Author: TechFlow

In the past few days, Binance's "alpaca" $ALPACA is active in the center of the market stage, stirring up the total trading volume of tens of billions of dollars with a circulating market value of US$30 million.

On April 24, Binance announced that it will remove four tokens including Alpaca Finance ($ALPACA) on May 2.

The news of "de-Binance" is usually a huge negative for projects - de-launch means that liquidity is reduced, trading volume shrinks, and token prices often fall or even fail to recover.

But after the news of the removal was released, $ALPACA suffered a 30% decline in a short period of time (based on spot on Binance Exchange), the price quickly soared nearly 12 times in three days, from $0.029 to a high of $0.3477. At the same time, $ALPACA open contract (OI) is far more than several times its token market value, and the long-short game "meat grinder" market around $ALPACA has begun.

Rate settlement accelerates, and long-short games are even more

Binance then adjusted the fund rate rules to shorten the cap rate cycle to once an hourly settlement (up to 2%), further aggravating the intensity of the long-short game. The bulls not only make profits by pulling the market, but also continue to "eat" high capital rates. The bulls "eat and take" within a few days, and the $ALPACA price continues to play at a high level for nearly four days.

The rate of -2% is settled every hour, so under the premise of 1x leverage, short sellers will lose at least 48% of their principal if they hold short positions for one day. Even with such a high fee rate, there are still funds that continue to choose to short.

