possible.

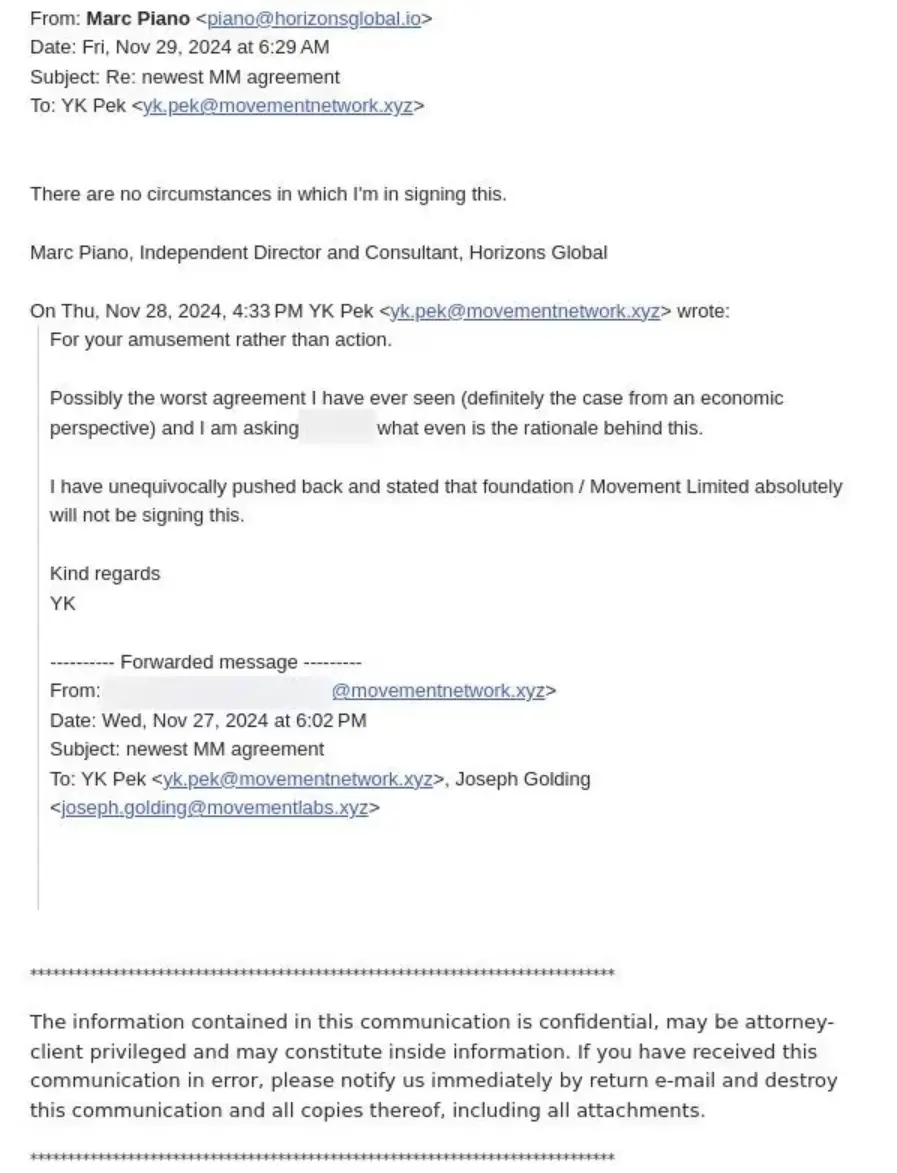

November 27, 2025: Rentech proposes a draft market maker agreement to Movement. In the agreement, Rentech is the debit and Movement is the lender. The agreement was not eventually signed. To protect privacy, CoinDesk hid some personal names in the disclosed documents, and some names have been blocked in advance in the original documents.

The draft proposes to lend up to 5% of MOVE tokens to Rentech, a company with no digital footprint at all.

Pek, the foundation’s legal counsel, noted in an email that the agreement “is probably the worst I’ve ever seen.” In another memorandum, he warned that the move would hand over dominance of the MOVE market to an unidentified external entity. Marc Piano, the foundation’s director in the British Virgin Islands, also refused to sign the agreement.

