Author:kizoki _Yz

Introduction: A New Chapter for Real Estate in the Web3 Era

On April 29, 2025, the Trump Organization, in collaboration with London-listed Dar Global, announced a $1 billion Trump Tower Dubai project in Dubai. The development includes a Trump-branded hotel, luxury residential units, and a private club, with completion expected within five years. Eric Trump, the second son of the Trump family, revealed that the project will accept cryptocurrency payments for property purchases, sparking widespread attention in the blockchain and cryptocurrency communities.

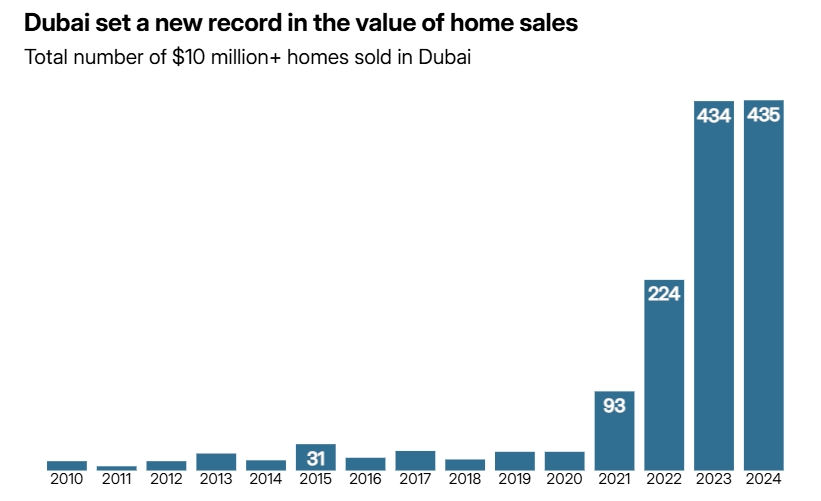

This move underscores the Trump Organization's ambition in the global luxury real estate market and highlights the potential of cryptocurrencies in high-end transactions. Against the backdrop of Dubai's 111 ultra-luxury property transactions exceeding $10 million in Q1 2025 and the addition of 7,200 millionaires in 2024 (bringing the total to approximately 130,500), this project serves as a vivid case study for the integration of Web3 technology with traditional real estate.

Project Overview: Where Luxury Meets Innovation

According to the Trump Organization's official website, Trump Tower Dubai is strategically located at the gateway to downtown Dubai, adjacent to the core business district, and comprises the following key components:

• Trump-Branded Hotel: Upholding its legacy of luxury, the hotel targets global high-net-worth individuals and business travelers, offering a world-class hospitality experience.

• Luxury Residential Units: Two penthouse apartments are priced at 75 million AED each (approximately $20.4 million), while standard apartments range from 4 million to 5 million AED (approximately $1.09 million to $1.36 million).

• Exclusive Private Club: Providing owners and members with a private social space equipped with top-tier leisure facilities.

In an interview with *Crypto Times*, Eric Trump stated, "Dubai is one of the most dynamic real estate markets in the world, and by accepting cryptocurrency payments, we aim to further attract international investors." This forward-thinking approach aligns with Dubai's progressive financial environment.

However, the specific cryptocurrencies supported have not yet been disclosed. CoinWorldNet speculates that mainstream assets like Bitcoin and Ethereum are likely candidates, though details remain pending. This uncertainty leaves room for market speculation and has sparked discussions in the community about the potential use of meme coins, such as TRUMP coin.

The Booming Context of Dubai's Real Estate Market

Dubai has emerged as a global hub for luxury real estate in recent years. According to *Gulf News*, in Q1 2025, Dubai’s luxury housing market recorded 111 transactions for properties valued over $10 million, a 15% increase year-over-year, with a total value of $1.9 billion. In 2024, Dubai welcomed 7,200 new millionaires, bringing the UAE’s total to 130,500, ranking 14th globally (*Knight Frank* report). This growth is fueled by Dubai’s diversified economic strategy, including its 10-year Golden Visa program, remote worker residency permits, and tax incentives for high-net-worth individuals.

This market environment provides fertile ground for the launch of Trump Tower Dubai. Dubai's long-term visa policies and residency permits for remote workers, such as the 10-year Golden Visa, further enhance its appeal to global high-net-worth individuals. Eric Trump remarked in the interview, "Dubai's skyline is transforming every day, and the investment opportunities here are unparalleled globally."