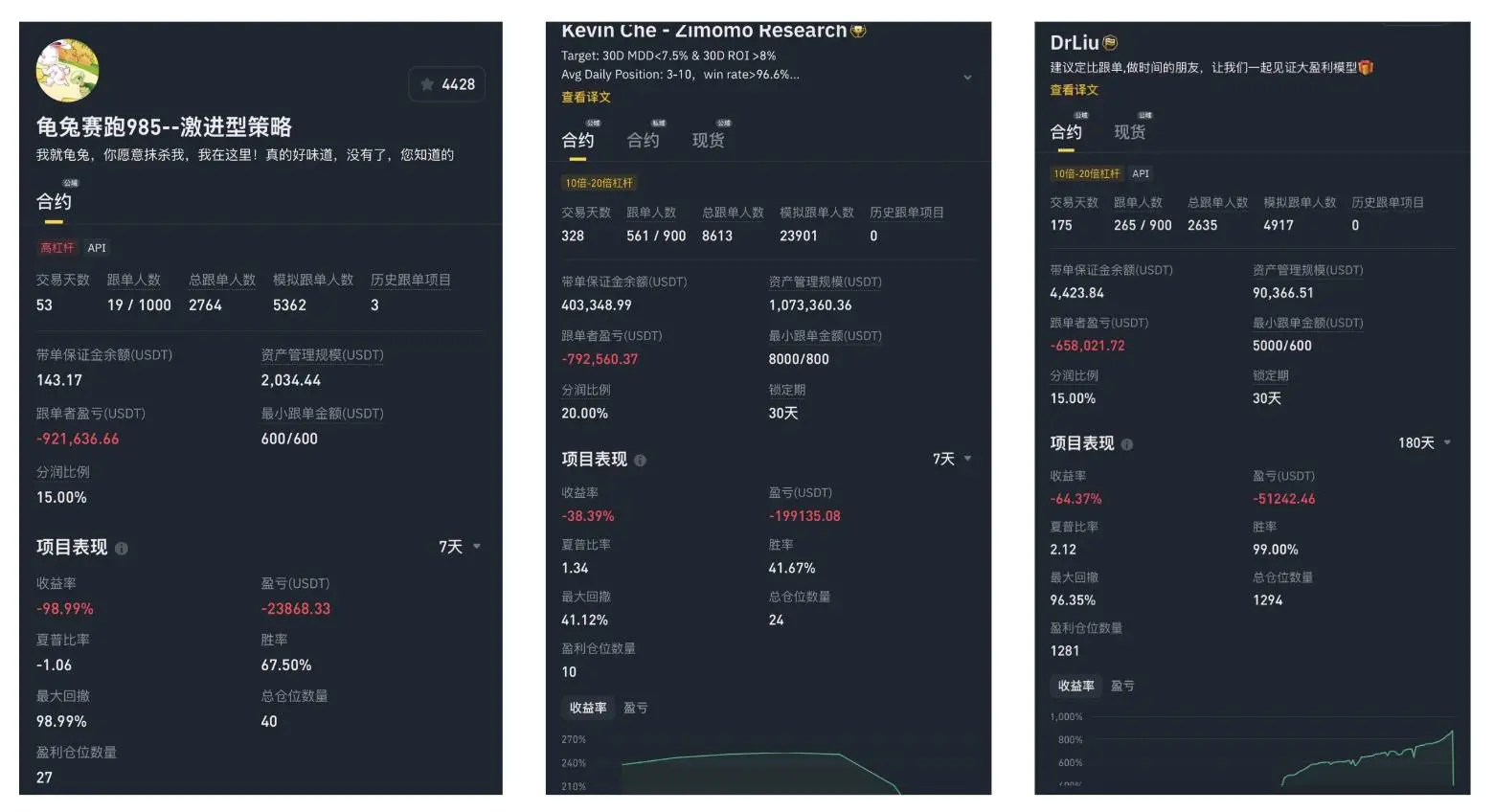

In the fierce game, some people found that some order-leading personnel with a size of millions of dollars have been shorting $ALPACA with high leverage, and finally the position was breached with millions of dollars of funds from the order-leading users.

On April 29, Binance raised the $ALPACA contract rate cap to ±4%. For short sellers, the increase in the rate cap will double the cost of short selling, but as soon as the rule that should have persuaded short sellers was released, the price of $ALPACA was "uncommon sense" and the price fell from US$0.27 to around US$0.067.

There is no absolute trading rule

As trading volume and attention gradually shift, the story of $ALPACA may come to an end.

Looking back at this farce of 100 billion yuan, in some ways, $ALPACA in the past few days is not a Meme - the negative news brought a lot of attention from the removal of the shelves, allowing the principle of "black and red are also red" to be exerted to the extreme in price fluctuations. At the same time, in the same level of environment (first-tier exchanges), relatively low circulating market value (lowing less than US$4 million), highly controlled chips, and wide price fluctuations that constantly stimulate players' nerves, even the image of "alpaca" is tied to Meme.

But although the image is cute, for users who are really involved in the game, these days may only be described as "bloody".

The negative news suddenly fell smoothly, and the complex trend of $ALPACA in recent days has subverted the usual "sell the news" logic and also subverted the positions of many people.

Obviously, the boundary between "good news" and "negative news" has gradually blurred, and the previous single judgment logic has gradually become unsuitable for the ever-evolving market. Instead, violent trading that plays with human nature is popular, and the constantly refreshed data on liquidated stocks is gradually occupying the center of the market. It may be more appropriate to describe this evolutionary direction by "wild growth".

However, things have both sides. Some people feel confused, while others feel excited. This farce is not a bad thing for everyone. For many participants who pursue stimulus in price fluctuations and superb abilities, the alpaca's way of walking is even an opportunity to make a lot of money for a long time.

There are also voices saying that behind the shorting of the money of the order-leading user at all costs is a hunt for retail investors' funds. As the movie's business card says: "The wealthy's money is returned in full, and the people's money is divided into 30,000 yuan." There is no way to judge whether the truth or false statement is true or false, but it is certain that even if the truth is not so dark, the final winner in this manipulation will not be an ordinary user.

With the premise that the corresponding regulatory measures have not been improved, $ALPACA may not be the last crazy manipulation in this market.

As of the completion of writing, the price of $ALPACA is still fluctuating violently, and there may be more exciting "performances" before it is officially taken off the shelves.

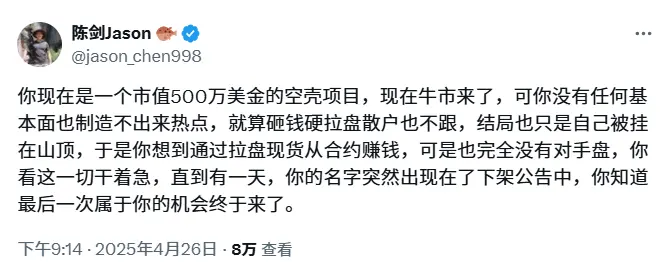

However, in the stormy price game, it is difficult to have private areas for ignorant participants. Under the hunt for attention and liquidity, perhaps looking less and moving long is the most correct way for retail investors to play EVs. When I saw big news and abnormal price trends, I felt that "the opportunity has come" was not only retail investors, but also long-awaited project parties.

No comments yet