YK Pek, General Counsel of the Sports Foundation, and Marc Piano, Director, respond to the Rentech Agreement (acquired by CoinDesk)

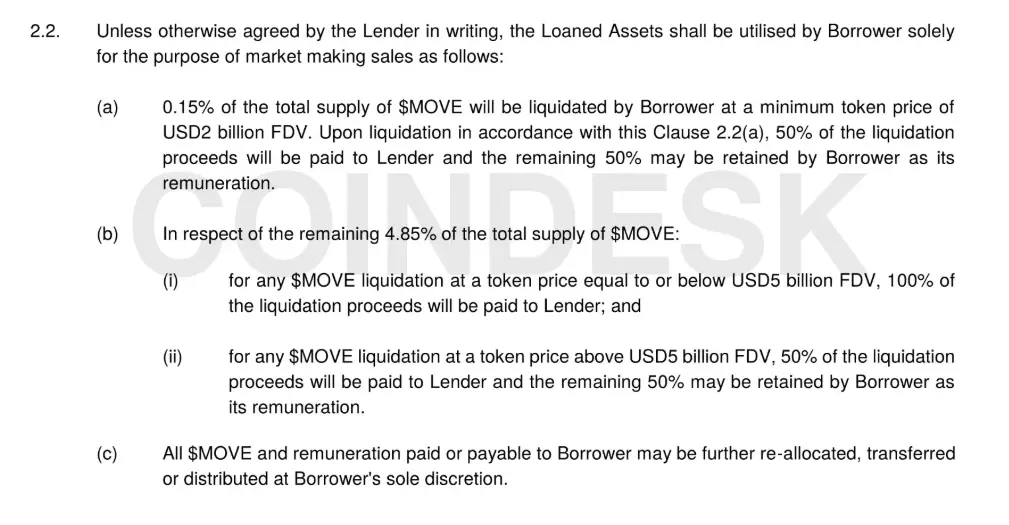

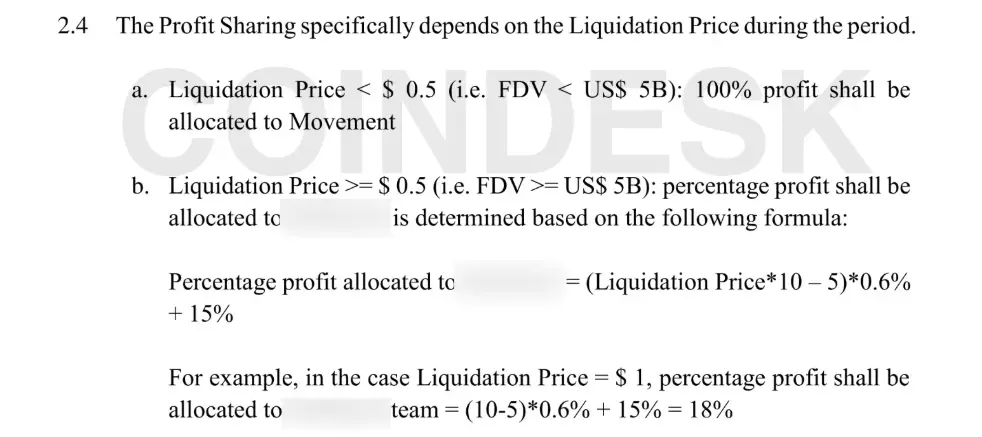

A highly controversial clause in the contract is to allow Rentech to immediately liquidate its tokens when the MOVE token is “fully diluted valuation” exceeds $5 billion and share profits with the foundation at a 50:50 ratio.

Manian pointed out that this design actually encourages market makers to make profits by raising the coin price and then selling a large number of tokens at high prices.

Although the Movement Foundation eventually rejected the draft, their negotiations with Rentech continue.

Rentech then claimed it was a subsidiary of Chinese market maker Web3Port and offered to provide $60 million in collateral assets out of pocket, a move that impressed the foundation to some extent, according to three people familiar with the negotiations and legal documents obtained by CoinDesk.

