Hello, crypto enthusiasts! Today, we’re going to dive into an important concept for traders—Dow Theory. Although this theory originated in the early 20th century, its principles are still highly relevant in the fast-paced world of cryptocurrency. Whether you are a complete beginner or a seasoned investor, understanding Dow Theory can enhance your trading strategies.

What is Dow Theory?

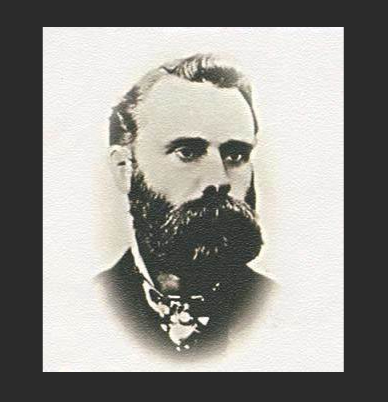

Dow Theory was developed by Charles Dow and is a market analysis method primarily used to identify market trends. In simple terms, Dow Theory suggests that market movements consist of three major trends: primary trends, secondary trends, and intraday trends.

Primary Trend: This is the main market trend, often lasting several months to years. In a bull market, the primary trend is upward; in a bear market, it’s downward.

Secondary Trend: These are short-term movements against the primary trend, usually lasting a few weeks to months. In an uptrend, secondary trends may show minor pullbacks; in a downtrend, they may exhibit temporary rebounds.

Intraday Trend: This is the shortest-term trend, appearing within the trading day and lasting a few hours to days.

Basic Principles of Dow Theory

Dow Theory has several key principles that help us understand how to utilize it in cryptocurrency trading:

The Market Discounts Everything: Dow Theory posits that all known information—technical, fundamental, and emotional—has already been reflected in the market price. In other words, price is everything.

Trend is Your Friend: In Dow Theory, trends are viewed as the market's main driving forces. Capturing the primary trend is vital for successful trading.

Confirmation Requires Multiple Indicators: Dow Theory emphasizes that a single price movement cannot confirm a trend change. Confirmation typically requires multiple indicators.

How to Apply Dow Theory to Cryptocurrency Trading

Let’s explore how to apply Dow Theory in cryptocurrency trading to make informed investment decisions.

1. Identify the Market Trend

In crypto trading, start by determining the overall market trend. You can use price charts and moving averages (like MA50 and MA200) to help you assess whether the market is in a bullish, bearish, or sideways phase.

For example:

If Bitcoin is trading above both MA50 and MA200 with both lines sloping upward, the market is likely in an uptrend.

Conversely, if the price is below both lines and they slope downward, the market may be in a downtrend.

2. Look for Secondary Trends

After determining the primary trend, look for secondary trends. These short-term adjustments can often provide entry and exit opportunities. For instance:

In an uptrend, if there’s a brief pullback, consider buying near support levels.

In a downtrend, if a rebound occurs, you might contemplate selling near resistance levels.

3. Use Multiple Indicators for Confirmation

Relying solely on price charts may not suffice; using volume, momentum indicators (like RSI and MACD) can help confirm trends. For example:

When the price rises and volume increases simultaneously, it typically confirms the trend’s strength.

If the price rises but volume decreases, it might indicate waning momentum, suggesting caution.

4. Adjust Your Strategy Timely

Markets are dynamic, so regularly reevaluating your position is essential. If the market breaks through a significant support or resistance level or if major news surfaces, quickly adjust your trading strategy to adapt to the new market environment.

Advantages and Disadvantages of Dow Theory

While Dow Theory is a valuable tool in cryptocurrency trading, it does have its limitations:

Advantages:

Simplicity: The basic principles of Dow Theory are easy to understand, making it suitable for novice traders.

Trend Identification: It helps traders capture primary trends and reduce emotional trading.

Disadvantages:

Lagging Signals: A disadvantage of Dow Theory is the lagging nature of confirmation signals, which may result in missed entry points.

Market Volatility: The highly volatile nature of the cryptocurrency market can sometimes render Dow Theory signals ineffective.

Conclusion

Dow Theory is not only a tool for traditional stock market analysis; it is also applicable to the opportunity-filled and challenging cryptocurrency market. Whether you are a beginner or an experienced trader, understanding and applying this theory can help you make more informed decisions in complex market conditions.

I hope this article has helped you grasp Dow Theory and how to implement it in your trading strategies. If you have any questions or thoughts, please feel free to leave a comment below. Let’s learn and discuss together!

No comments yet