The Significance of Cryptocurrency Payments: Deep Integration of Web3 and Real Estate

Accepting cryptocurrency payments is an emerging trend in real estate, but Dubai's regulatory environment offers favorable conditions. The Dubai Virtual Assets Regulatory Authority (VARA) has advanced the legalization of blockchain and cryptocurrencies in recent years, providing a regulatory framework for such transactions. Eric Trump noted in the interview that real estate and cryptocurrencies are "mutually trusted safe-haven instruments," a perspective that resonates strongly in the current market environment.

For cryptocurrency enthusiasts and blockchain researchers, this trend carries multiple implications:

1. Cross-Border Transaction Convenience: The decentralized nature of cryptocurrencies reduces costs and time for cross-border payments, making them ideal for international investments by high-net-worth individuals.

2. Privacy and Efficiency: Compared to traditional bank transfers, cryptocurrency transactions offer greater privacy and faster settlement, which is particularly critical for high-value real estate deals.

3. Mainstream Adoption: The Trump Organization's endorsement may accelerate the adoption of cryptocurrencies in traditional industries, especially real estate.

According to *Bitcoin Ethereum News*, this project could be the first large-scale luxury real estate development to accept Bitcoin for property purchases, likely attracting significant participation from cryptocurrency holders. This not only provides real-world use cases for cryptocurrencies but also opens new avenues for Web3 technology in the physical economy.

Ziad El Chaaar, CEO of Dar Global, stated, "The grand launch of Trump Tower Dubai is an extraordinary addition to Dubai's luxury market and Dar Global's prestigious portfolio of hotels and residences. This unique luxury project will elevate our achievements in creating bespoke landmark developments in the region, contributing to Dubai's skyline while reinforcing the city's reputation as a global exemplar of excellence and sophistication. Trump Tower Dubai will be an iconic project, redefining luxury living in Dubai and capturing global attention."

Implications for Investors: How to Participate in Such Transactions

For investors looking to engage in such transactions, the cryptocurrency payment model requires familiarity with digital asset management and trading processes. Buyers may need to acquire Bitcoin, Ethereum, or other assets through reliable platforms, ensuring wallet security and transaction compliance. Investors should also consider the following:

• Market Research: Understand the liquidity and historical performance of target cryptocurrencies to manage price volatility.

• Technical Preparedness: Select highly secure wallets and trading platforms to ensure the safety of high-value transactions.

• Compliance: Be aware of cryptocurrency transaction regulations in Dubai and the investor's home country to avoid legal risks.

For investors keen on meme coins or high-frequency trading, tracking market dynamics and community sentiment is critical. Dubai's open environment offers opportunities to explore new asset classes, such as tokenized real estate, and investors can use blockchain analytics tools to monitor on-chain activity and seize potential opportunities.

Potential Risks and Challenges

Despite its promising outlook, the project faces certain challenges.

First, the volatility of the cryptocurrency market may impact buyers' purchasing power. For instance, Bitcoin's price fluctuated significantly in April 2025, peaking above $100,000 and dipping to $85,000, requiring investors to remain vigilant about price risks.

Second, regulatory uncertainties may impose restrictions on cross-border cryptocurrency payments. While Dubai maintains an open stance toward blockchain technology, global regulatory disparities warrant attention.

Additionally, the project's security merits scrutiny. According to *The Defiant*, the Trump Organization's related ventures in the cryptocurrency space, such as World Liberty Financial, have raised concerns about potential conflicts of interest. Investors should exercise caution regarding the project's funding sources and operational details.

Future Outlook: The Broad Prospects of Web3 Real Estate

The cryptocurrency payment model of Trump Tower Dubai marks the beginning of Web3's integration with real estate. The Dubai government plans to launch a blockchain-based real estate transaction platform in 2025 to enhance transparency and efficiency. Real-world asset (RWA) tokenization is gaining traction, enabling investors to access fractional ownership and liquidity in high-end real estate, broadening opportunities for smaller investors.

For cryptocurrency enthusiasts and blockchain researchers, this trend represents both an investment opportunity and a research frontier. The transparency, decentralization, and smart contract capabilities of Web3 are reshaping traditional industries, and more real estate projects may involve property registration, asset management, and profit distribution in the future.

Conclusion

The Trump Organization's $1 billion Dubai project is not only a masterpiece of luxury real estate but also a milestone in the penetration of cryptocurrency payments into traditional industries. It aligns with the booming trend of Dubai's real estate market and provides a case study for Web3 technology applications. For cryptocurrency enthusiasts and blockchain researchers, this is a noteworthy development, signaling the potential of blockchain technology to reshape the global economy.

On Dubai's vibrant landscape, the rise of Trump Tower Dubai is not only a new chapter for the city's skyline but also a symbol of the convergence of Web3 and the real world. As more projects embrace blockchain technology, the boundaries of the real estate industry will be redefined, offering a broader stage for investors and researchers alike.

No Comments