On December 8, 2024, the Movement Foundation finally signed a revised market-making agreement with Rentech, removing some of the most controversial terms. This includes cancellation of the terms of the cancellation of the terms that Web3Port can sue the Foundation for claims if it fails to put MOVE on a specific exchange.

On December 8, 2025, Rentech and Movement reached a revised market maker agreement. In the agreement, Rentech is still the debit, but its identity in the file is explicitly marked as "Web3Port" (the name has been fuzzy in the file), and the Movement Foundation is the lender. The agreement has been officially signed. CoinDesk has processed some personal names in the file for privacy reasons, and some names have been blocked original.

Although the revised agreement was drafted by Pek, the foundation legal counsel who had previously opposed the deal, its core content was still highly similar to the original version: the agreement still allows Web3Port to borrow 5% of the total MOVE tokens and can be sold under certain mechanisms for profit, although the allocation of funds has been adjusted.

The debit name in the new contract is Web3Port, signed by a representative of Rentech’s directors.

It is worth noting that the domain name record shows that on the day of signing the agreement, the domain name web3portrentech.io, which was used by the director, had just registered.

There was an appointment already

According to three people familiar with the matter, the relevant person in charge of the Movement Foundation did not realize that Web3Port had signed another agreement with "Movement" a few weeks ago when the agreement was officially signed on December 8.

On November 25, 2024, Rentech signed a market maker agreement with Web3Port (the name of Web3Port is blurred in the file). In this agreement, Rentech is the lender and Web3Port is the debit. Rentech is also called "Movement" in the file. When CoinDesk obtained this contract, some of the content had been deleted. At the same time, to protect privacy, CoinDesk further handled his personal names.

The agreement version shows that Web3Port has already reached an agreement with "Movement", and its terms are highly similar to the initial market-making proposal that the Movement Foundation had rejected. And in this contract, Rentech is listed as the representative of Movement.

Web3Port's contract with Rentech allows borrowers to make a profit of 50% of the Liquidate assets. (Acquired by CoinDesk)

The agreement is structured similar to the November 27 contract, explicitly allowing market makers to liquidate when the price of MOVE tokens reaches a specific target — one of the core terms in the old version of the agreement and a key issue that industry experts like Manian are particularly wary of.

"Shadow Co-founder"

People familiar with the matter revealed that there are many speculations within Movement about who the trader behind the relationship with Rentech is. This cooperation eventually led to the token sale in December last year and also put Movement into a public opinion storm.

According to Blockworks, the agreement was originally circulated internally by Rushi Manche. Manchester was briefly suspended for investigation last week.

"During the entire market maker selection process, the MVMT Labs team trusted several consultants and members on the foundation team to provide advice and assist in designing the transaction structure. It is clear that at least one foundation member represents the interests of both parties in the transaction, which is an issue we are currently investigating in depth."

The incident also caused questions about Sam Thapaliya's role. He is the founder of the crypto protocol Zebec and one of the consultants for Manchester and Scanlon.

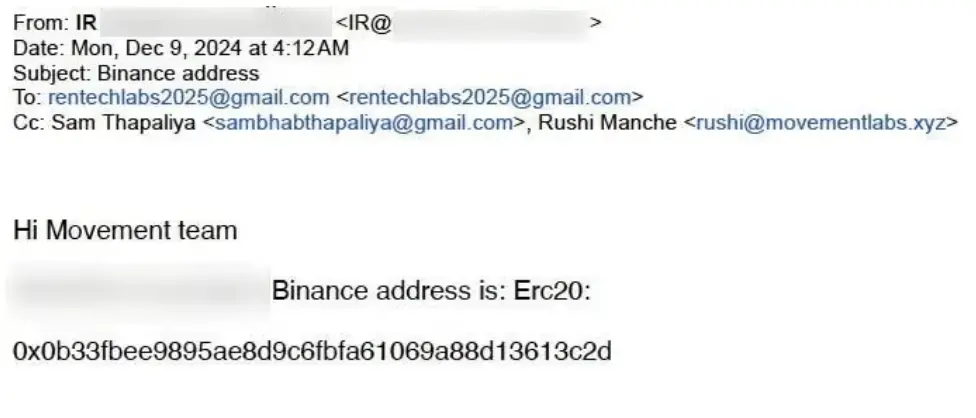

Communications data reviewed by CoinDesk show that Thapaliya was cc in an email sent by Web3Port to the "Movement Team" and also appeared in other transactional emails related to market making arrangements, alongside Rentech and Manchester.

Web3Port cc Sam Thapaliya and Rushi Manchester in an email to Rentech (email obtained by CoinDesk)

“A employee said, “As far as I understand, Sam is a close consultant to Rushi, and in some ways, she is the ‘third co-founder of the shadow’. Rushi has always kept a low profile about this relationship, and we usually only hear his name occasionally. ”

“我们经常在内部已经做出决定之后,最后一刻却突然被改动,”另一位员工说道,“而每当发生这种情况,我们都知道,大概率是 Sam 的意思。”

According to three people present, on the day the MOVE token was launched to the public, Thapaliya appeared in Movement’s San Francisco office.

Telegram screenshots reviewed by CoinDesk also show that Movement co-founder Scanlon has commissioned Thapaliya to assist in screening the whitelist of MOVE token airdrops — a list of wallet addresses that strictly limit the community coin-gift activity (the event has been postponed several times before).

This arrangement further deepened the impression of some employees: Thapaliya's internal influence in Movement far exceeded the company's disclosures.

Thapaliya told CoinDesk that he met Rushi Manche when they were college students and Cooper Scanlon, and later advised Movement as an external consultant. He stressed that he "has no shares in Movement Labs", "has not obtained any tokens from the Movement Foundation", and "has no decision-making power in both organizations."

Who is Rentech?

Rentech is the core entity of the token dispute, created by Galen Law-Kun, who is Thapaliya’s business partner. Law-Kun told CoinDesk that it set up Rentech as a subsidiary of Singapore-based financial services company Autonomy, aiming to connect crypto projects with family offices in Asia.

In response to CoinDesk's statement, Galen Law-Kun said YK Pek "had helped establish and serve as general counsel for Autonomy SG, which is Rentech's parent or affiliate." He also claimed that while Pek had internally opposed a preliminary agreement with Rentech, he “had suggested establishing a structure for Rentech to advance the project” and “had been involved in drafting the first version of the contract, which was almost exactly the same as the one he later drafted and approved for the foundation”.

However, CoinDesk's investigation has found no evidence that Pek had set up Rentech on behalf of Autonomy or had drafted the first edition of the contract.

In response, Pek responded clearly: "I am not and have never served as general counsel for Galen or any of its entities." He further explained that a corporate administrative services company he co-founded did provide company secretarial services to more than 150 entities in the Web3 space, including two companies under Law-Kun's name. But both companies filed as “assetless” in their 2025 annual reports, and neither of them are Rentech.

Pek said he had reviewed the consultant agreements signed by Law-Kun with a project in 2024 "two hours"; in addition, "he also contacted me about the FTX-related filing deadline," and "in August, he forwarded a Docusign NDA, which I just took a rough look and didn't charge."

“I have no idea why Galen claims I am his general counsel, and this statement has confused and disturbed me,” Pek concluded, adding that in the emails between Law-Kun and his company’s secretary service partner, the other party was actually represented by a private attorney called “Hillington Group.”

According to YK Pek, “The Movement Foundation (by me) and the two general counsel of Movement Labs were introduced to GS Legal through Rushi Manche and are known as the legal representative of Rentech.”

And in Galen Law-Kun’s statement, Pek was introduced to 10 projects by him as legal counsel for Autonomy and “never objected to or corrected this statement.” Law-Kun also said that introducing GS Legal is just a formality as required by Movement.

In a Slack message sent to employees, Scanlon, co-founder of Movement, said the company has hired external audit agency Groom Lake to conduct independent third-party investigations into recent market making behaviors.

He wrote in the message: “Movement was the victim in this incident.”

No comments yet